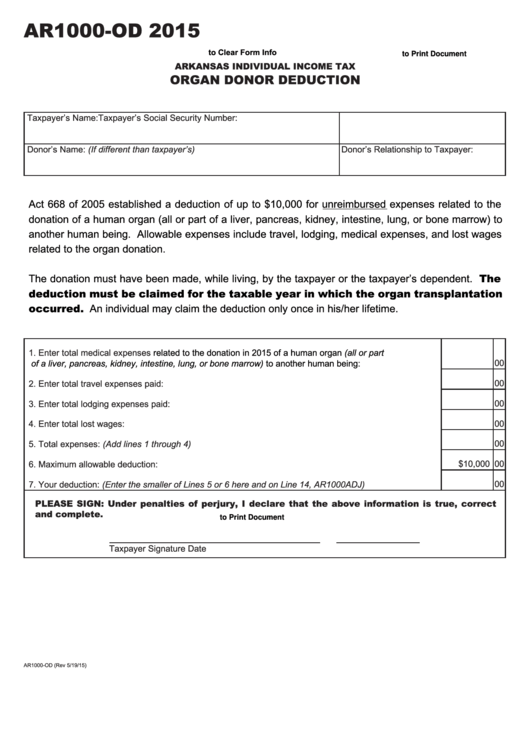

AR1000-OD

2015

Click Here to Clear Form Info

Click Here to Print Document

ARKANSAS INDIVIDUAL INCOME TAX

ORGAN DONOR DEDUCTION

Taxpayer’s Name:

Taxpayer’s Social Security Number:

Donor’s Name: (If different than taxpayer’s)

Donor’s Relationship to Taxpayer:

Act 668 of 2005 established a deduction of up to $10,000 for unreimbursed expenses related to the

donation of a human organ (all or part of a liver, pancreas, kidney, intestine, lung, or bone marrow) to

another human being. Allowable expenses include travel, lodging, medical expenses, and lost wages

related to the organ donation.

The donation must have been made, while living, by the taxpayer or the taxpayer’s dependent. The

deduction must be claimed for the taxable year in which the organ transplantation

occurred. An individual may claim the deduction only once in his/her lifetime.

1. Enter total medical expenses

related to the donation in 2015 of a human organ (all or part

00

of a liver, pancreas, kidney, intestine, lung, or bone marrow) to another human

being: ..........................1

2. Enter total travel expenses paid: ..............................................................................................................2

00

00

3. Enter total lodging expenses paid: ...........................................................................................................3

00

4. Enter total lost wages: ..............................................................................................................................4

00

5. Total expenses: (Add lines 1 through 4) ...................................................................................................5

$10,000

00

6. Maximum allowable deduction: ................................................................................................................6

00

7. Your deduction: (Enter the smaller of Lines 5 or 6 here and on Line 14, AR1000ADJ) ...........................7

PLEASE SIGN: Under penalties of perjury, I declare that the above information is true, correct

and complete.

Click Here to Print Document

Taxpayer Signature

Date

AR1000-OD (Rev 5/19/15)

1

1