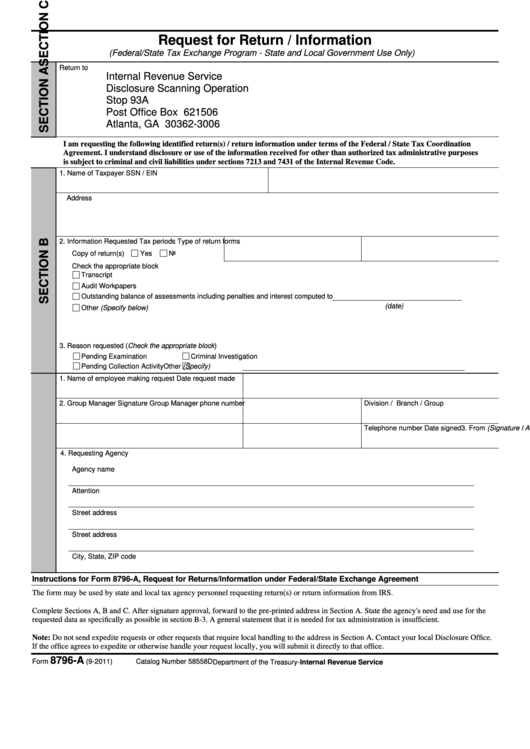

Request for Return / Information

(Federal/State Tax Exchange Program - State and Local Government Use Only)

Return to

Internal Revenue Service

Disclosure Scanning Operation

Stop 93A

Post Office Box 621506

Atlanta, GA 30362-3006

I am requesting the following identified return(s) / return information under terms of the Federal / State Tax Coordination

Agreement. I understand disclosure or use of the information received for other than authorized tax administrative purposes

is subject to criminal and civil liabilities under sections 7213 and 7431 of the Internal Revenue Code.

1. Name of Taxpayer

SSN / ElN

Address

2. Information Requested

Tax periods

Type of return forms

Copy of return(s)

Yes

No

Check the appropriate block

Transcript

Audit Workpapers

Outstanding balance of assessments including penalties and interest computed to

(date)

Other (Specify below)

3. Reason requested (Check the appropriate block)

Pending Examination

Criminal Investigation

Pending Collection Activity

Other (Specify)

1. Name of employee making request

Date request made

2. Group Manager Signature

Group Manager phone number

Division / Branch / Group

3. From (Signature l Authorized Representative)

Date signed

Telephone number

4. Requesting Agency

Agency name

Attention

Street address

Street address

City, State, ZIP code

Instructions for Form 8796-A, Request for Returns/Information under Federal/State Exchange Agreement

The form may be used by state and local tax agency personnel requesting return(s) or return information from IRS.

Complete Sections A, B and C. After signature approval, forward to the pre-printed address in Section A. State the agency's need and use for the

requested data as specifically as possible in section B-3. A general statement that it is needed for tax administration is insufficient.

Note: Do not send expedite requests or other requests that require local handling to the address in Section A. Contact your local Disclosure Office.

If the office agrees to expedite or otherwise handle your request locally, you will submit it directly to that office.

8796-A

Form

(9-2011)

Catalog Number 58558D

Department of the Treasury-Internal Revenue Service

1

1