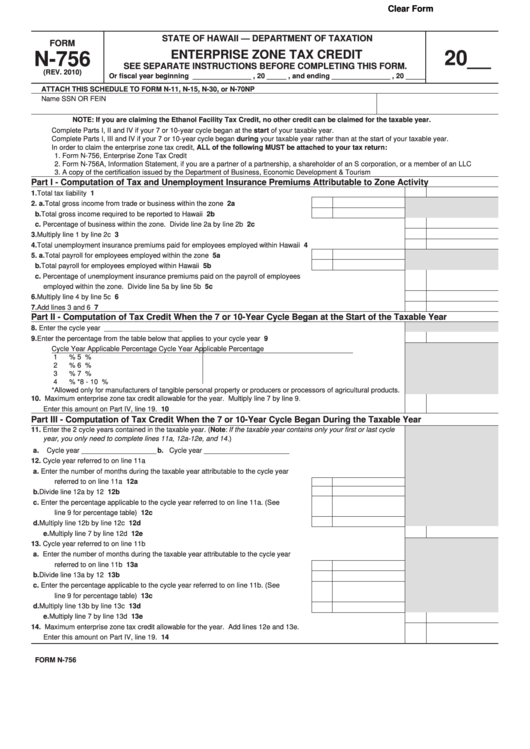

Clear Form

STATE OF HAWAII — DEPARTMENT OF TAXATION

FORM

ENTERPRISE ZONE TAX CREDIT

20__

N-756

SEE SEPARATE INSTRUCTIONS BEFORE COMPLETING THIS FORM.

(REV. 2010)

Or fiscal year beginning _______________ , 20 _____ , and ending _______________ , 20 _____

ATTACH THIS SCHEDULE TO FORM N-11, N-15, N-30, or N-70NP

Name

SSN OR FEIN

NOTE:

If you are claiming the Ethanol Facility Tax Credit, no other credit can be claimed for the taxable year.

Complete Parts I, II and IV if your 7 or 10-year cycle began at the start of your taxable year.

Complete Parts I, III and IV if your 7 or 10-year cycle began during your taxable year rather than at the start of your taxable year.

In order to claim the enterprise zone tax credit, ALL of the following MUST be attached to your tax return:

1. Form N-756, Enterprise Zone Tax Credit

2. Form N-756A, Information Statement, if you are a partner of a partnership, a shareholder of an S corporation, or a member of an LLC

3. A copy of the certification issued by the Department of Business, Economic Development & Tourism

Part I - Computation of Tax and Unemployment Insurance Premiums Attributable to Zone Activity

1. Total tax liability ................................................................................................................................................................

1

2. a. Total gross income from trade or business within the zone ......................................

2a

b. Total gross income required to be reported to Hawaii ...............................................

2b

c. Percentage of business within the zone. Divide line 2a by line 2b ............................................................................

2c

3. Multiply line 1 by line 2c ...................................................................................................................................................

3

4. Total unemployment insurance premiums paid for employees employed within Hawaii ..................................................

4

5. a. Total payroll for employees employed within the zone .................................................

5a

b. Total payroll for employees employed within Hawaii ....................................................

5b

c. Percentage of unemployment insurance premiums paid on the payroll of employees

employed within the zone. Divide line 5a by line 5b ....................................................................................................

5c

6. Multiply line 4 by line 5c ...................................................................................................................................................

6

7. Add lines 3 and 6 .............................................................................................................................................................

7

Part II - Computation of Tax Credit When the 7 or 10-Year Cycle Began at the Start of the Taxable Year

8. Enter the cycle year ____________________

9. Enter the percentage from the table below that applies to your cycle year ......................................................................

9

Cycle Year

Applicable Percentage

Cycle Year

Applicable Percentage

1 ................................... 80%

5 ................................... 40%

2 ................................... 70%

6 ................................... 30%

3 ................................... 60%

7 ................................... 20%

4 ................................... 50%

*8 - 10 .............................. 20%

*Allowed only for manufacturers of tangible personal property or producers or processors of agricultural products.

10. Maximum enterprise zone tax credit allowable for the year. Multiply line 7 by line 9.

Enter this amount on Part IV, line 19. ..............................................................................................................................

10

Part III - Computation of Tax Credit When the 7 or 10-Year Cycle Began During the Taxable Year

11. Enter the 2 cycle years contained in the taxable year. (Note: If the taxable year contains only your first or last cycle

year, you only need to complete lines 11a, 12a-12e, and 14.)

a.

Cycle year _________________

b. Cycle year _________________

12. Cycle year referred to on line 11a

a. Enter the number of months during the taxable year attributable to the cycle year

referred to on line 11a ...............................................................................................

12a

b. Divide line 12a by 12 .................................................................................................

12b

c. Enter the percentage applicable to the cycle year referred to on line 11a. (See

line 9 for percentage table) .......................................................................................

12c

d. Multiply line 12b by line 12c ......................................................................................

12d

e. Multiply line 7 by line 12d ...........................................................................................................................................

12e

13. Cycle year referred to on line 11b

a. Enter the number of months during the taxable year attributable to the cycle year

referred to on line 11b ...............................................................................................

13a

b. Divide line 13a by 12 .................................................................................................

13b

c. Enter the percentage applicable to the cycle year referred to on line 11b. (See

line 9 for percentage table) .......................................................................................

13c

d. Multiply line 13b by line 13c ......................................................................................

13d

e. Multiply line 7 by line 13d ...........................................................................................................................................

13e

14. Maximum enterprise zone tax credit allowable for the year. Add lines 12e and 13e.

Enter this amount on Part IV, line 19. ..............................................................................................................................

14

FORM N-756

1

1 2

2