Iowa Department of Revenue

2015 IA 133

https://tax.iowa.gov

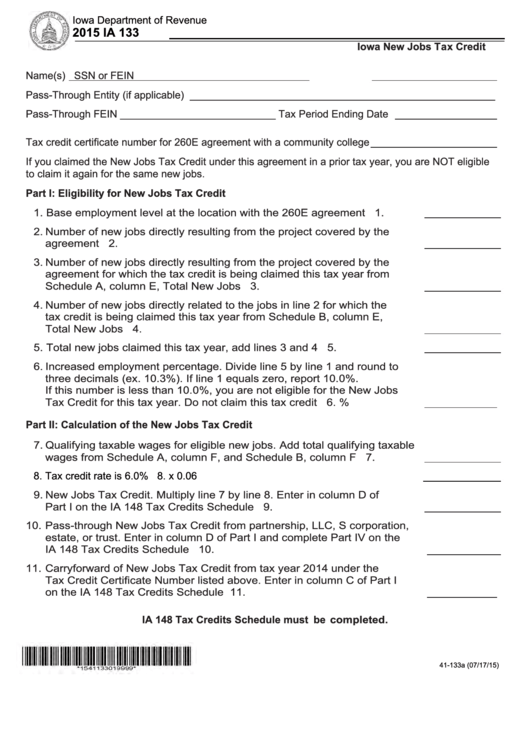

Iowa New Jobs Tax Credit

Name(s)

SSN or FEIN

Pass-Through Entity (if applicable) _____________________________________________________

Pass-Through FEIN ___________________________ Tax Period Ending Date

Tax credit certificate number for 260E agreement with a community college

If you claimed the New Jobs Tax Credit under this agreement in a prior tax year, you are NOT eligible

to claim it again for the same new jobs.

Part I: Eligibility for New Jobs Tax Credit

1. Base employment level at the location with the 260E agreement ............ 1.

2. Number of new jobs directly resulting from the project covered by the

agreement ................................................................................................... 2.

3. Number of new jobs directly resulting from the project covered by the

agreement for which the tax credit is being claimed this tax year from

Schedule A, column E, Total New Jobs ..................................................... 3.

4. Number of new jobs directly related to the jobs in line 2 for which the

tax credit is being claimed this tax year from Schedule B, column E,

Total New Jobs ........................................................................................... 4.

5. Total new jobs claimed this tax year, add lines 3 and 4 ............................ 5.

6. Increased employment percentage. Divide line 5 by line 1 and round to

three decimals (ex. 10.3%). If line 1 equals zero, report 10.0%.

If this number is less than 10.0%, you are not eligible for the New Jobs

Tax Credit for this tax year. Do not claim this tax credit ............................ 6.

%

Part II: Calculation of the New Jobs Tax Credit

7. Qualifying taxable wages for eligible new jobs. Add total qualifying taxable

wages from Schedule A, column F, and Schedule B, column F ............... 7.

8. Tax credit rate is 6.0% ......................................................................................... 8.

x 0.06

9. New Jobs Tax Credit. Multiply line 7 by line 8. Enter in column D of

Part I on the IA 148 Tax Credits Schedule ................................................. 9.

10. Pass-through New Jobs Tax Credit from partnership, LLC, S corporation,

estate, or trust. Enter in column D of Part I and complete Part IV on the

IA 148 Tax Credits Schedule .................................................................... 10.

11. Carryforward of New Jobs Tax Credit from tax year 2014 under the

Tax Credit Certificate Number listed above. Enter in column C of Part I

on the IA 148 Tax Credits Schedule......................................................... 11.

IA 148 Tax Credits Schedule must be completed.

41-133a (07/17/15)

1

1 2

2 3

3 4

4