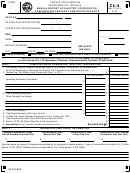

Form Cl-4 - Annual Report Of Electric Cooperative Corporation Property And Gross Receipts Page 2

ADVERTISEMENT

CL-4

PART III

ANNUAL REPORT TO BE COMPLETED BY ALL ELECTRIC COOPERATIVES

1. Name

2. Organized under the laws of the State of

3. Location of the Registered Office of the Cooperative in the State of South Carolina is

In the City of

Registered Agent at such address is

4. Location of principal office (street address)

5. The total number of authorized shares of capital stock, itemized by class and series, if any, within each class is as follows:

NUMBER OF SHARES

CLASS

SERIES

6. The total number of issued and outstanding shares of capital stock itemized by class and series, if any, within each class is as follows:

NUMBER OF SHARES

CLASS

SERIES

7. The names and business addresses of the directors (or individuals functioning as directors) and principal officers in the Cooperative are:

(If additional space is necessary, attach separate schedule).

NAME

TITLE

BUSINESS ADDRESS

8. Date Organized

Date commenced business in the State of South Carolina was

9. Date of this report

FEIN

10. If Foreign Entity, the date qualified to do business in the State of South Carolina is

11. Was the name of the Cooperative changed during the year?

Give old name

12. The Cooperative's books are in the care of

Located at (street address)

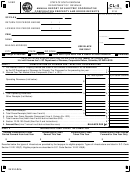

I, the undersigned, a principal officer of the electric cooperative for which this return is made declare that this return, including

Please

accompanying Annual Report, statements and schedules, has been examined by me and is to the best of my knowledge and belief,

Sign

a true and complete return.

Here

Signature of officer

Officer's title

Email

Officer's printed name

Date

Telephone Number

Preparer's Printed Name

I authorize the Director of the Department of Revenue or delegate to

discuss this return, attachments and related tax matters with the preparer.

Yes

No

Date

Preparer's Telephone Number

Preparer's

Check if

Paid

signature

self-employed

Preparer's

Firm's name (or

PTIN or FEIN

Use Only

yours if self-employed)

ZIP Code

and address

If this is an electric cooperative's final return, signing here authorizes the Department of Revenue to disclose that information with the Secretary of

State. You must close with the Secretary of State as well as the Department of Revenue and complete I-349.

Taxpayer's Signature

Date

ATTACH COMPLETE COPY OF FEDERAL RETURN

Make check payable to: SC Department of Revenue. Include Business Name, FEIN and SC File Number.

File by the 15th day of the 3rd month after the end of the tax year (March 15 if calendar year).

Mail with license fee to:

SC Department of Revenue, Corporation Return, Columbia, SC 29214-0100

31352024

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3