Schedule K-63 - Kansas Habitat Management Credit

ADVERTISEMENT

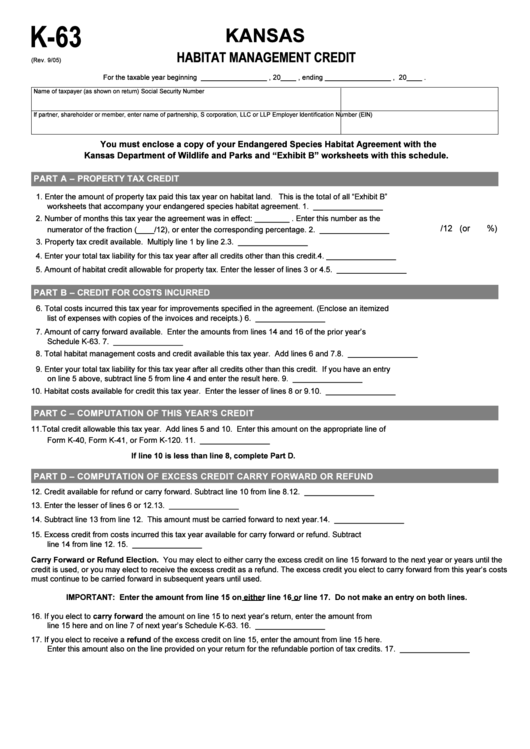

K-63

KANSAS

HABITAT MANAGEMENT CREDIT

(Rev. 9/05)

For the taxable year beginning _________________ , 20____ , ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer Identification Number (EIN)

You must enclose a copy of your Endangered Species Habitat Agreement with the

Kansas Department of Wildlife and Parks and “Exhibit B” worksheets with this schedule.

PART A – PROPERTY TAX CREDIT

1. Enter the amount of property tax paid this tax year on habitat land. This is the total of all “Exhibit B”

worksheets that accompany your endangered species habitat agreement.

1. ________________

2. Number of months this tax year the agreement was in effect: ________ . Enter this number as the

/12 (or

%)

numerator of the fraction (____/12), or enter the corresponding percentage.

2. ________________

3. Property tax credit available. Multiply line 1 by line 2.

3. ________________

4. Enter your total tax liability for this tax year after all credits other than this credit.

4. ________________

5. Amount of habitat credit allowable for property tax. Enter the lesser of lines 3 or 4.

5. ________________

PART B – CREDIT FOR COSTS INCURRED

6. Total costs incurred this tax year for improvements specified in the agreement. (Enclose an itemized

list of expenses with copies of the invoices and receipts.)

6. ________________

7. Amount of carry forward available. Enter the amounts from lines 14 and 16 of the prior year’s

Schedule K-63.

7. ________________

8. Total habitat management costs and credit available this tax year. Add lines 6 and 7.

8. ________________

9. Enter your total tax liability for this tax year after all credits other than this credit. If you have an entry

on line 5 above, subtract line 5 from line 4 and enter the result here.

9. ________________

10. Habitat costs available for credit this tax year. Enter the lesser of lines 8 or 9.

10. ________________

PART C – COMPUTATION OF THIS YEAR’S CREDIT

11. Total credit allowable this tax year. Add lines 5 and 10. Enter this amount on the appropriate line of

Form K-40, Form K-41, or Form K-120.

11. ________________

If line 10 is less than line 8, complete Part D.

PART D – COMPUTATION OF EXCESS CREDIT CARRY FORWARD OR REFUND

12. Credit available for refund or carry forward. Subtract line 10 from line 8.

12. ________________

13. Enter the lesser of lines 6 or 12.

13. ________________

14. Subtract line 13 from line 12. This amount must be carried forward to next year.

14. ________________

15. Excess credit from costs incurred this tax year available for carry forward or refund. Subtract

line 14 from line 12.

15. ________________

Carry Forward or Refund Election. You may elect to either carry the excess credit on line 15 forward to the next year or years until the

credit is used, or you may elect to receive the excess credit as a refund. The excess credit you elect to carry forward from this year’s costs

must continue to be carried forward in subsequent years until used.

IMPORTANT: Enter the amount from line 15 on either line 16 or line 17. Do not make an entry on both lines.

16. If you elect to carry forward the amount on line 15 to next year’s return, enter the amount from

line 15 here and on line 7 of next year’s Schedule K-63.

16. ________________

17. If you elect to receive a refund of the excess credit on line 15, enter the amount from line 15 here.

Enter this amount also on the line provided on your return for the refundable portion of tax credits.

17. ________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2