FORM N-586

Page 4

(REV. 2014)

tion, estate, or trust) skip lines 1-3 and go

if the property was placed in service on or

Enter the total on line 5 or 6. (This in-

to line 4.

after July 1, 2005.

terest is not deductible on your income tax

return.)

Line 1 — Tax credit recapture.—

Lines 5 and 6 — Interest.—Compute

Section 42(j)(5) partnerships fill in line 7

the interest separately for each prior tax

Line 7 — Include the total credit recap-

also. All other flow-through entities (part-

year using a rate of 8% (.00667 monthly)

tured on the appropriate line representing

nerships, S corporations, estates, or trusts)

for the period beginning on the due date for

your tax liability.

enter the result here and on the appropri-

filing the original return for each prior year

For flow-through entities that file Form

ate line of Schedule K of your respective

involved. Add the interest amounts for each

N-20 or Form N-35, identify amounts as

return. Enter each recipient’s share on the

prior year until the earlier of:

“Recapture of low-income housing tax

appropriate line of Schedule K-1.

•

The due date (not including extensions)

credit”:

of the return for the recapture year, or

Line 2 — Appropriate credit percent-

N-20, Schedule K-1, line 31.

•

age.—Enter 30% if the property was placed

The date the return for the recapture

N-35, Schedule K-1, line 24.

in service before July 1, 2005. Enter 50%

year is filed and any income tax due for

that year has been fully paid.

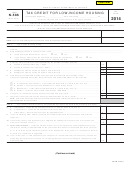

CREDIT WORKSHEET

Amount

Tax Credit

a. Income Taxes Paid to another state

or foreign country . . . . . . . . . . . . . . .

b.

Enterprise Zone Tax Credit . . . . . . . .

c.

Carryover of the Energy

Conservation Tax Credit . . . . . . . . . .

d. Credit for Employment of Vocational

Rehabilitation Referrals . . . . . . . . . . .

e.

Carryover of the Individual

Development Account Contribution

Tax Credit . . . . . . . . . . . . . . . . . . . . .

f.

Credit for School Repair and

Maintenance . . . . . . . . . . . . . . . . . . .

g. Carryover of the Renewable Energy

Technologies Income Tax Credit (For

Systems Installed and Placed in

Service Before July 1, 2009) . . . . . . .

h. Renewable Energy Technologies

Income Tax Credit (Nonrefundable) .

i.

Add lines a through h. Enter the

amount here and on

line 9 . . . . . . . . . . . . . . . . . . . . . . . . .

1

1 2

2 3

3 4

4