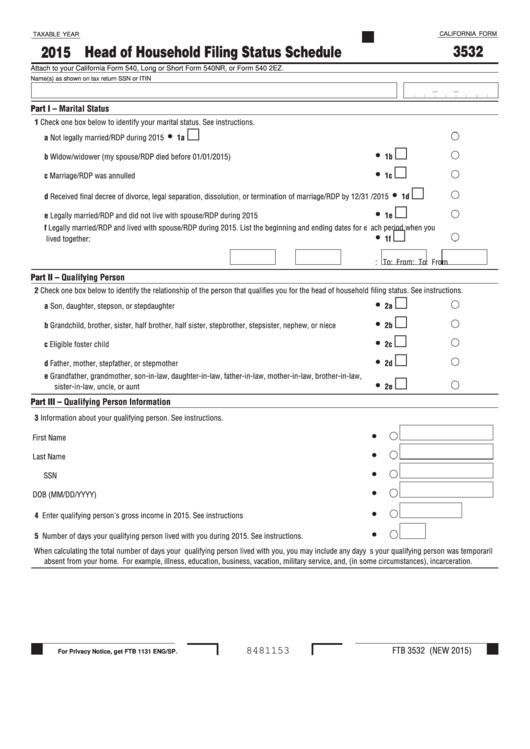

Form 3532 - California Head Of Household Filing Status Schedule - 2015

ADVERTISEMENT

CALIFORNIA FORM

TAXABLE YEAR

3532

2015

Head of Household Filing Status Schedule

Attach to your California Form 540, Long or Short Form 540NR, or Form 540 2EZ.

Name(s) as shown on tax return

SSN or ITIN

Part I – Marital Status

1 Check one box below to identify your marital status. See instructions.

m

a Not legally married/RDP during 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1a

m

b Widow/widower (my spouse/RDP died before 01/01/2015) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

1b

m

c Marriage/RDP was annulled . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

1c

m

d Received final decree of divorce, legal separation, dissolution, or termination of marriage/RDP by 12/31

/2015 . . . . . . . . . . . . . . .

1d

m

e Legally married/RDP and did not live with spouse/RDP during 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

1e

f

Legally married/RDP and lived with spouse/RDP during 2015. List the beginning and ending dates for e

ach period when you

m

lived together: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

1f

From:

To:

From

:

To:

Part II – Qualifying Person

2 Check one box below to identify the relationship of the person that qualifies you for the head of household

filing status. See instructions.

m

a Son, daughter, stepson, or stepdaughter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

2a

m

b Grandchild, brother, sister, half brother, half sister, stepbrother, stepsister, nephew, or niece . . . . . . . . .

2b

. . . . . . . . . . . . . . . . . . . .

m

c Eligible foster child . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

2c

m

d Father, mother, stepfather, or stepmother . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

2d

e Grandfather, grandmother, son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law,

m

sister-in-law, uncle, or aunt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . .

2e

Part III – Qualifying Person Information

3 Information about your qualifying person. See instructions.

First Name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . .

Last Name . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . .

SSN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . .

DOB (MM/DD/YYYY) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . .

4 Enter qualifying person's gross income in 2015. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . .

5 Number of days your qualifying person lived with you during 2015. See instructions. . . . . . . . . . . . . . . . . .

. . . .

When calculating the total number of days your qualifying person lived with you, you may include any day

s your qualifying person was temporaril

y

absent from your home. For example, illness, education, business, vacation, military service, and, (in some circumstances), incarceration.

FTB 3532 (NEW 2015)

8481153

For Privacy Notice, get FTB 1131 ENG/SP.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1