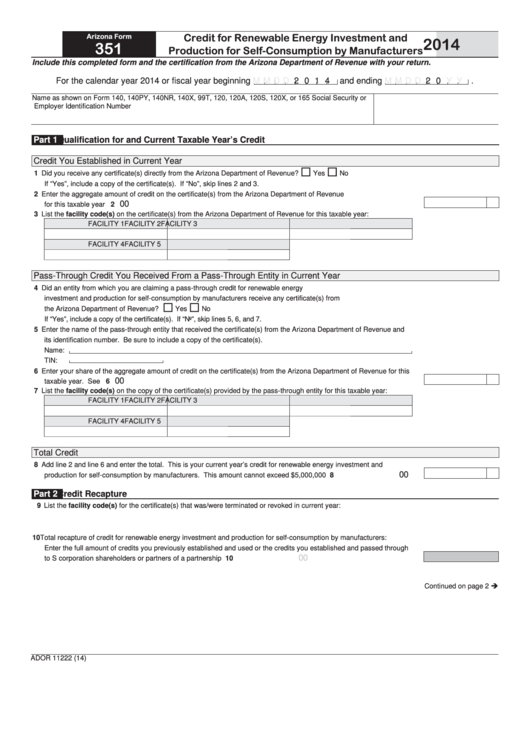

Credit for Renewable Energy Investment and

Arizona Form

2014

351

Production for Self-Consumption by Manufacturers

Include this completed form and the certification from the Arizona Department of Revenue with your return.

For the calendar year 2014 or fiscal year beginning

M M D D

2 0 1 4 and ending

M M D D

2 0

Y Y

.

Name as shown on Form 140, 140PY, 140NR, 140X, 99T, 120, 120A, 120S, 120X, or 165

Social Security or

Employer Identification Number

Qualification for and Current Taxable Year’s Credit

Part 1

Credit You Established in Current Year

1 Did you receive any certificate(s) directly from the Arizona Department of Revenue?......................

Yes

No

If “Yes”, include a copy of the certificate(s). If “No”, skip lines 2 and 3.

2 Enter the aggregate amount of credit on the certificate(s) from the Arizona Department of Revenue

00

for this taxable year ............................................................................................................................................................... 2

3 List the facility code(s) on the certificate(s) from the Arizona Department of Revenue for this taxable year:

FACILITY 1

FACILITY 2

FACILITY 3

FACILITY 4

FACILITY 5

Pass-Through Credit You Received From a Pass-Through Entity in Current Year

4 Did an entity from which you are claiming a pass-through credit for renewable energy

investment and production for self-consumption by manufacturers receive any certificate(s) from

the Arizona Department of Revenue? ...............................................................................................

Yes

No

If “Yes”, include a copy of the certificate(s). If “No”, skip lines 5, 6, and 7.

5 Enter the name of the pass-through entity that received the certificate(s) from the Arizona Department of Revenue and

its identification number. Be sure to include a copy of the certificate(s).

Name:

TIN:

6 Enter your share of the aggregate amount of credit on the certificate(s) from the Arizona Department of Revenue for this

00

taxable year. See instructions............................................................................................................................................... 6

7 List the facility code(s) on the copy of the certificate(s) provided by the pass-through entity for this taxable year:

FACILITY 1

FACILITY 2

FACILITY 3

FACILITY 4

FACILITY 5

Total Credit

8 Add line 2 and line 6 and enter the total. This is your current year’s credit for renewable energy investment and

00

production for self-consumption by manufacturers. This amount cannot exceed $5,000,000 .............................................

8

Credit Recapture

Part 2

9 List the facility code(s) for the certificate(s) that was/were terminated or revoked in current year:

10 Total recapture of credit for renewable energy investment and production for self-consumption by manufacturers:

Enter the full amount of credits you previously established and used or the credits you established and passed through

00

to S corporation shareholders or partners of a partnership ................................................................................................... 10

Continued on page 2

ADOR 11222 (14)

1

1 2

2 3

3