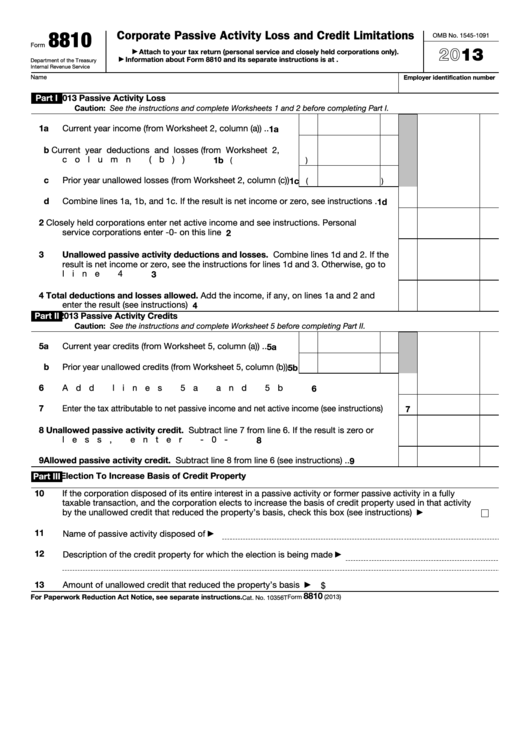

8810

Corporate Passive Activity Loss and Credit Limitations

OMB No. 1545-1091

Form

2013

Attach to your tax return (personal service and closely held corporations only).

▶

Information about Form 8810 and its separate instructions is at

▶

Department of the Treasury

Internal Revenue Service

Name

Employer identification number

Part I

2013 Passive Activity Loss

Caution: See the instructions and complete Worksheets 1 and 2 before completing Part I.

1a

Current year income (from Worksheet 2, column (a)) . .

1a

b

Current year deductions and losses (from Worksheet 2,

column (b))

. . . . . . . . . . . . . . . . .

1b

(

)

c

Prior year unallowed losses (from Worksheet 2, column (c))

1c

(

)

d

Combine lines 1a, 1b, and 1c. If the result is net income or zero, see instructions

.

1d

2

Closely held corporations enter net active income and see instructions. Personal

service corporations enter -0- on this line . . . . . . . . . . . . . . . .

2

3

Unallowed passive activity deductions and losses. Combine lines 1d and 2. If the

result is net income or zero, see the instructions for lines 1d and 3. Otherwise, go to

line 4

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4

Total deductions and losses allowed. Add the income, if any, on lines 1a and 2 and

enter the result (see instructions)

. . . . . . . . . . . . . . . . . . .

4

Part II

2013 Passive Activity Credits

Caution: See the instructions and complete Worksheet 5 before completing Part II.

5a

Current year credits (from Worksheet 5, column (a))

. .

5a

b

Prior year unallowed credits (from Worksheet 5, column (b))

5b

6

Add lines 5a and 5b . . . . . . . . . . . . . . . . . . . . . . . .

6

7

Enter the tax attributable to net passive income and net active income (see instructions)

7

8

Unallowed passive activity credit. Subtract line 7 from line 6. If the result is zero or

less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

Allowed passive activity credit. Subtract line 8 from line 6 (see instructions)

. .

9

Election To Increase Basis of Credit Property

Part III

10

If the corporation disposed of its entire interest in a passive activity or former passive activity in a fully

taxable transaction, and the corporation elects to increase the basis of credit property used in that activity

by the unallowed credit that reduced the property’s basis, check this box (see instructions) . . . . .

▶

11

Name of passive activity disposed of

▶

12

Description of the credit property for which the election is being made

▶

13

Amount of unallowed credit that reduced the property’s basis

. . . . . .

$

▶

8810

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2013)

Cat. No. 10356T

1

1