Instructions For Alaska Veteran Employment Tax Credit (Form 6325) - 2015

ADVERTISEMENT

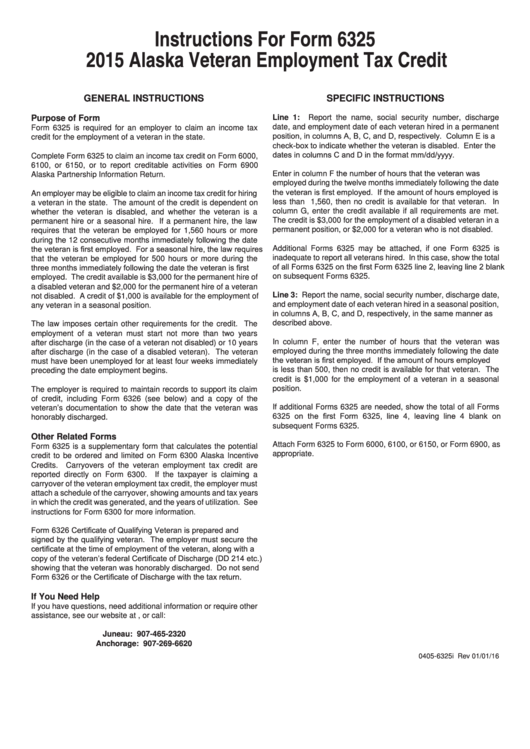

Instructions For Form 6325

2015 Alaska Veteran Employment Tax Credit

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

Report the name, social security number, discharge

Line 1:

Purpose of Form

date, and employment date of each veteran hired in a permanent

Form 6325 is required for an employer to claim an income tax

position, in columns A, B, C, and D, respectively. Column E is a

credit for the employment of a veteran in the state.

check-box to indicate whether the veteran is disabled. Enter the

dates in columns C and D in the format mm/dd/yyyy.

Complete Form 6325 to claim an income tax credit on Form 6000,

6100, or 6150, or to report creditable activities on Form 6900

Enter in column F the number of hours that the veteran was

Alaska Partnership Information Return.

employed during the twelve months immediately following the date

the veteran is first employed. If the amount of hours employed is

An employer may be eligible to claim an income tax credit for hiring

less than 1,560, then no credit is available for that veteran. In

a veteran in the state. The amount of the credit is dependent on

column G, enter the credit available if all requirements are met.

whether the veteran is disabled, and whether the veteran is a

The credit is $3,000 for the employment of a disabled veteran in a

permanent hire or a seasonal hire. If a permanent hire, the law

permanent position, or $2,000 for a veteran who is not disabled.

requires that the veteran be employed for 1,560 hours or more

during the 12 consecutive months immediately following the date

Additional Forms 6325 may be attached, if one Form 6325 is

the veteran is first employed. For a seasonal hire, the law requires

inadequate to report all veterans hired. In this case, show the total

that the veteran be employed for 500 hours or more during the

of all Forms 6325 on the first Form 6325 line 2, leaving line 2 blank

three months immediately following the date the veteran is first

on subsequent Forms 6325.

employed. The credit available is $3,000 for the permanent hire of

a disabled veteran and $2,000 for the permanent hire of a veteran

Line 3: Report the name, social security number, discharge date,

not disabled. A credit of $1,000 is available for the employment of

and employment date of each veteran hired in a seasonal position,

any veteran in a seasonal position.

in columns A, B, C, and D, respectively, in the same manner as

described above.

The law imposes certain other requirements for the credit. The

employment of a veteran must start not more than two years

In column F, enter the number of hours that the veteran was

after discharge (in the case of a veteran not disabled) or 10 years

employed during the three months immediately following the date

after discharge (in the case of a disabled veteran). The veteran

the veteran is first employed. If the amount of hours employed

must have been unemployed for at least four weeks immediately

is less than 500, then no credit is available for that veteran. The

preceding the date employment begins.

credit is $1,000 for the employment of a veteran in a seasonal

position.

The employer is required to maintain records to support its claim

of credit, including Form 6326 (see below) and a copy of the

If additional Forms 6325 are needed, show the total of all Forms

veteran’s documentation to show the date that the veteran was

6325 on the first Form 6325, line 4, leaving line 4 blank on

honorably discharged.

subsequent Forms 6325.

Other Related Forms

Attach Form 6325 to Form 6000, 6100, or 6150, or Form 6900, as

Form 6325 is a supplementary form that calculates the potential

appropriate.

credit to be ordered and limited on Form 6300 Alaska Incentive

Credits. Carryovers of the veteran employment tax credit are

reported directly on Form 6300. If the taxpayer is claiming a

carryover of the veteran employment tax credit, the employer must

attach a schedule of the carryover, showing amounts and tax years

in which the credit was generated, and the years of utilization. See

instructions for Form 6300 for more information.

Form 6326 Certificate of Qualifying Veteran is prepared and

signed by the qualifying veteran. The employer must secure the

certificate at the time of employment of the veteran, along with a

copy of the veteran’s federal Certificate of Discharge (DD 214 etc.)

showing that the veteran was honorably discharged. Do not send

Form 6326 or the Certificate of Discharge with the tax return.

If You Need Help

If you have questions, need additional information or require other

assistance, see our website at , or call:

Juneau: 907-465-2320

Anchorage: 907-269-6620

0405-6325i Rev 01/01/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1