average of the amount of ethanol contained in E85 during

calendar year even if the site-by-site method is chosen.

warm and cold weather. If a blend other than E10, E15, or E85

Taxpayers with total gasoline sales exceeding 200,000 gallons in

is sold, designate the ethanol gallons sold in line 4, column

a year face a higher biofuel percentage threshold than taxpayers

A/D, the ethanol content percentage in line 4, column B/E, and

with total gasoline sales of 200,000 gallons or less.

compute the pure ethanol in column C/F. If more than one

The biofuel threshold percentage is 14% for taxpayers who

additional blend is sold, provide total other blends sold in line 4,

sell 200,000 gallons or less during the 2015 calendar year.

column A/D and the average ethanol content percentage in line

The biofuel threshold percentage is 15% for taxpayers who

4, column B/E.

sell 200,000 gallons or less during the 2016 calendar year.

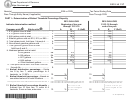

Line 7: Total gasoline gallons sold - Total gasoline gallons

The biofuel threshold percentage is 17% for taxpayers who

computed in line 7, column A/D, is the total number of gallons of

sell more than 200,000 gallons during the 2015 calendar

gasoline sold. This does not include any biodiesel or diesel

year.

gallons sold.

The biofuel threshold percentage is 19% for taxpayers who

sell more than 200,000 gallons during the 2016 calendar

Line 8: Biodiesel gallons sold - Pure biodiesel sold is

year.

computed on lines 8a-8e by multiplying the biodiesel blended fuel

gallons sold (column A/D) by the appropriate biodiesel content

For fiscal year filers, it is necessary to determine the

percentage (column B/E). For example, 10,000 gallons of

applicable biofuel threshold percentage by annualizing

biodiesel blended fuel formulated with 5% by volume of biodiesel

sales for each calendar year in which the fiscal year falls.

results in 500 gallons of pure biodiesel.

Example: A taxpayer with a fiscal year beginning May 1, 2015,

If sales of biodiesel blended fuel are made for a blend other than

and ending April 30, 2016, with sales of 100,000 gallons at all

those listed, designate the biodiesel gallons sold in line 8e,

retail locations between May 1, 2015, and December 31, 2015,

column A/D, and the biodiesel content percentage in line 8e,

would have annualized 2015 sales of 150,000 gallons that

column B/E. If more than one additional blend is sold, provide

would result in a 2015 biofuel threshold percentage of 14%

total gallons of other blends in line 8e, column A/D, and the

(100,000 gallons / 8 months * 12 months = 150,000 annualized

average biodiesel content percentage in line 8e, column B/E.

gallons). If the same taxpayer had sales of 70,000 gallons

between January 1, 2016, and April 30, 2016, the 2016

Line 10: Biofuel distribution percentage - Divide line 9,

annualized sales would be 210,000 gallons and the 2016

column C by line 7, column A for calendar year 2015 sales.

biofuel threshold percentage would be 19% (70,000 gallons / 4

Divide line 9, column F by line 7, column D for calendar year

months * 12 months = 210,000 annualized gallons).

2016 sales. Record the result rounding to four decimal places

(1/100th of 1%), for example, 12.05%.

Line 12: Biofuel threshold percentage disparity - To

determine the applicable Ethanol Promotion Tax Credit rate, the

Line 11: Biofuel threshold percentage - The tax credit rate

taxpayer subtracts the calculated biofuel distribution percentage

applied under the Ethanol Promotion Tax Credit depends on

on line 10, column A/D from the proper biofuel threshold

whether the taxpayer attains the biofuel threshold percentage,

percentage on line 11, column A/D. The taxpayer calculates a

which is dependent on the number of total gasoline gallons sold

separate biofuel threshold percentage disparity for each calendar

at all retail motor fuel sites operated by the taxpayer during the

year for which sales are reported. Enter zero if line 10 exceeds

41-151d (06/19/15)

1

1 2

2 3

3 4

4 5

5