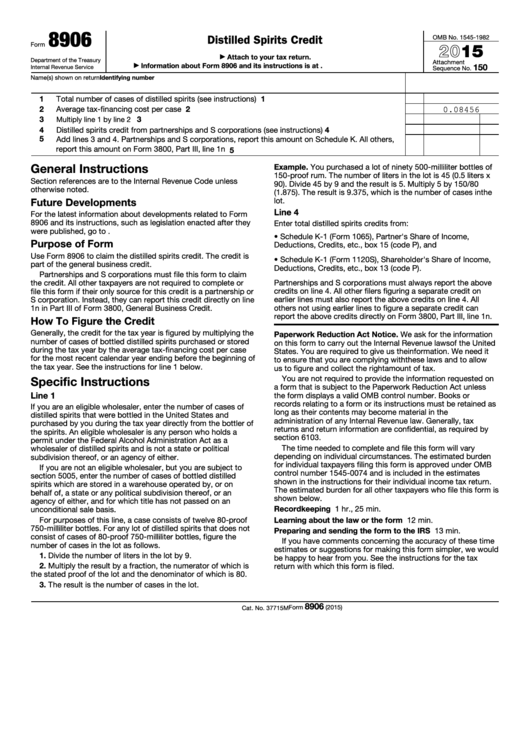

8906

Distilled Spirits Credit

OMB No. 1545-1982

2015

Form

Attach to your tax return.

▶

Department of the Treasury

Attachment

Information about Form 8906 and its instructions is at

150

▶

Internal Revenue Service

Sequence No.

Identifying number

Name(s) shown on return

1

Total number of cases of distilled spirits (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Average tax-financing cost per case .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

0.08456

3

3

Multiply line 1 by line 2 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Distilled spirits credit from partnerships and S corporations (see instructions)

.

.

.

.

.

.

.

4

5

Add lines 3 and 4. Partnerships and S corporations, report this amount on Schedule K. All others,

report this amount on Form 3800, Part III, line 1n .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

General Instructions

Example. You purchased a lot of ninety 500-milliliter bottles of

150-proof rum. The number of liters in the lot is 45 (0.5 liters x

Section references are to the Internal Revenue Code unless

90). Divide 45 by 9 and the result is 5. Multiply 5 by 150/80

otherwise noted.

(1.875). The result is 9.375, which is the number of cases in the

Future Developments

lot.

Line 4

For the latest information about developments related to Form

8906 and its instructions, such as legislation enacted after they

Enter total distilled spirits credits from:

were published, go to

• Schedule K-1 (Form 1065), Partner's Share of Income,

Purpose of Form

Deductions, Credits, etc., box 15 (code P), and

Use Form 8906 to claim the distilled spirits credit. The credit is

• Schedule K-1 (Form 1120S), Shareholder's Share of Income,

part of the general business credit.

Deductions, Credits, etc., box 13 (code P).

Partnerships and S corporations must file this form to claim

Partnerships and S corporations must always report the above

the credit. All other taxpayers are not required to complete or

file this form if their only source for this credit is a partnership or

credits on line 4. All other filers figuring a separate credit on

S corporation. Instead, they can report this credit directly on line

earlier lines must also report the above credits on line 4. All

others not using earlier lines to figure a separate credit can

1n in Part III of Form 3800, General Business Credit.

report the above credits directly on Form 3800, Part III, line 1n.

How To Figure the Credit

Generally, the credit for the tax year is figured by multiplying the

Paperwork Reduction Act Notice. We ask for the information

number of cases of bottled distilled spirits purchased or stored

on this form to carry out the Internal Revenue laws of the United

during the tax year by the average tax-financing cost per case

States. You are required to give us the information. We need it

for the most recent calendar year ending before the beginning of

to ensure that you are complying with these laws and to allow

the tax year. See the instructions for line 1 below.

us to figure and collect the right amount of tax.

You are not required to provide the information requested on

Specific Instructions

a form that is subject to the Paperwork Reduction Act unless

Line 1

the form displays a valid OMB control number. Books or

records relating to a form or its instructions must be retained as

If you are an eligible wholesaler, enter the number of cases of

long as their contents may become material in the

distilled spirits that were bottled in the United States and

administration of any Internal Revenue law. Generally, tax

purchased by you during the tax year directly from the bottler of

returns and return information are confidential, as required by

the spirits. An eligible wholesaler is any person who holds a

section 6103.

permit under the Federal Alcohol Administration Act as a

The time needed to complete and file this form will vary

wholesaler of distilled spirits and is not a state or political

depending on individual circumstances. The estimated burden

subdivision thereof, or an agency of either.

for individual taxpayers filing this form is approved under OMB

If you are not an eligible wholesaler, but you are subject to

control number 1545-0074 and is included in the estimates

section 5005, enter the number of cases of bottled distilled

shown in the instructions for their individual income tax return.

spirits which are stored in a warehouse operated by, or on

The estimated burden for all other taxpayers who file this form is

behalf of, a state or any political subdivision thereof, or an

shown below.

agency of either, and for which title has not passed on an

Recordkeeping

.

.

.

.

.

.

.

.

.

.

. 1 hr., 25 min.

unconditional sale basis.

For purposes of this line, a case consists of twelve 80-proof

Learning about the law or the form .

.

.

.

.

.

. 12 min.

750-milliliter bottles. For any lot of distilled spirits that does not

Preparing and sending the form to the IRS .

.

.

. 13 min.

consist of cases of 80-proof 750-milliliter bottles, figure the

If you have comments concerning the accuracy of these time

number of cases in the lot as follows.

estimates or suggestions for making this form simpler, we would

1. Divide the number of liters in the lot by 9.

be happy to hear from you. See the instructions for the tax

2. Multiply the result by a fraction, the numerator of which is

return with which this form is filed.

the stated proof of the lot and the denominator of which is 80.

3. The result is the number of cases in the lot.

8906

Form

(2015)

Cat. No. 37715M

1

1