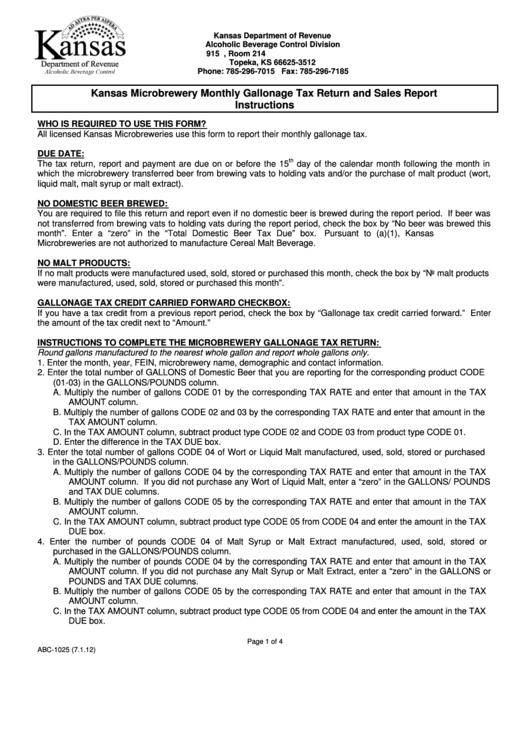

Kansas Department of Revenue

Alcoholic Beverage Control Division

915 S.W. Harrison Street, Room 214

Topeka, KS 66625-3512

Phone: 785-296-7015 Fax: 785-296-7185

Kansas Microbrewery Monthly Gallonage Tax Return and Sales Report

Instructions

WHO IS REQUIRED TO USE THIS FORM?

All licensed Kansas Microbreweries use this form to report their monthly gallonage tax.

DUE DATE:

th

The tax return, report and payment are due on or before the 15

day of the calendar month following the month in

which the microbrewery transferred beer from brewing vats to holding vats and/or the purchase of malt product (wort,

liquid malt, malt syrup or malt extract).

NO DOMESTIC BEER BREWED:

You are required to file this return and report even if no domestic beer is brewed during the report period. If beer was

not transferred from brewing vats to holding vats during the report period, check the box by “No beer was brewed this

month”. Enter a “zero” in the “Total Domestic Beer Tax Due” box.

Pursuant to K.S.A 41-308(a)(1), Kansas

Microbreweries are not authorized to manufacture Cereal Malt Beverage.

NO MALT PRODUCTS:

If no malt products were manufactured used, sold, stored or purchased this month, check the box by “No malt products

were manufactured, used, sold, stored or purchased this month”.

GALLONAGE TAX CREDIT CARRIED FORWARD CHECKBOX:

If you have a tax credit from a previous report period, check the box by “Gallonage tax credit carried forward.” Enter

the amount of the tax credit next to “Amount.”

INSTRUCTIONS TO COMPLETE THE MICROBREWERY GALLONAGE TAX RETURN:

Round gallons manufactured to the nearest whole gallon and report whole gallons only.

1. Enter the month, year, FEIN, microbrewery name, demographic and contact information.

2. Enter the total number of GALLONS of Domestic Beer that you are reporting for the corresponding product CODE

(01-03) in the GALLONS/POUNDS column.

A. Multiply the number of gallons CODE 01 by the corresponding TAX RATE and enter that amount in the TAX

AMOUNT column.

B. Multiply the number of gallons CODE 02 and 03 by the corresponding TAX RATE and enter that amount in the

TAX AMOUNT column.

C. In the TAX AMOUNT column, subtract product type CODE 02 and CODE 03 from product type CODE 01.

D. Enter the difference in the TAX DUE box.

3. Enter the total number of gallons CODE 04 of Wort or Liquid Malt manufactured, used, sold, stored or purchased

in the GALLONS/POUNDS column.

A. Multiply the number of gallons CODE 04 by the corresponding TAX RATE and enter that amount in the TAX

AMOUNT column. If you did not purchase any Wort of Liquid Malt, enter a “zero” in the GALLONS/ POUNDS

and TAX DUE columns.

B. Multiply the number of gallons CODE 05 by the corresponding TAX RATE and enter that amount in the TAX

AMOUNT column.

C. In the TAX AMOUNT column, subtract product type CODE 05 from CODE 04 and enter the amount in the TAX

DUE box.

4. Enter the number of pounds CODE 04 of Malt Syrup or Malt Extract manufactured, used, sold, stored or

purchased in the GALLONS/POUNDS column.

A. Multiply the number of pounds CODE 04 by the corresponding TAX RATE and enter that amount in the TAX

AMOUNT column. If you did not purchase any Malt Syrup or Malt Extract, enter a “zero” in the GALLONS or

POUNDS and TAX DUE columns.

B. Multiply the number of gallons CODE 05 by the corresponding TAX RATE and enter that amount in the TAX

AMOUNT column.

C. In the TAX AMOUNT column, subtract product type CODE 05 from CODE 04 and enter the amount in the TAX

DUE box.

Page 1 of 4

ABC-1025 (7.1.12)

1

1 2

2 3

3 4

4