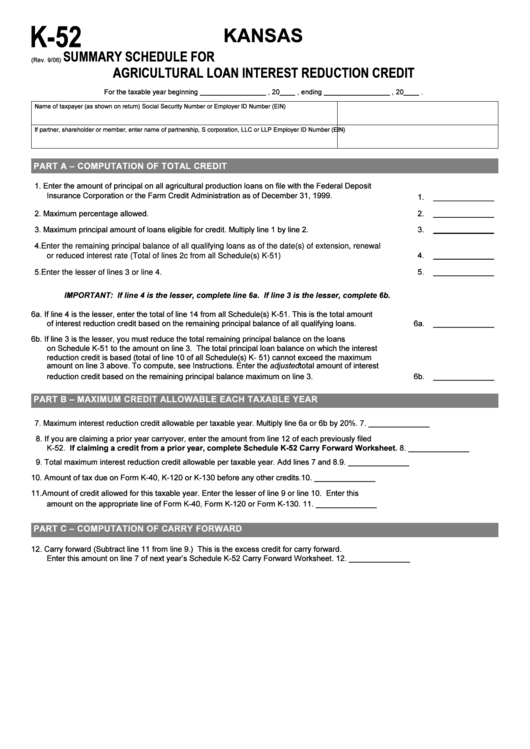

Schedule K-52 - Kansas Summary Schedule For Agricultural Loan Interest Reduction Credit

ADVERTISEMENT

K-52

KANSAS

SUMMARY SCHEDULE FOR

(Rev. 9/06)

AGRICULTURAL LOAN INTEREST REDUCTION CREDIT

For the taxable year beginning _________________ , 20____ , ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – COMPUTATION OF TOTAL CREDIT

1. Enter the amount of principal on all agricultural production loans on file with the Federal Deposit

Insurance Corporation or the Farm Credit Administration as of December 31, 1999.

1.

______________

2. Maximum percentage allowed.

2.

______________

3. Maximum principal amount of loans eligible for credit. Multiply line 1 by line 2.

3.

______________

4. Enter the remaining principal balance of all qualifying loans as of the date(s) of extension, renewal

4.

______________

or reduced interest rate (Total of lines 2c from all Schedule(s) K-51)

5. Enter the lesser of lines 3 or line 4.

5.

______________

IMPORTANT: If line 4 is the lesser, complete line 6a. If line 3 is the lesser, complete 6b.

6a. If line 4 is the lesser, enter the total of line 14 from all Schedule(s) K-51. This is the total amount

of interest reduction credit based on the remaining principal balance of all qualifying loans.

6a.

______________

6b. If line 3 is the lesser, you must reduce the total remaining principal balance on the loans

on Schedule K-51 to the amount on line 3. The total principal loan balance on which the interest

reduction credit is based (total of line 10 of all Schedule(s) K- 51) cannot exceed the maximum

amount on line 3 above. To compute, see Instructions. Enter the adjusted total amount of interest

reduction credit based on the remaining principal balance maximum on line 3.

6b.

______________

PART B – MAXIMUM CREDIT ALLOWABLE EACH TAXABLE YEAR

7. Maximum interest reduction credit allowable per taxable year. Multiply line 6a or 6b by 20%.

7.

______________

8. If you are claiming a prior year carryover, enter the amount from line 12 of each previously filed

K-52. If claiming a credit from a prior year, complete Schedule K-52 Carry Forward Worksheet.

8.

______________

9. Total maximum interest reduction credit allowable per taxable year. Add lines 7 and 8.

9.

______________

10. Amount of tax due on Form K-40, K-120 or K-130 before any other credits.

10.

______________

11. Amount of credit allowed for this taxable year. Enter the lesser of line 9 or line 10. Enter this

amount on the appropriate line of Form K-40, Form K-120 or Form K-130.

11.

______________

PART C – COMPUTATION OF CARRY FORWARD

12. Carry forward (Subtract line 11 from line 9.) This is the excess credit for carry forward.

Enter this amount on line 7 of next year’s Schedule K-52 Carry Forward Worksheet.

12.

______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1