Instructions For Arizona Form 201 - Renter'S Certificate Of Property Taxes Paid - 2014

ADVERTISEMENT

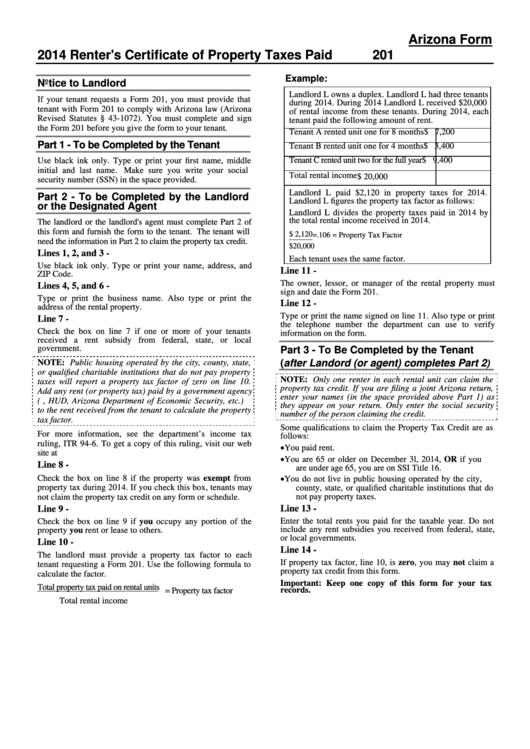

Arizona Form

2014 Renter's Certificate of Property Taxes Paid

201

Example:

Notice to Landlord

Landlord L owns a duplex. Landlord L had three tenants

If your tenant requests a Form 201, you must provide that

during 2014. During 2014 Landlord L received $20,000

tenant with Form 201 to comply with Arizona law (Arizona

of rental income from these tenants. During 2014, each

Revised Statutes § 43-1072). You must complete and sign

tenant paid the following amount of rent.

the Form 201 before you give the form to your tenant.

Tenant A rented unit one for 8 months

$ 7,200

Part 1 - To be Completed by the Tenant

Tenant B rented unit one for 4 months

$ 3,400

Use black ink only. Type or print your first name, middle

Tenant C rented unit two for the full year

$ 9,400

initial and last name. Make sure you write your social

Total rental income

$ 20,000

security number (SSN) in the space provided.

Landlord L paid $2,120 in property taxes for 2014.

Part 2 - To be Completed by the Landlord

Landlord L figures the property tax factor as follows:

or the Designated Agent

Landlord L divides the property taxes paid in 2014 by

the total rental income received in 2014.

The landlord or the landlord's agent must complete Part 2 of

this form and furnish the form to the tenant. The tenant will

$ 2,120 =.106 = Property Tax Factor

need the information in Part 2 to claim the property tax credit.

$20,000

Lines 1, 2, and 3 -

Each tenant uses the same factor.

Use black ink only. Type or print your name, address, and

Line 11 -

ZIP Code.

The owner, lessor, or manager of the rental property must

Lines 4, 5, and 6 -

sign and date the Form 201.

Type or print the business name. Also type or print the

Line 12 -

address of the rental property.

Type or print the name signed on line 11. Also type or print

Line 7 -

the telephone number the department can use to verify

Check the box on line 7 if one or more of your tenants

information on the form.

received a rent subsidy from federal, state, or local

government.

Part 3 - To Be Completed by the Tenant

(after Landord (or agent) completes Part 2

NOTE: Public housing operated by the city, county, state,

)

or qualified charitable institutions that do not pay property

NOTE: Only one renter in each rental unit can claim the

taxes will report a property tax factor of zero on line 10.

property tax credit. If you are filing a joint Arizona return,

Add any rent (or property tax) paid by a government agency

enter your names (in the space provided above Part 1) as

(i.e., HUD, Arizona Department of Economic Security, etc.)

they appear on your return. Only enter the social security

to the rent received from the tenant to calculate the property

number of the person claiming the credit.

tax factor.

Some qualifications to claim the Property Tax Credit are as

For more information, see the department’s income tax

follows:

ruling, ITR 94-6. To get a copy of this ruling, visit our web

You paid rent.

site at

You are 65 or older on December 3l, 2014, OR if you

Line 8 -

are under age 65, you are on SSI Title 16.

Check the box on line 8 if the property was exempt from

You do not live in public housing operated by the city,

property tax during 2014. If you check this box, tenants may

county, state, or qualified charitable institutions that do

not pay property taxes.

not claim the property tax credit on any form or schedule.

Line 13 -

Line 9 -

Enter the total rents you paid for the taxable year. Do not

Check the box on line 9 if you occupy any portion of the

include any rent subsidies you received from federal, state,

property you rent or lease to others.

or local governments.

Line 10 -

Line 14 -

The landlord must provide a property tax factor to each

If property tax factor, line 10, is zero, you may not claim a

tenant requesting a Form 201. Use the following formula to

property tax credit from this form.

calculate the factor.

Important: Keep one copy of this form for your tax

Total property tax paid on rental units = Property tax factor

records.

Total rental income

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1