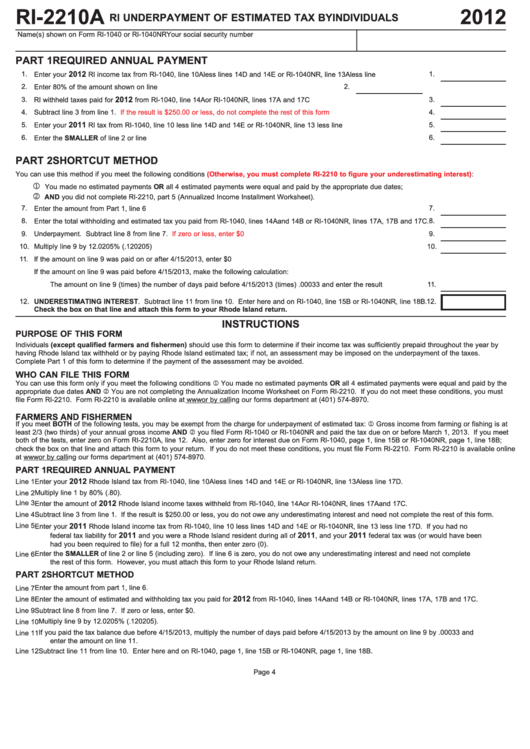

RI-2210A

2012

RI UNDERPAYMENT OF ESTIMATED TAX BY INDIVIDUALS

Name(s) shown on Form RI-1040 or RI-1040NR

Your social security number

PART 1

REQUIRED ANNUAL PAYMENT

2012

1.

Enter your

RI income tax from RI-1040, line 10A less lines 14D and 14E or RI-1040NR, line 13A less line 17D................

1.

2.

Enter 80% of the amount shown on line 1...........................................................................................

2.

3.

2012

3.

RI withheld taxes paid for

from RI-1040, line 14A or RI-1040NR, lines 17A and 17C ..........................................................

4.

4.

Subtract line 3 from line 1.

If the result is $250.00 or less, do not complete the rest of this

form..................................................

2011

5.

Enter your

RI tax from RI-1040, line 10 less line 14D and 14E or RI-1040NR, line 13 less line 17D...................................

5.

6.

Enter the SMALLER of line 2 or line 5.............................................................................................................................................

6.

PART 2

SHORTCUT METHOD

You can use this method if you meet the following conditions

(Otherwise, you must complete RI-2210 to figure your underestimating

interest):

1

You made no estimated payments OR all 4 estimated payments were equal and paid by the appropriate due dates;

2

AND you did not complete RI-2210, part 5 (Annualized Income Installment Worksheet).

7.

Enter the amount from Part 1, line 6 above.....................................................................................................................................

7.

8.

Enter the total withholding and estimated tax you paid from RI-1040, lines 14A and 14B or RI-1040NR, lines 17A, 17B and 17C.

8.

9.

Underpayment. Subtract line 8 from line 7.

If zero or less, enter

$0.............................................................................................

9.

10.

Multiply line 9 by 12.0205% (.120205).............................................................................................................................................

10.

11.

If the amount on line 9 was paid on or after 4/15/2013, enter $0

If the amount on line 9 was paid before 4/15/2013, make the following calculation:

The amount on line 9 (times) the number of days paid before 4/15/2013 (times) .00033 and enter the result here.............

11.

12.

UNDERESTIMATING INTEREST. Subtract line 11 from line 10. Enter here and on RI-1040, line 15B or RI-1040NR, line 18B.

12.

Check the box on that line and attach this form to your Rhode Island return.

INSTRUCTIONS

PURPOSE OF THIS FORM

Individuals (except qualified farmers and fishermen) should use this form to determine if their income tax was sufficiently prepaid throughout the year by

having Rhode Island tax withheld or by paying Rhode Island estimated tax; if not, an assessment may be imposed on the underpayment of the taxes.

Complete Part 1 of this form to determine if the payment of the assessment may be avoided.

WHO CAN FILE THIS FORM

You can use this form only if you meet the following conditions 1 You made no estimated payments OR all 4 estimated payments were equal and paid by the

appropriate due dates AND 2 You are not completing the Annualization Income Worksheet on Form RI-2210. If you do not meet these conditions, you must

file Form RI-2210. Form RI-2210 is available online at or by calling our forms department at (401) 574-8970.

FARMERS AND FISHERMEN

If you meet BOTH of the following tests, you may be exempt from the charge for underpayment of estimated tax: 1 Gross income from farming or fishing is at

least 2/3 (two thirds) of your annual gross income AND 2 you filed Form RI-1040 or RI-1040NR and paid the tax due on or before March 1, 2013. If you meet

both of the tests, enter zero on Form RI-2210A, line 12. Also, enter zero for interest due on Form RI-1040, page 1, line 15B or RI-1040NR, page 1, line 18B;

check the box on that line and attach this form to your return. If you do not meet these conditions, you must file Form RI-2210. Form RI-2210 is available online

at or by calling our forms department at (401) 574-8970.

PART 1

REQUIRED ANNUAL PAYMENT

2012

Line 1

Enter your

Rhode Island tax from RI-1040, line 10A less lines 14D and 14E or RI-1040NR, line 13A less line 17D.

Multiply line 1 by 80% (.80).

Line 2

Line 3

2012

Enter the amount of

Rhode Island income taxes withheld from RI-1040, line 14A or RI-1040NR, lines 17A and 17C.

Line 4

Subtract line 3 from line 1. If the result is $250.00 or less, you do not owe any underestimating interest and need not complete the rest of this form.

Line 5

2011

Enter your

Rhode Island income tax from RI-1040, line 10 less lines 14D and 14E or RI-1040NR, line 13 less line 17D. If you had no

2011

2011

2011

federal tax liability for

and you were a Rhode Island resident during all of

, and your

federal tax was (or would have been

had you been required to file) for a full 12 months, then enter zero (0).

Enter the SMALLER of line 2 or line 5 (including zero). If line 6 is zero, you do not owe any underestimating interest and need not complete

Line 6

the rest of this form. However, you must attach this form to your Rhode Island return.

PART 2

SHORTCUT METHOD

Enter the amount from part 1, line 6.

Line 7

2012

Line 8

Enter the amount of estimated and withholding tax you paid for

from RI-1040, lines 14A and 14B or RI-1040NR, lines 17A, 17B and 17C.

Subtract line 8 from line 7. If zero or less, enter $0.

Line 9

Multiply line 9 by 12.0205% (.120205).

Line 10

If you paid the tax balance due before 4/15/2013, multiply the number of days paid before 4/15/2013 by the amount on line 9 by .00033 and

Line 11

enter the amount on line 11.

Line 12

Subtract line 11 from line 10. Enter here and on RI-1040, page 1, line 15B or RI-1040NR, page 1, line 18B.

Page 4

1

1