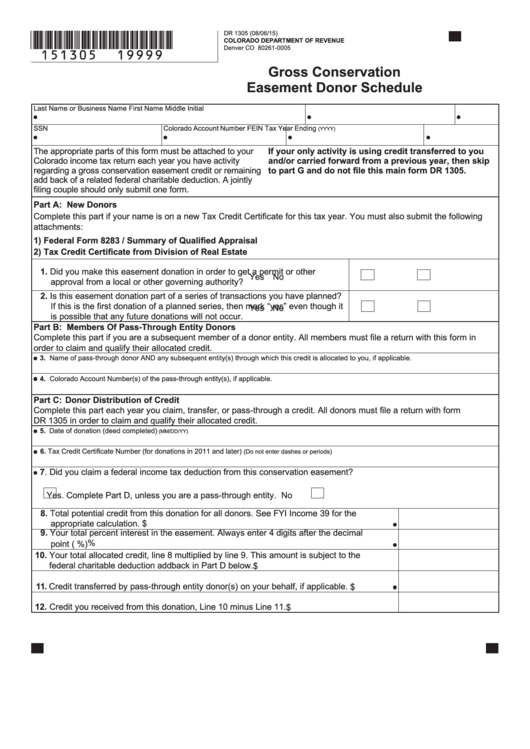

DR 1305 (08/06/15)

*151305==19999*

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0005

Gross Conservation

Easement Donor Schedule

Last Name or Business Name

First Name

Middle Initial

SSN

Colorado Account Number

FEIN

Tax Year Ending

(YYYY)

The appropriate parts of this form must be attached to your

If your only activity is using credit transferred to you

Colorado income tax return each year you have activity

and/or carried forward from a previous year, then skip

regarding a gross conservation easement credit or remaining

to part G and do not file this main form DR 1305.

add back of a related federal charitable deduction. A jointly

filing couple should only submit one form.

Part A: New Donors

Complete this part if your name is on a new Tax Credit Certificate for this tax year. You must also submit the following

attachments:

1) Federal Form 8283 / Summary of Qualified Appraisal

2) Tax Credit Certificate from Division of Real Estate

1. Did you make this easement donation in order to get a permit or other

Yes

No

approval from a local or other governing authority?

2. Is this easement donation part of a series of transactions you have planned?

If this is the first donation of a planned series, then mark “yes” even though it

Yes

No

is possible that any future donations will not occur.

Part B: Members Of Pass-Through Entity Donors

Complete this part if you are a subsequent member of a donor entity. All members must file a return with this form in

order to claim and qualify their allocated credit.

3. Name of pass-through donor AND any subsequent entity(s) through which this credit is allocated to you, if applicable.

4. Colorado Account Number(s) of the pass-through entity(s), if applicable.

Part C: Donor Distribution of Credit

Complete this part each year you claim, transfer, or pass-through a credit. All donors must file a return with form

DR 1305 in order to claim and qualify their allocated credit.

5. Date of donation (deed completed)

(MM/DD/YY)

6. Tax Credit Certificate Number (for donations in 2011 and later)

(Do not enter dashes or periods)

7. Did you claim a federal income tax deduction from this conservation easement?

Yes. Complete Part D, unless you are a pass-through entity.

No

8. Total potential credit from this donation for all donors. See FYI Income 39 for the

appropriate calculation.

$

9. Your total percent interest in the easement. Always enter 4 digits after the decimal

%

point (nnn.nnnn %)

10. Your total allocated credit, line 8 multiplied by line 9. This amount is subject to the

federal charitable deduction addback in Part D below.

$

11. Credit transferred by pass-through entity donor(s) on your behalf, if applicable.

$

12. Credit you received from this donation, Line 10 minus Line 11.

$

1

1 2

2