Clear Form

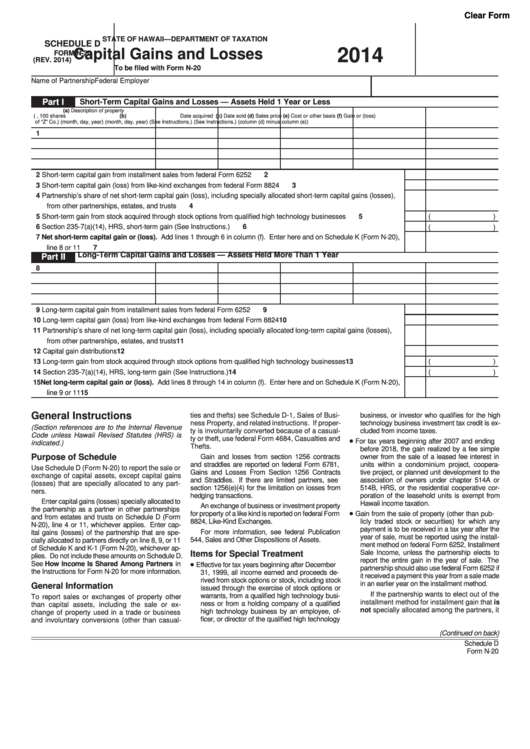

STATE OF HAWAII—DEPARTMENT OF TAXATION

SCHEDULE D

2014

Capital Gains and Losses

FORM N-20

(REV. 2014)

To be filed with Form N-20

Name of Partnership

Federal Employer I.D. No.

Part I

Short-Term Capital Gains and Losses — Assets Held 1 Year or Less

(a) Description of property

(e.g., 100 shares

(b) Date acquired

(c) Date sold

(d) Sales price

(e) Cost or other basis

(f) Gain or (loss)

of “Z” Co.)

(month, day, year)

(month, day, year)

(See Instructions.)

(See Instructions.)

(column (d) minus column (e))

1

2 Short-term capital gain from installment sales from federal Form 6252 .............................................................................

2

3 Short-term capital gain (loss) from like-kind exchanges from federal Form 8824 ..............................................................

3

4 Partnership’s share of net short-term capital gain (loss), including specially allocated short-term capital gains (losses),

from other partnerships, estates, and trusts ........................................................................................................................

4

5 Short-term gain from stock acquired through stock options from qualified high technology businesses ...........................

5

(

)

6 Section 235-7(a)(14), HRS, short-term gain (See Instructions.) .........................................................................................

6

(

)

7 Net short-term capital gain or (loss). Add lines 1 through 6 in column (f). Enter here and on Schedule K (Form N-20),

line 8 or 11 ...........................................................................................................................................................................

7

Part II

Long-Term Capital Gains and Losses — Assets Held More Than 1 Year

8

9 Long-term capital gain from installment sales from federal Form 6252 ..............................................................................

9

10 Long-term capital gain (loss) from like-kind exchanges from federal Form 8824 ...............................................................

10

11 Partnership’s share of net long-term capital gain (loss), including specially allocated long-term capital gains (losses),

from other partnerships, estates, and trusts ........................................................................................................................

11

12 Capital gain distributions .....................................................................................................................................................

12

13 Long-term gain from stock acquired through stock options from qualified high technology businesses ...........................

13

(

)

14 Section 235-7(a)(14), HRS, long-term gain (See Instructions.) ..........................................................................................

14

(

)

15 Net long-term capital gain or (loss). Add lines 8 through 14 in column (f). Enter here and on Schedule K (Form N-20),

line 9 or 11 ...........................................................................................................................................................................

15

General Instructions

ties and thefts) see Schedule D-1, Sales of Busi-

business, or investor who qualifies for the high

ness Property, and related instructions. If proper-

technology business investment tax credit is ex-

(Section references are to the Internal Revenue

ty is involuntarily converted because of a casual-

cluded from income taxes.

Code unless Hawaii Revised Statutes (HRS) is

ty or theft, use federal Form 4684, Casualties and

•

For tax years beginning after 2007 and ending

indicated.)

Thefts.

before 2018, the gain realized by a fee simple

Purpose of Schedule

Gain and losses from section 1256 contracts

owner from the sale of a leased fee interest in

and straddles are reported on federal Form 6781,

units within a condominium project, coopera-

Use Schedule D (Form N-20) to report the sale or

Gains and Losses From Section 1256 Contracts

tive project, or planned unit development to the

exchange of capital assets, except capital gains

and Straddles. If there are limited partners, see

association of owners under chapter 514A or

(losses) that are specially allocated to any part-

section 1256(e)(4) for the limitation on losses from

514B, HRS, or the residential cooperative cor-

ners.

hedging transactions.

poration of the leasehold units is exempt from

Enter capital gains (losses) specially allocated to

Hawaii income taxation.

An exchange of business or investment property

the partnership as a partner in other partnerships

•

for property of a like kind is reported on federal Form

Gain from the sale of property (other than pub-

and from estates and trusts on Schedule D (Form

8824, Like-Kind Exchanges.

licly traded stock or securities) for which any

N-20), line 4 or 11, whichever applies. Enter cap-

payment is to be received in a tax year after the

For more information, see federal Publication

ital gains (losses) of the partnership that are spe-

year of sale, must be reported using the install-

544, Sales and Other Dispositions of Assets.

cially allocated to partners directly on line 8, 9, or 11

ment method on federal Form 6252, Installment

of Schedule K and K-1 (Form N-20), whichever ap-

Sale Income, unless the partnership elects to

Items for Special Treatment

plies. Do not include these amounts on Schedule D.

report the entire gain in the year of sale. The

•

See How Income Is Shared Among Partners in

Effective for tax years beginning after December

partnership should also use federal Form 6252 if

the Instructions for Form N-20 for more information.

31, 1999, all income earned and proceeds de-

it received a payment this year from a sale made

rived from stock options or stock, including stock

in an earlier year on the installment method.

General Information

issued through the exercise of stock options or

If the partnership wants to elect out of the

warrants, from a qualified high technology busi-

To report sales or exchanges of property other

installment method for installment gain that is

ness or from a holding company of a qualified

than capital assets, including the sale or ex-

not specially allocated among the partners, it

high technology business by an employee, of-

change of property used in a trade or business

ficer, or director of the qualified high technology

and involuntary conversions (other than casual-

(Continued on back)

Schedule D

Form N-20

1

1 2

2