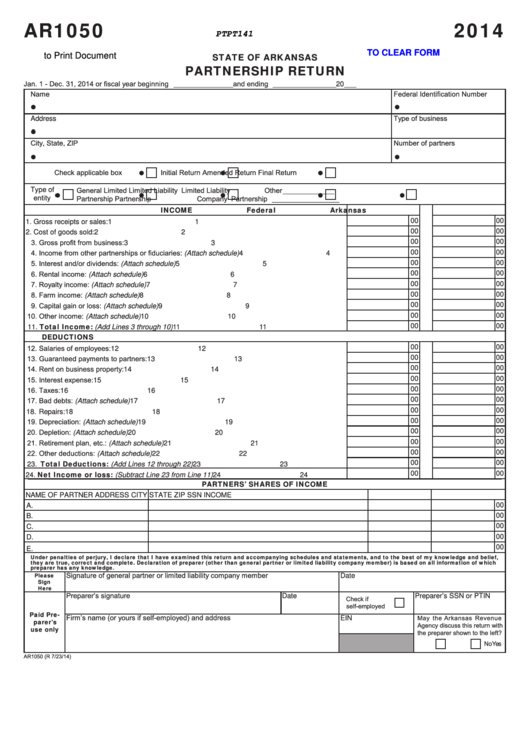

AR1050

2014

PTPT141

CLICK HERE TO CLEAR FORM

STATE OF ARKANSAS

Click Here to Print Document

PARTNERSHIP RETURN

Jan. 1 - Dec. 31, 2014 or fiscal year beginning _______________ and ending ________________ 20 ___

Name

Federal Identification Number

Type of business

Address

City, State, ZIP

Number of partners

Check applicable box

Initial Return

Amended Return

Final Return

General

Limited

Limited Liability

Limited Liability

Other _____________

Type of

entity

Partnership

Partnership

Company

Partnership

_________________

INCOME

Federal

Arkansas

00

00

1. Gross receipts or sales: ................................................................................................................... 1

1

00

00

2. Cost of goods sold: .......................................................................................................................... 2

2

3. Gross profit from business: ............................................................................................................. 3

00

00

3

4. Income from other partnerships or fiduciaries: (Attach schedule) ................................................... 4

00

00

4

5. Interest and/or dividends: (Attach schedule) ................................................................................... 5

00

00

5

6. Rental income: (Attach schedule) ................................................................................................... 6

00

00

6

7. Royalty income: (Attach schedule) .................................................................................................. 7

00

00

7

8. Farm income: (Attach schedule) ..................................................................................................... 8

00

00

8

9. Capital gain or loss: (Attach schedule) ............................................................................................ 9

00

00

9

10. Other income: (Attach schedule) ................................................................................................... 10

00

00

10

11. Total Income: (Add Lines 3 through 10) ....................................................................................11

00

00

11

DEDUCTIONS

12. Salaries of employees: .................................................................................................................. 12

00

00

12

13. Guaranteed payments to partners: ................................................................................................ 13

00

00

13

14. Rent on business property: ........................................................................................................... 14

00

00

14

15. Interest expense: ........................................................................................................................... 15

00

00

15

16. Taxes: ............................................................................................................................................ 16

00

00

16

17. Bad debts: (Attach schedule) ........................................................................................................ 17

00

00

17

00

00

18. Repairs: ......................................................................................................................................... 18

18

19. Depreciation: (Attach schedule) .................................................................................................... 19

00

00

19

20. Depletion: (Attach schedule) ......................................................................................................... 20

00

00

20

21. Retirement plan, etc.: (Attach schedule) ....................................................................................... 21

00

00

21

22. Other deductions: (Attach schedule) ............................................................................................. 22

00

00

22

23. Total Deductions: (Add Lines 12 through 22) ......................................................................... 23

00

00

23

24. Net Income or loss: (Subtract Line 23 from Line 11).............................................................. 24

00

00

24

PARTNERS’ SHARES OF INCOME

NAME OF PARTNER

ADDRESS

CITY

STATE

ZIP

SSN

INCOME

00

A.

00

B.

00

C.

00

D.

00

E.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct and complete. Declaration of preparer (other than general partner or limited liability company member) is based on all information of which

preparer has any knowledge.

Signature of general partner or limited liability company member

Please

Date

Sign

Here

Preparer’s signature

Date

Preparer’s SSN or PTIN

Check if

self-employed

Paid Pre-

Firm’s name (or yours if self-employed) and address

May the Arkansas Revenue

EIN

parer’s

Agency discuss this return with

use only

the preparer shown to the left?

Yes

No

AR1050 (R 7/23/14)

1

1 2

2