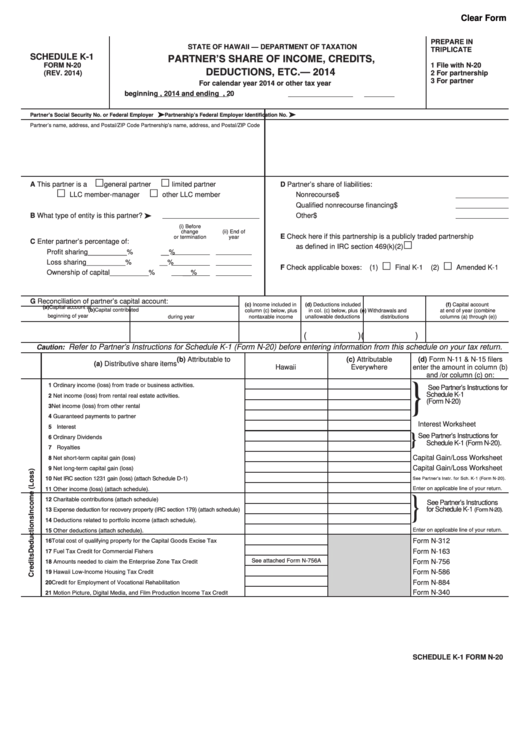

Clear Form

PREPARE IN

STATE OF HAWAII — DEPARTMENT OF TAXATION

TRIPLICATE

PARTNER’S SHARE OF INCOME, CREDITS,

SCHEDULE K-1

FORM N-20

1

File with N-20

DEDUCTIONS, ETC.— 2014

(REV. 2014)

2

For partnership

3

For partner

For calendar year 2014 or other tax year

beginning

, 2014 and ending

, 20

Partner’s Social Security No. or Federal Employer I.D. No.

Partnership’s Federal Employer Identification No.

Partner’s name, address, and Postal/ZIP Code

Partnership’s name, address, and Postal/ZIP Code

A

This partner is a

general partner

limited partner

D

Partner’s share of liabilities:

LLC member-manager

other LLC member

Nonrecourse ........................................................... $

Qualified nonrecourse financing ............................. $

What type of entity is this partner?

B

Other ....................................................................... $

(i) Before

change

(ii) End of

E

Check here if this partnership is a publicly traded partnership

or termination

year

C

Enter partner’s percentage of:

as defined in IRC section 469(k)(2) ........

Profit sharing ...........................................__________%

__%

Loss sharing ............................................__________%

__%

F

Check applicable boxes:

(1)

Final K-1

(2)

Amended K-1

Ownership of capital ...............................__________%

__%

G

Reconciliation of partner’s capital account:

(c) Income included in

(d) Deductions included

(f) Capital account

(a) Capital account at

(b) Capital contributed

column (c) below, plus

in col. (c) below, plus

(e) Withdrawals and

at end of year (combine

beginning of year

during year

nontaxable income

unallowable deductions

distributions

columns (a) through (e))

(

) (

)

Refer to Partner’s Instructions for Schedule K-1 (Form N-20) before entering information from this schedule on your tax return.

Caution:

(b) Attributable to

(c) Attributable

(d) Form N-11 & N-15 filers

(a) Distributive share items

Hawaii

Everywhere

enter the amount in column (b)

and /or column (c) on:

1 Ordinary income (loss) from trade or business activities. .............................

}

See Partner’s Instructions for

2 Net income (loss) from rental real estate activities. ......................................

Schedule K-1

(Form N-20)

3 Net income (loss) from other rental activities................................................

4 Guaranteed payments to partner ..................................................................

Interest Worksheet

5 Interest ..........................................................................................................

}

6 Ordinary Dividends .......................................................................................

See Partner’s Instructions for

Schedule K-1 (Form N-20).

7 Royalties .......................................................................................................

8 Net short-term capital gain (loss) .................................................................

Capital Gain/Loss Worksheet

9 Net long-term capital gain (loss) ...................................................................

Capital Gain/Loss Worksheet

10 Net IRC section 1231 gain (loss) (attach Schedule D-1) ................................

See Partner’s Instr. for Sch. K-1 (Form N-20).

11 Other income (loss) (attach schedule). .........................................................

Enter on applicable line of your return.

12 Charitable contributions (attach schedule) ...................................................

}

See Partner’s Instructions

13 Expense deduction for recovery property (IRC section 179) (attach schedule)

for Schedule K-1 (Form N-20).

14 Deductions related to portfolio income (attach schedule). ............................

15 Other deductions (attach schedule). .............................................................

Enter on applicable line of your return.

16 Total cost of qualifying property for the Capital Goods Excise Tax Credit.....

Form N-312

17 Fuel Tax Credit for Commercial Fishers ........................................................

Form N-163

See attached Form N-756A

18 Amounts needed to claim the Enterprise Zone Tax Credit ..........................

Form N-756

19 Hawaii Low-Income Housing Tax Credit .......................................................

Form N-586

20 Credit for Employment of Vocational Rehabilitation Referrals.......................

Form N-884

21 Motion Picture, Digital Media, and Film Production Income Tax Credit ........

Form N-340

SCHEDULE K-1 FORM N-20

1

1 2

2