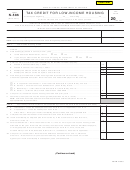

FORM N-586

Page 2

(REV. 2014)

PART III

Recapture of Low-Income Housing Credit

Date placed in service

Building

Address of Building (as shown on Form N-586)

(from Form N-586)

A

B

Building

TOTAL

A

B

1

Enter the amount of accelerated portion of tax credits

recaptured, federal Form 8611, line 7 ..................................................

1

2

Enter the appropriate credit percentage (see Instructions) ..................

2

3

Multiply line 1 by line 2 and enter result ...............................................

3

4

Enter net recapture amount from flow-through entities, Schedule K-1

or Federal Form 1099-PATR .................................................................

4

5

Enter the interest on line 4 recapture amount (see Instructions) .........

5

6

IRC Section 42 (j)(5) Partnerships ONLY - Enter interest

on line 3 recapture amount ...................................................................

6

7

Total recapture - Add lines 3, 4, 5, and 6. Enter here and on

proper line of your tax return ...............................................................

7

General

housing must use Form N-586 to claim the

Caution: No credit may be claimed on any

low-income housing credit.

building for which there has been allowed

Instructions

any relief from the passive loss rules under

The tax credit does not apply to occu-

section 502 of the Tax Reform Act of 1986.

pants of low-income housing units.

(Section references are to the Internal

Low-Income Housing Tax

Revenue Code (IRC) unless otherwise

For more information, contact the De-

noted.)

Credit.

partment of Taxation, Taxpayer Services

Branch at (808) 587-4242, or toll-free at

The Hawaii low-income housing tax

Each taxpayer subject to the tax im-

1-800-222-3229.

credit allowed under section 235-110.8, Ha-

posed by chapter 235, HRS, who files a

waii Revised Statutes (HRS), is based upon

Banks and other financial institutions.

net income tax return for a taxable year

the tax credit allowed for federal income tax

–– Complete Parts I and II. Attach a copy of

may claim a low-income housing tax credit

purposes under section 42. Generally, the

federal Form 8586 to Form F-1.

against the taxpayer’s net income tax li-

Hawaii low-income tax credit is 50% of the

ability. The amount of the credit shall be

allowable federal low-income housing tax

Partnerships, S Corporations, Estates

deductible from the taxpayer’s net income

credit (30% for property placed in service

and Trusts.—Complete Part I to figure

tax liability, if any, imposed by chapter 235,

before July 1, 2005). A taxpayer may claim

the credit to pass through to the partners,

HRS for the taxable year in which the credit

this credit whether or not the taxpayer claims

shareholders, or beneficiaries.

Attach a

is properly claimed on a timely basis. A

a federal low-income housing tax credit.

copy of federal Form 8586 to the entity’s

credit under this section may be claimed

income tax return.

Note: Although a taxpayer no longer has

whether or not the taxpayer claims a federal

to claim the federal low-income housing tax

Partnership investors now have the flexibility

low-income housing tax credit pursuant to

credit in order to claim the State low-income

of allocating the State low-income housing

section 42.

housing tax credit, federal low-income

tax credit among its partners without regard

The low-income housing tax credit shall

housing tax credit forms, Form 8586, will

to the partners’ proportionate interests in

be fifty or thirty percent of the applicable

need to be completed in order to claim the

the partnership for taxable years beginning

percentage basis of each building located

State low-income housing tax credit. Form

after December 31, 1999.

in Hawaii. Applicable percentage shall be

8586 needs to be attached to your Hawaii

Insurers.—Complete Part I to figure the

calculated as provided in section 42(b).

return even if you are not required to attach

credit to carry to Form 314, Annual Premium

it to your federal return.

The credit allowed shall be claimed

Tax Return. Attach a copy of federal Form

against net income tax liability for the tax-

Purpose of Form. Owners of residen-

8586 to Form 314.

able year. For the purpose of deducting this

tial rental buildings providing low-income

tax credit, net income tax liability means

1

1 2

2 3

3 4

4