Instructions For Form Boe-401-A - State, Local, And District Sales And Use Tax Return

ADVERTISEMENT

BOE-401-INST REV. 13 (4-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

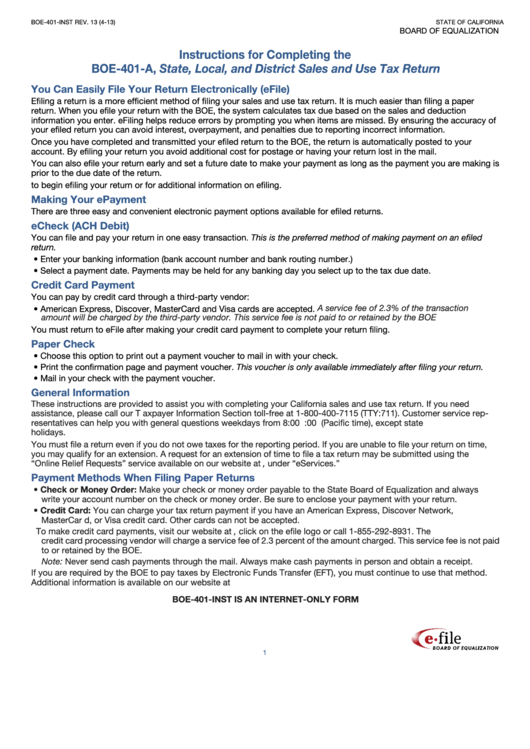

Instructions for Completing the

BOE-401-A, State, Local, and District Sales and Use Tax Return

You Can Easily File Your Return Electronically (eFile)

Efiling a return is a more efficient method of filing your sales and use tax return. It is much easier than filing a paper

return. When you efile your return with the BOE, the system calculates tax due based on the sales and deduction

information you enter. eFiling helps reduce errors by prompting you when items are missed. By ensuring the accuracy of

your efiled return you can avoid interest, overpayment, and penalties due to reporting incorrect information.

Once you have completed and transmitted your efiled return to the BOE, the return is automatically posted to your

account. By efiling your return you avoid additional cost for postage or having your return lost in the mail.

You can also efile your return early and set a future date to make your payment as long as the payment you are making is

prior to the due date of the return.

Click here to begin efiling your return or for additional information on efiling.

Making Your ePayment

There are three easy and convenient electronic payment options available for efiled returns.

eCheck (ACH Debit)

You can file and pay your return in one easy transaction. This is the preferred method of making payment on an efiled

return.

• Enter your banking information (bank account number and bank routing number.)

• Select a payment date. Payments may be held for any banking day you select up to the tax due date.

Credit Card Payment

You can pay by credit card through a third-party vendor:

A service fee of 2.3% of the transaction

• American Express, Discover, MasterCard and Visa cards are accepted.

amount will be charged by the third-party vendor. This service fee is not paid to or retained by the BOE

You must return to eFile after making your credit card payment to complete your return filing.

Paper Check

• Choose this option to print out a payment voucher to mail in with your check.

• Print the confirmation page and payment voucher. This voucher is only available immediately after filing your return.

• Mail in your check with the payment voucher.

General Information

These instructions are provided to assist you with completing your California sales and use tax return. If you need

assistance, please call our T axpayer Information Section toll-free at 1-800-400-7115 (TTY:711). Customer service rep-

resentatives can help you with general questions weekdays from 8:00 a.m. to 5:00 p.m. (Pacific time), except state

holidays.

You must file a return even if you do not owe taxes for the reporting period. If you are unable to file your return on time,

you may qualify for an extension. A request for an extension of time to file a tax return may be submitted using the

“Online Relief Requests” service available on our website at , under “eServices.”

Payment Methods When Filing Paper Returns

• Check or Money Order: Make your check or money order payable to the State Board of Equalization and always

write your account number on the check or money order. Be sure to enclose your payment with your return.

• Credit Card: You can charge your tax return payment if you have an American Express, Discover Network,

MasterCar d, or Visa credit card. Other cards can not be accepted.

To make credit card payments, visit our website at , click on the efile logo or call 1-855-292-8931. The

credit card processing vendor will charge a service fee of 2.3 percent of the amount charged. This service fee is not paid

to or retained by the BOE.

Note: Never send cash payments through the mail. Always make cash payments in person and obtain a receipt.

If you are required by the BOE to pay taxes by Electronic Funds Transfer (EFT), you must continue to use that method.

Additional information is available on our website at boe.ca.gov/elecsrv/eft.htm.

BOE-401-INST IS AN INTERNET-ONLY FORM

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10