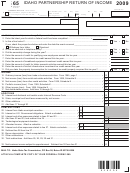

D-65 PAGE 2

*150650120002*

Business Name:

Federal Employer Identification No.:

Schedule F - DC apportionment factor

(See instructions.)

Round cents to the nearest dollar. If an amount is zero, leave the line blank.

Carry all factors to six decimal places

Column 1 TOTAL

Column 2 in DC

DC Apportionment

Factor

.

1. SALES FACTOR: All gross receipts of the partnership other

.

00

00

$

$

than gross receipts from items of non-business income.

(Column 2 divided by Column 1)

DC APPORTIONMENT FACTOR:

2.

Column 2 divided by

.

Column 1.

A.

Date entity was organized

B. Fill in your accounting method

cash

accrual

other (specify)

C.

Number of partners in this partnership

D. Is this a limited partnership?

YES

YES

NO

E.

Is this a limited liability company?

YES

NO

F.

Are any partners in this partnership also partnerships or corporate entities?

YES

NO

YES

NO

G. Is this partnership a partner in another partnership?

H. Was there a distribution or transfer of property that caused an adjustment of the basis of

the partnership’s assets under IRC Section 754?

YES

NO

I.

Was a D-65 fi led for the preceding year?

YES

NO

J.

Was a 2015 DC unincorporated business franchise tax return (Form D-30) filed for this business?

If “YES,” enter the name under which the return was fi led.

YES

NO

K.

Did you file and pay an annual ballpark fee return?

YES

NO

L.

.

Have you filed annual federal income tax information return Forms 1099 and 1096?

YES

NO

M.

Did you withhold DC income tax from the wages of your DC employees during 2015?

YES

NO

If “NO,” state reason:

N. During 2015, has the IRS made or proposed any adjustments to your federal partnership

Form 1065, or did you fi le amended returns with the IRS?

YES

NO

If “YES,” submit a separate, detailed explanation and an amended D-65 return reflecting the adjustments to:

Office of Tax and Revenue, 1101 4th Street, SW, FL4, Washington DC 20024.

• Attach a copy of the Form 1065 with the K-1 and any other schedules you filed.

• Attach a schedule showing the pass-through distribution of income to all members of the partnership.

• If you are filing Form D-65, instead of Form D-30, attach an explanation.

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct.

PLEASE

Declaration of paid preparer is based on all information available to the preparer.

SIGN

HERE

Partner or member’s signature

Date

Telephone number of person to contact

Preparer’s signature (if other than taxpayer)

Date

PAID

PREPARER

Paid Preparer’s Tax Identification Number (PTIN)

ONLY

Firm name

If you want to allow the paid preparer to discuss this return

with the Office of Tax and Revenue fill in the oval.

Firm address

Mail return to: Office of Tax and Revenue, 1101 4th Street, SW, FL4, Washington DC 20024

Make no payment with this return.

2015 D-65 P2

Partnership Return of Income page 2

Revised 11/15

1

1 2

2