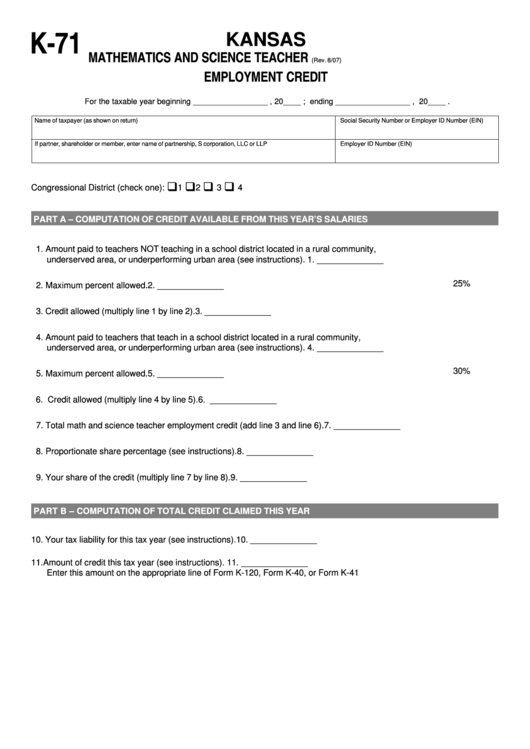

Schedule K-71 - Kansas Mathematics And Science Teacher Employment Credit

ADVERTISEMENT

K-71

KANSAS

MATHEMATICS AND SCIENCE TEACHER

(Rev. 8/07)

EMPLOYMENT CREDIT

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

‰

‰

‰

‰

Congressional District (check one):

1

2

3

4

PART A – COMPUTATION OF CREDIT AVAILABLE FROM THIS YEAR’S SALARIES

1. Amount paid to teachers NOT teaching in a school district located in a rural community,

underserved area, or underperforming urban area (see instructions).

1. ______________

25%

2. Maximum percent allowed.

2. ______________

3. Credit allowed (multiply line 1 by line 2).

3. ______________

4. Amount paid to teachers that teach in a school district located in a rural community,

underserved area, or underperforming urban area (see instructions).

4. ______________

30%

5. Maximum percent allowed.

5. ______________

6. Credit allowed (multiply line 4 by line 5).

6. ______________

7. Total math and science teacher employment credit (add line 3 and line 6).

7. ______________

8. Proportionate share percentage (see instructions).

8. ______________

9. Your share of the credit (multiply line 7 by line 8).

9. ______________

PART B – COMPUTATION OF TOTAL CREDIT CLAIMED THIS YEAR

10. Your tax liability for this tax year (see instructions).

10. ______________

11. Amount of credit this tax year (see instructions).

11. ______________

Enter this amount on the appropriate line of Form K-120, Form K-40, or Form K-41

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2