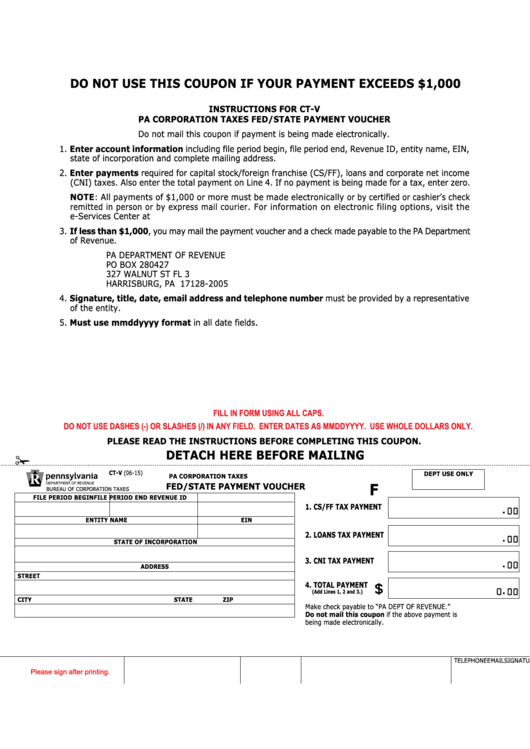

DO NOT USE THIS COUPON IF YOUR PAYMENT EXCEEDS $1,000

INSTRUCTIONS FOR CT-V

PA CORPORATION TAXES FED/STATE PAYMENT VOUCHER

Do not mail this coupon if payment is being made electronically.

1. Enter account information including file period begin, file period end, Revenue ID, entity name, EIN,

state of incorporation and complete mailing address.

2. Enter payments required for capital stock/foreign franchise (CS/FF), loans and corporate net income

(CNI) taxes. Also enter the total payment on Line 4. If no payment is being made for a tax, enter zero.

NOTE: All payments of $1,000 or more must be made electronically or by certified or cashier’s check

remitted in person or by express mail courier. For information on electronic filing options, visit the

e-Services Center at

3. If less than $1,000, you may mail the payment voucher and a check made payable to the PA Department

of Revenue.

PA DEPARTMENT OF REVENUE

PO BOX 280427

327 WALNUT ST FL 3

HARRISBURG, PA 17128-2005

4. Signature, title, date, email address and telephone number must be provided by a representative

of the entity.

5. Must use mmddyyyy format in all date fields.

FILL IN FORM USING ALL CAPS.

DO NOT USE DASHES (-) OR SLASHES (/) IN ANY FIELD. ENTER DATES AS MMDDYYYY. USE WHOLE DOLLARS ONLY.

PLEASE READ THE INSTRUCTIONS BEFORE COMPLETING THIS COUPON.

✁

DETACH HERE BEFORE MAILING

CT-V (06-15)

DEPT USE ONLY

PA CORPORATION TAXES

FED/STATE PAYMENT VOUCHER

F

BUREAU OF CORPORATION TAXES

FILE PERIOD BEGIN

FILE PERIOD END

REVENUE ID

1. CS/FF TAX PAYMENT

.00

ENTITY NAME

EIN

2. LOANS TAX PAYMENT

.00

STATE OF INCORPORATION

3. CNI TAX PAYMENT

.00

ADDRESS

STREET

4. TOTAL PAYMENT

$

.00

0

(Add Lines 1, 2 and 3.)

CITY

STATE

ZIP

Make check payable to “PA DEPT OF REVENUE.”

Do not mail this coupon if the above payment is

being made electronically.

RESET

PRINT

SIGNATURE

TITLE

DATE

EMAIL

TELEPHONE

Please sign after printing.

1

1