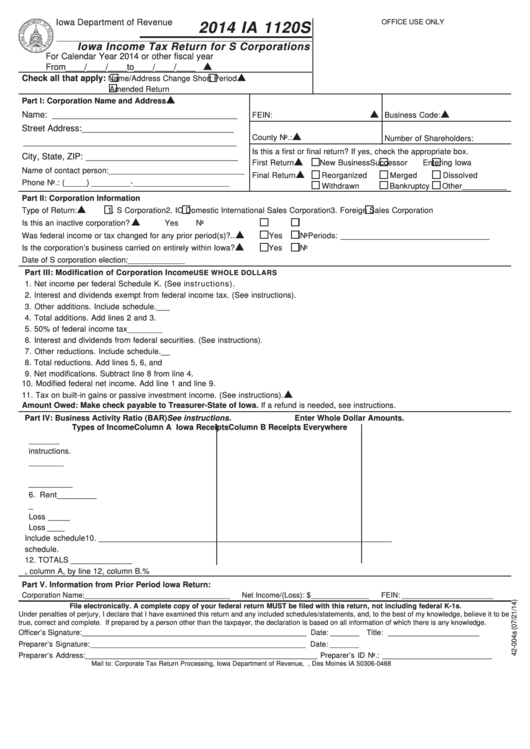

Iowa Department of Revenue

OFFICE USE ONLY

2014 IA 1120S

Iowa Income Tax Return for S Corporations

For Calendar Year 2014 or other fiscal year

From____/____/____to____/____/____

Check all that apply:

Name/Address Change

Short Period

Amended Return

Part I: Corporation Name and Address

Name: _______________________________________

FEIN:

Business Code:

Street Address: ________________________________

County No.:

Number of Shareholders:

_____________________________________________

Is this a first or final return? If yes, check the appropriate box.

City, State, ZIP: ________________________________

First Return

New Business

Successor

Entering Iowa

Name of contact person: _______________________________

Final Return

Reorganized

Merged

Dissolved

Phone No.: ( _____ ) _________ - ______________________

Withdrawn

Bankruptcy

Other__________

Part II: Corporation Information

Type of Return:

1. S Corporation

2. IC Domestic International Sales Corporation

3. Foreign Sales Corporation

Is this an inactive corporation? ................................................

Yes

No

Was federal income or tax changed for any prior period(s)?..

Yes

No Periods: __________________________________

Is the corporation’s business carried on entirely within Iowa?

Yes

No

Date of S corporation election: _____________

Part III: Modification of Corporation Income

USE WHOLE DOLLARS

1. Net income per federal Schedule K. (See instructions). ................................................................................ 1. ________________

2. Interest and dividends exempt from federal income tax. (See instructions). ........... 2. ________________

3. Other additions. Include schedule. ........................................................................... 3. ________________

4. Total additions. Add lines 2 and 3. ........................................................................................................................ 4. ________________

5. 50% of federal income tax ......................................................................................... 5. ________________

6. Interest and dividends from f eder al securities. (See instructions). ......................... 6. ________________

7. Other reductions. Include schedule. ......................................................................... 7. ________________

8. Total reductions. Add lines 5, 6, and 7. ................................................................................................................ 8. ________________

9. Net modifications. Subtract line 8 from line 4. ..................................................................................................... 9. ________________

10. Modified federal net income. Add line 1 and line 9. ............................................................................................ 10. ________________

11. Tax on built-in gains or passive investment income. (See instructions). ............................................................ 11. _______________

Amount Owed: Make check payable to Treasurer-State of Iowa. If a refund is needed, see instructions.

Part IV: Business Activity Ratio (BAR) See instructions.

Enter Whole Dollar Amounts.

Types of Income

Column A Iowa Receipts

Column B Receipts Everywhere

1. Gross Receipts ................................................. 1. ___________________________________________________________________

2. Net Dividends. See instructions. ...................... 2. ___________________________________________________________________

3. Exempt Interest ................................................. 3. ___________________________________________________________________

4. Accounts Receivable Interest .......................... 4. ___________________________________________________________________

5. Other Interest .................................................... 5. ___________________________________________________________________

6. Rent ................................................................... 6. ___________________________________________________________________

7. Royalties ........................................................... 7. ___________________________________________________________________

8. Capital Gains / Loss ......................................... 8. ___________________________________________________________________

9. Ordinary Gains / Loss ....................................... 9. ___________________________________________________________________

10. Partnership Gross Receipts. Include schedule10. ___________________________________________________________________

11. Other. Must include schedule. ......................... 11. ___________________________________________________________________

12. TOTALS ............................................................. 12. ___________________________________________________________________

13. BAR to six decimal places. Divide line 12, column A, by line 12, column B.

%

Part V. Information from Prior Period Iowa Return:

Corporation Name: ___________________________________

Net Income/(Loss): $ ______________

FEIN: ______________________

File electronically. A complete copy of your federal return MUST be filed with this return, not including federal K-1s.

Under penalties of perjury, I declare that I have examined this return and any included schedules/statements, and, to the best of my knowledge, believe it to be

true, correct and complete. If prepared by a person other than the taxpayer, the declaration is based on all information of which there is any knowledge.

Officer’s Signature: ______________________________________________________

Date: _______ Title: ______________________

Preparer’s Signature: ____________________________________________________

Date: _______

Preparer’s Address:_______________________________________________________ Preparer’s ID No.: __________________________

Mail to: Corporate Tax Return Processing, Iowa Department of Revenue, P.O. Box 10468, Des Moines IA 50306-0468

1

1 2

2