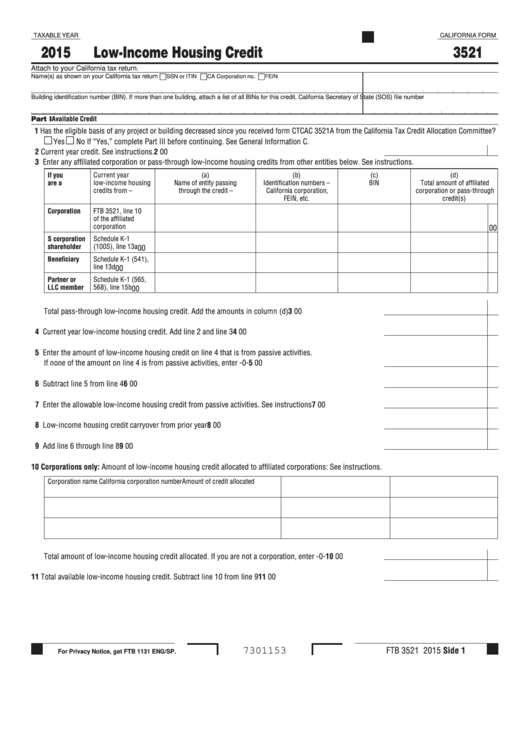

TAXABLE YEAR

CALIFORNIA FORM

2015

Low-Income Housing Credit

3521

Attach to your California tax return.

Name(s) as shown on your California tax return

.

SSN or ITIN

CA Corporation no

FEIN

Building identification number (BIN). If more than one building, attach a list of all BINs for this credit.

California Secretary of State (SOS) file number

Part I Available Credit

1 Has the eligible basis of any project or building decreased since you received form CTCAC 3521A from the California Tax Credit Allocation Committee?

Yes

No If “Yes,” complete Part III before continuing. See General Information C.

2 Current year credit. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

00

3 Enter any affiliated corporation or pass-through low-income housing credits from other entities below. See instructions.

If you

Current year

(a)

(b)

(c)

(d)

are a

low-income housing

Name of entity passing

Identification numbers –

BIN

Total amount of affiliated

credits from –

through the credit –

California corporation,

corporation or pass-through

FEIN, etc.

credit(s)

Corporation

FTB 3521, line 10

of the affiliated

corporation

00

S corporation

Schedule K-1

shareholder

(100S), line 13a

00

Beneficiary

Schedule K-1 (541),

line 13d

00

Partner or

Schedule K-1 (565,

LLC member

568), line 15b

00

Total pass-through low-income housing credit. Add the amounts in column (d) . . . . . . . . . . . . . . . . . . . . . . 3

00

4 Current year low-income housing credit. Add line 2 and line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

00

5 Enter the amount of low-income housing credit on line 4 that is from passive activities.

If none of the amount on line 4 is from passive activities, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

00

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

7 Enter the allowable low-income housing credit from passive activities. See instructions. . . . . . . . . . . . . . . . 7

00

8 Low-income housing credit carryover from prior year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

9 Add line 6 through line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

00

10 Corporations only: Amount of low-income housing credit allocated to affiliated corporations: See instructions.

Corporation name

California corporation number

Amount of credit allocated

Total amount of low-income housing credit allocated. If you are not a corporation, enter -0- . . . . . . . . . . . . 10

00

11 Total available low-income housing credit. Subtract line 10 from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

00

FTB 3521 2015 Side 1

7301153

For Privacy Notice, get FTB 1131 ENG/SP.

1

1 2

2 3

3 4

4