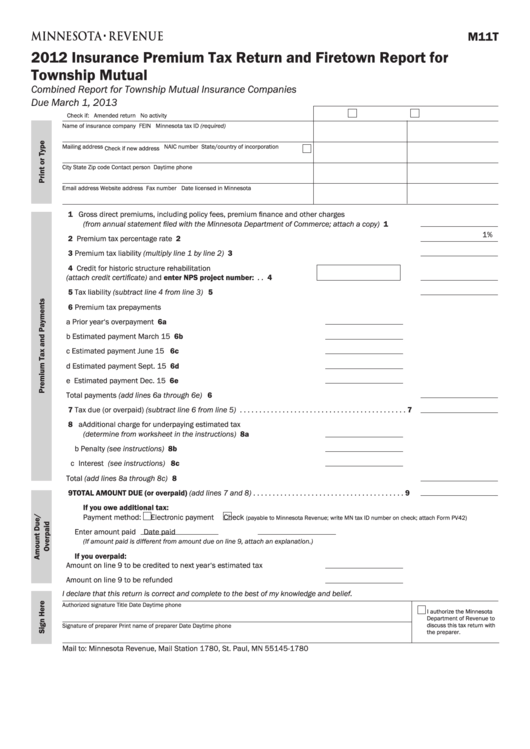

M11T

2012 Insurance Premium Tax Return and Firetown Report for

Township Mutual

Combined Report for Township Mutual Insurance Companies

Due March 1, 2013

Check if:

Amended return

No activity

Name of insurance company

FEIN

Minnesota tax ID (required)

Mailing address

NAIC number

State/country of incorporation

Check if new address

City

State

Zip code

Contact person

Daytime phone

Email address

Website address

Fax number

Date licensed in Minnesota

1 Gross direct premiums, including policy fees, premium finance and other charges

(from annual statement filed with the Minnesota Department of Commerce; attach a copy) . . . . . . . . 1

1%

2 Premium tax percentage rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Premium tax liability (multiply line 1 by line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Credit for historic structure rehabilitation

(attach credit certificate) and enter NPS project number: . . . . . . . . . . . .

. . 4

5 Tax liability (subtract line 4 from line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Premium tax prepayments

a Prior year‘s overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

b Estimated payment March 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

c Estimated payment June 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6c

d Estimated payment Sept. 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6d

e Estimated payment Dec. 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6e

Total payments (add lines 6a through 6e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Tax due (or overpaid) (subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 a Additional charge for underpaying estimated tax

(determine from worksheet in the instructions) . . . . . . . . . . . . . . . . . 8a

b Penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8b

c Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c

Total (add lines 8a through 8c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 TOTAL AMOUNT DUE (or overpaid) (add lines 7 and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

If you owe additional tax:

Payment method:

Electronic payment

Check

(payable to Minnesota Revenue; write MN tax ID number on check; attach Form PV42)

Enter amount paid

Date paid

(If amount paid is different from amount due on line 9, attach an explanation.)

If you overpaid:

Amount on line 9 to be credited to next year‘s estimated tax . . . . . . . . . . . . .

Amount on line 9 to be refunded . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

I declare that this return is correct and complete to the best of my knowledge and belief.

Authorized signature

Title

Date

Daytime phone

I authorize the Minnesota

Department of Revenue to

discuss this tax return with

Signature of preparer

Print name of preparer

Date

Daytime phone

the preparer.

Mail to: Minnesota Revenue, Mail Station 1780, St. Paul, MN 55145-1780

1

1 2

2 3

3 4

4