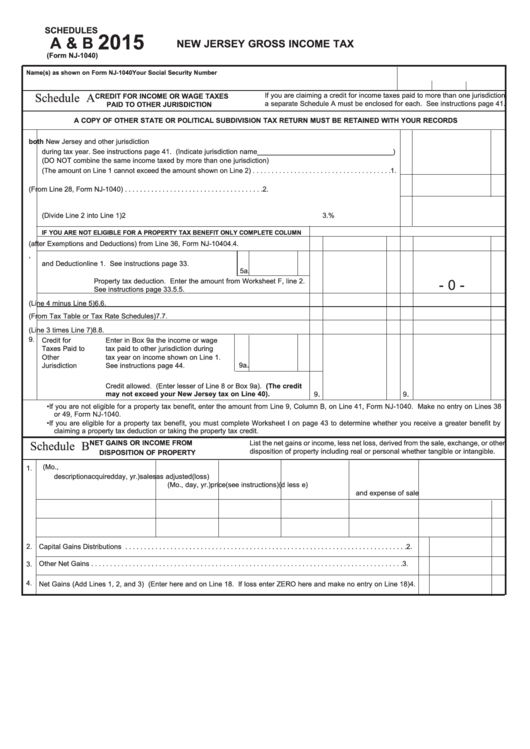

SCHEDULES

2015

A & B

NEW JERSEY GROSS INCOME TAX

(Form NJ-1040)

Name(s) as shown on Form NJ-1040

Your Social Security Number

If you are claiming a credit for income taxes paid to more than one jurisdiction,

Schedule A

CREDIT FOR INCOME OR WAGE TAXES

a separate Schedule A must be enclosed for each. See instructions page 41.

PAID TO OTHER JURISDICTION

A COPY OF OTHER STATE OR POLITICAL SUBDIVISION TAX RETURN MUST BE RETAINED WITH YOUR RECORDS

1.

Income properly taxed by both New Jersey and other jurisdiction

during tax year. See instructions page 41. (Indicate jurisdiction name____________________________________)

(DO NOT combine the same income taxed by more than one jurisdiction)

(The amount on Line 1 cannot exceed the amount shown on Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2.

Income subject to tax by New Jersey (From Line 28, Form NJ-1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3.

Maximum Allowable Credit Percentage

1_____________

(Divide Line 2 into Line 1)

2

3.

%

IF YOU ARE NOT ELIGIBLE FOR A PROPERTY TAX BENEFIT ONLY COMPLETE COLUMN B.

COLUMN A

COLUMN B

4.

Taxable Income (after Exemptions and Deductions) from Line 36, Form NJ-1040

4.

4.

5.

Property Tax

Enter in Box 5a the amount from Worksheet F,

and Deduction

line 1. See instructions page 33.

5a.

Property tax deduction. Enter the amount from Worksheet F, line 2.

- 0 -

See instructions page 33.

5.

5.

6.

New Jersey Taxable Income (Line 4 minus Line 5)

6.

6.

7. Tax on Line 6 amount (From Tax Table or Tax Rate Schedules)

7.

7.

8. Allowable Credit (Line 3 times Line 7)

8.

8.

9.

Credit for

Enter in Box 9a the income or wage

Taxes Paid to

tax paid to other jurisdiction during

Other

tax year on income shown on Line 1.

.

Jurisdiction

See instructions page 44.

9a

Credit allowed. (Enter lesser of Line 8 or Box 9a). (The credit

.

.

may not exceed your New Jersey tax on Line 40).

9

9

• If you are not eligible for a property tax benefit, enter the amount from Line 9, Column B, on Line 41, Form NJ-1040. Make no entry on Lines 38

or 49, Form NJ-1040.

• If you are eligible for a property tax benefit, you must complete Worksheet I on page 43 to determine whether you receive a greater benefit by

claiming a property tax deduction or taking the property tax credit.

NET GAINS OR INCOME FROM

List the net gains or income, less net loss, derived from the sale, exchange, or other

Schedule B

disposition of property including real or personal whether tangible or intangible.

DISPOSITION OF PROPERTY

a. Kind of property and

b. Date

c. Date sold (Mo.,

d. Gross

e.Cost or other basis

f. Gain or

1.

description

acquired

day, yr.)

sales

as adjusted

(loss)

(Mo., day, yr.)

price

(see instructions)

(d less e)

and expense of sale

2.

Capital Gains Distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

Other Net Gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

3.

4.

Net Gains (Add Lines 1, 2, and 3) (Enter here and on Line 18. If loss enter ZERO here and make no entry on Line 18)

4.

1

1