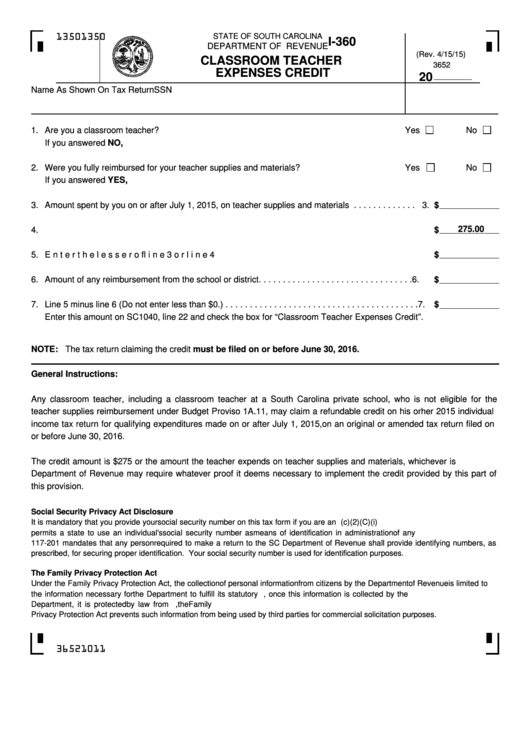

Form I-360 - Classroom Teacher Expenses Credit

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

I-360

DEPARTMENT OF REVENUE

(Rev. 4/15/15)

CLASSROOM TEACHER

3652

EXPENSES CREDIT

20

Name As Shown On Tax Return

SSN

1.

Are you a classroom teacher?

Yes

No

If you answered NO, STOP. You do not qualify for this credit.

2.

Were you fully reimbursed for your teacher supplies and materials?

Yes

No

If you answered YES, STOP. You do not qualify for this credit.

3.

Amount spent by you on or after July 1, 2015, on teacher supplies and materials . . . . . . . . . . . . . 3.

$

275.00

4.

Maximum credit amount . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

$

5.

Enter the lesser of line 3 or line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

$

6.

Amount of any reimbursement from the school or district . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

$

7.

Line 5 minus line 6 (Do not enter less than $0.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

$

Enter this amount on SC1040, line 22 and check the box for “Classroom Teacher Expenses Credit”.

NOTE: The tax return claiming the credit must be filed on or before June 30, 2016.

General Instructions:

Any classroom teacher, including a classroom teacher at a South Carolina private school, who is not eligible for the

teacher supplies reimbursement under Budget Proviso 1A.11, may claim a refundable credit on his or her 2015 individual

income tax return for qualifying expenditures made on or after July 1, 2015, on an original or amended tax return filed on

or before June 30, 2016.

The credit amount is $275 or the amount the teacher expends on teacher supplies and materials, whichever is less. The

Department of Revenue may require whatever proof it deems necessary to implement the credit provided by this part of

this provision.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form if you are an individual taxpayer. 42 U.S.C. 405(c)(2)(C)(i)

permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

117-201 mandates that any person required to make a return to the SC Department of Revenue shall provide identifying numbers, as

prescribed, for securing proper identification. Your social security number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to

the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the

Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family

Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

36521011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1