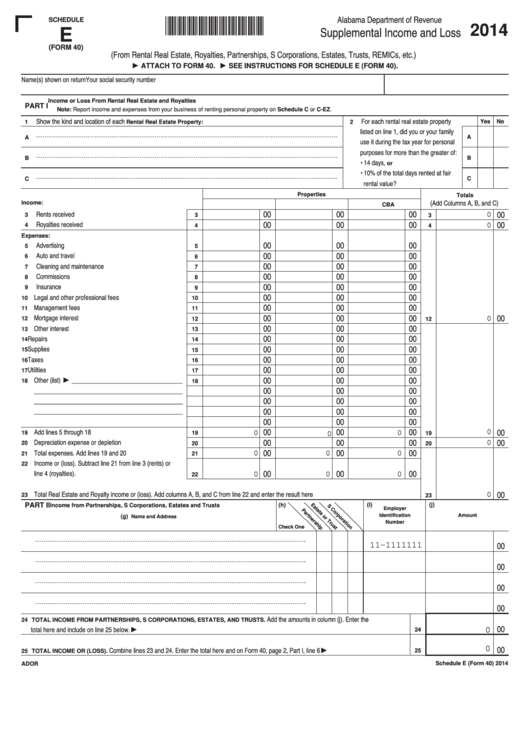

Alabama Department of Revenue

Supplemental Income and Loss

SCHEDULE

XX001440

2014

E

(From Rental Real Estate, Royalties, Partnerships, S Corporations, Estates, Trusts, REMICs, etc.)

(FORM 40)

ATTACH TO FORM 40.

SEE INSTRUCTIONS FOR SCHEDULE E (FORM 40).

Name(s) shown on return

Your social security number

Income or Loss From Rental Real Estate and Royalties

Reset Schedule E

PART I

Note: Report income and expenses from your business of renting personal property on Schedule C or C-EZ.

1 Show the kind and location of each Rental Real Estate Property:

2 For each rental real estate property

Yes No

listed on line 1, did you or your family

use it during the tax year for personal

A

A

purposes for more than the greater of:

• 14 days, or

B

B

• 10% of the total days rented at fair

rental value?

C

C

Properties

(Add Columns A, B, and C)

Totals

Income:

00

00

00

00

A

B

C

3 Rents received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

00

3

3

0

4 Royalties received. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4

0

00

00

00

Expenses:

5 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

5

6 Auto and travel . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

6

7 Cleaning and maintenance . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

7

8 Commissions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

8

9 Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

9

10 Legal and other professional fees . . . . . . . . . . . . . . . . . . . .

00

00

00

10

11 Management fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

00

11

12 Mortgage interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

12

12

0

13 Other interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

13

14 Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

14

15 Supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

15

16 Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

16

17 Utilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

17

18 Other (list)

___________________________________

00

00

00

18

_______________________________________________

00

00

00

_______________________________________________

00

00

00

_______________________________________________

00

00

00

00

00

00

00

19 Add lines 5 through 18 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

00

00

0

19

0

0

19

0

20 Depreciation expense or depletion . . . . . . . . . . . . . . . . . . .

00

00

00

20

20

0

21 Total expenses. Add lines 19 and 20 . . . . . . . . . . . . . . . . .

21

0

0

0

22 Income or (loss). Subtract line 21 from line 3 (rents) or

00

00

00

line 4 (royalties). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

0

0

0

00

23 Total Real Estate and Royalty income or (loss). Add columns A, B, and C from line 22 and enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

0

PART II

(i)

(j)

Income from Partnerships, S Corporations, Estates and Trusts

(h)

Employer

Identification

Amount

(g)

Name and Address

Number

Check One

00

11-1111111

00

00

00

24 TOTAL INCOME FROM PARTNERSHIPS, S CORPORATIONS, ESTATES, AND TRUSTS. Add the amounts in column (j). Enter the

00

total here and include on line 25 below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

0

00

25 TOTAL INCOME OR (LOSS). Combine lines 23 and 24. Enter the total here and on Form 40, page 2, Part I, line 6 . . . . . . . . . . . . . . . . . . . . . . . .

0

25

Schedule E (Form 40) 2014

ADOR

1

1