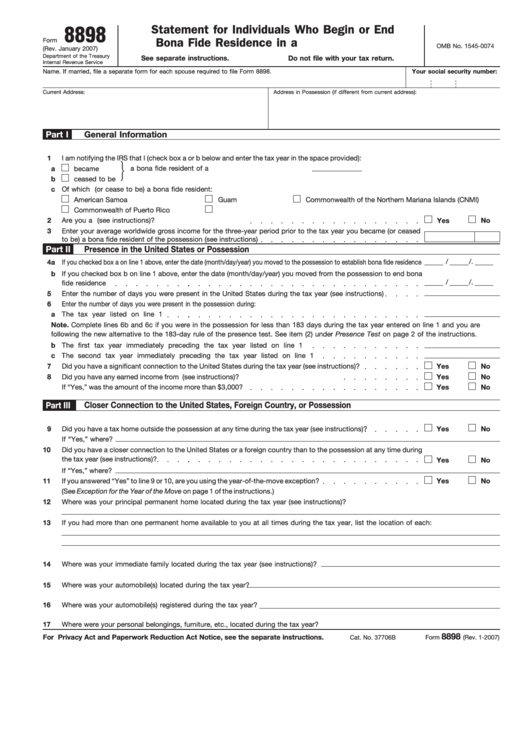

Statement for Individuals Who Begin or End

8898

Form

Bona Fide Residence in a U.S. Possession

OMB No. 1545-0074

(Rev. January 2007)

Department of the Treasury

See separate instructions.

Do not file with your tax return.

Internal Revenue Service

Name. If married, file a separate form for each spouse required to file Form 8898.

Your social security number:

Current Address:

Address in Possession (if different from current address):

Part I

General Information

1

I am notifying the IRS that I (check box a or b below and enter the tax year in the space provided):

a bona fide resident of a U.S. possession in tax year

a

became

b

ceased to be

c Of which U.S. possession did you become (or cease to be) a bona fide resident:

American Samoa

Guam

Commonwealth of the Northern Mariana Islands (CNMI)

Commonwealth of Puerto Rico

U.S. Virgin Islands

2

Are you a U.S. citizen or resident alien (see instructions)?

Yes

No

3

Enter your average worldwide gross income for the three-year period prior to the tax year you became (or ceased

to be) a bona fide resident of the possession (see instructions)

Part II

Presence in the United States or Possession

/

/

.

4a If you checked box a on line 1 above, enter the date (month/day/year) you moved to the possession to establish bona fide residence

b

If you checked box b on line 1 above, enter the date (month/day/year) you moved from the possession to end bona

/

/

.

fide residence

5

Enter the number of days you were present in the United States during the tax year (see instructions)

6

Enter the number of days you were present in the possession during:

a

The tax year listed on line 1

Note. Complete lines 6b and 6c if you were in the possession for less than 183 days during the tax year entered on line 1 and you are

following the new alternative to the 183-day rule of the presence test. See item (2) under Presence Test on page 2 of the instructions.

b

The first tax year immediately preceding the tax year listed on line 1

c

The second tax year immediately preceding the tax year listed on line 1

7

Did you have a significant connection to the United States during the tax year (see instructions)?

Yes

No

8

Did you have any earned income from U.S. sources during the tax year (see instructions)?

Yes

No

If “Yes,” was the amount of the income more than $3,000?

Yes

No

Part III

Closer Connection to the United States, Foreign Country, or Possession

9

Did you have a tax home outside the possession at any time during the tax year (see instructions)?

Yes

No

If “Yes,” where?

10

Did you have a closer connection to the United States or a foreign country than to the possession at any time during

the tax year (see instructions)?

Yes

No

If “Yes,” where?

11

If you answered “Yes” to line 9 or 10, are you using the year-of-the-move exception?

Yes

No

(See Exception for the Year of the Move on page 1 of the instructions.)

12

Where was your principal permanent home located during the tax year (see instructions)?

13

If you had more than one permanent home available to you at all times during the tax year, list the location of each:

14

Where was your immediate family located during the tax year (see instructions)?

15

Where was your automobile(s) located during the tax year?

16

Where was your automobile(s) registered during the tax year?

17

Where were your personal belongings, furniture, etc., located during the tax year?

8898

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 37706B

Form

(Rev. 1-2007)

1

1 2

2