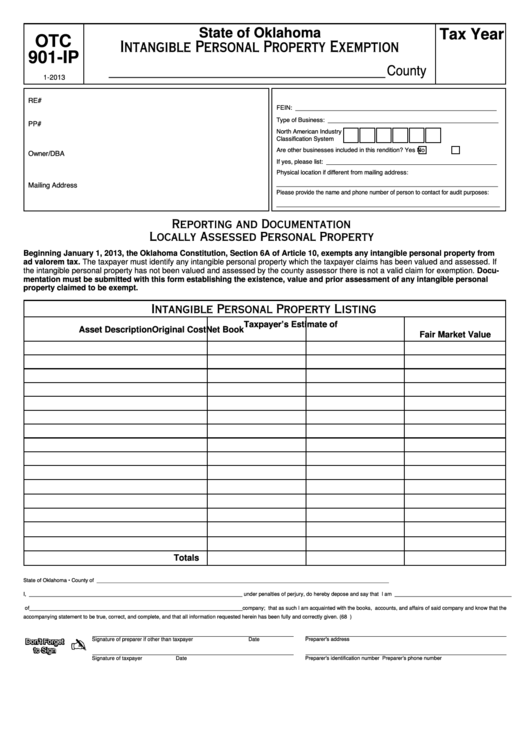

State of Oklahoma

Tax Year

OTC

Intangible Personal Property Exemption

901-IP

____________________________________County

1-2013

RE#

FEIN: ___________________________________________________________

Type of Business: __________________________________________________

PP#

North American Industry

Classification System

Are other businesses included in this rendition?

Yes

No

Owner/DBA

If yes, please list: __________________________________________________

Physical location if different from mailing address:

Mailing Address

_________________________________________________________________

Please provide the name and phone number of person to contact for audit purposes:

_____________________________________________________________________

Reporting and Documentation

Locally Assessed Personal Property

Beginning January 1, 2013, the Oklahoma Constitution, Section 6A of Article 10, exempts any intangible personal property from

ad valorem tax. The taxpayer must identify any intangible personal property which the taxpayer claims has been valued and assessed. If

the intangible personal property has not been valued and assessed by the county assessor there is not a valid claim for exemption. Docu-

mentation must be submitted with this form establishing the existence, value and prior assessment of any intangible personal

property claimed to be exempt.

Intangible Personal Property Listing

Taxpayer’s Estimate of

Asset Description

Original Cost

Net Book

Fair Market Value

Totals

State of Oklahoma • County of ____________________________________________________________________________________________________

I, _________________________________________________________________________ under penalties of perjury, do hereby depose and say that I am ________________________________________

of _________________________________________________________________________ company; that as such I am acquainted with the books, accounts, and affairs of said company and know that the

accompanying statement to be true, correct, and complete, and that all information requested herein has been fully and correctly given. (68 O.S. Section 2945 provides penalties for false oaths)

✍

Preparer’s address

Don’t Forget

Signature of preparer if other than taxpayer

Date

to Sign

Preparer’s identification number

Preparer’s phone number

Signature of taxpayer

Date

1

1