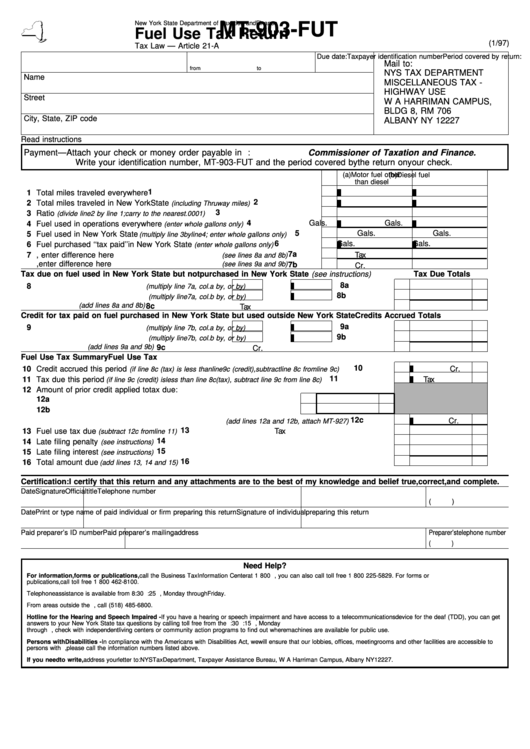

Form Mt-903-Fut - Fuel Use Tax Return

ADVERTISEMENT

New York State Department of Taxation and Finance

MT-903-FUT

Fuel Use Tax Return

(1/97)

Tax Law — Article 21-A

Taxpayer identification number

Period covered by return:

Due date:

Mail to:

from

to

NYS TAX DEPARTMENT

Name

MISCELLANEOUS TAX -

HIGHWAY USE

Street

W A HARRIMAN CAMPUS,

BLDG 8, RM 706

City, State, ZIP code

ALBANY NY 12227

Read instructions carefully. Keep a copy of this completed form for your records.

Payment — Attach your check or money order payable in U.S. funds to: Commissioner of Taxation and Finance.

Write your identification number, MT-903-FUT and the period covered by the return on your check.

(a) Motor fuel other

(b) Diesel fuel

than diesel

1

1 Total miles traveled everywhere . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Total miles traveled in New York State

. . . . . . . . . . . . . . . . . . .

(including Thruway miles)

3

3 Ratio

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(divide line 2 by line 1; carry to the nearest .0001)

4

Gals.

Gals.

4 Fuel used in operations everywhere

. . . . . . . . . . . . . . . . . . . . .

(enter whole gallons only)

5

Gals.

Gals.

5 Fuel used in New York State

. . . . . . .

(multiply line 3 by line 4; enter whole gallons only)

6

Gals.

Gals.

6 Fuel purchased ‘‘tax paid’’ in New York State

(enter whole gallons only)

. . . . . . . . . . . . .

. . . . . . . . . 7a

Gals.

Gals. Tax

7 a. If line 5 is more than line 6, enter difference here

(see lines 8a and 8b)

b. If line 6 is more than line 5, enter difference here

. . . . . . . . . 7b

(see lines 9a and 9b)

Gals.

Gals.

Cr.

Tax due on fuel used in New York State but not purchased in New York State (see instructions)

Tax Due Totals

. . . . . . . . . . . . . . . 8a

8 a. Motor fuel other than diesel

(multiply line 7a, col. a by

, or by

)

. . . . . . . . . . . . . . . . 8b

b. Diesel fuel. . . . . . . . . . . . . . . . . . .

(multiply line 7a, col. b by

, or by

)

c. Total tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c

(add lines 8a and 8b)

Tax

Credit for tax paid on fuel purchased in New York State but used outside New York State

Credits Accrued Totals

. . . . . . . . . . . . . . . 9a

9 a. Motor fuel other than diesel

(multiply line 7b, col. a by

, or by

)

. . . . . . . . . . . . . . . . 9b

b. Diesel fuel. . . . . . . . . . . . . . . . . . .

(multiply line 7b, col. b by

, or by

)

c. Total credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9c

(add lines 9a and 9b)

Cr.

Fuel Use Tax Summary

Fuel Use Tax

. . . . . . . . . . . 10

10 Credit accrued this period

Cr.

(if line 8c (tax) is less than line 9c (credit), subtract line 8c from line 9c)

. . . . . . . . . . . . . . . . . . 11

11 Tax due this period

Tax

(if line 9c (credit) is less than line 8c (tax), subtract line 9c from line 8c)

12 Amount of prior credit applied to tax due:

a. Prior fuel use tax credits applied to tax due . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12a

b. Prior truck mileage tax overpayments applied to tax due . . . . . . . . . . . . . . . 12b

. . . . . . . . . . . . 12c

c. Total prior credits/overpayments applied to tax due

Cr.

(add lines 12a and 12b, attach MT-927)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

13 Fuel use tax due

Tax

(subtract 12c from line 11)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

14 Late filing penalty

(see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

15 Late filing interest

(see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

16 Total amount due

(add lines 13, 14 and 15)

Certification: I certify that this return and any attachments are to the best of my knowledge and belief true, correct, and complete.

Date

Signature

Official title

Telephone number

(

)

Date

Print or type name of paid individual or firm preparing this return

Signature of individual preparing this return

Paid preparer’s ID number

Paid preparer’s mailing address

Preparer’s telephone number

(

)

Need Help?

For information, forms or publications, call the Business Tax Information Center at 1 800 972-1233. For information, you can also call toll free 1 800 225-5829. For forms or

publications, call toll free 1 800 462-8100.

Telephone assistance is available from 8:30 a.m. to 4:25 p.m., Monday through Friday.

From areas outside the U.S. and Canada, call (518) 485-6800.

Hotline for the Hearing and Speech Impaired - If you have a hearing or speech impairment and have access to a telecommunications device for the deaf (TDD), you can get

answers to your New York State tax questions by calling toll free from the U.S. and Canada 1 800 634-2110. Hours of operation are from 8:30 a.m. to 4:15 p.m., Monday

through Friday. If you do not own a TDD, check with independent living centers or community action programs to find out where machines are available for public use.

Persons with Disabilities - In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms and other facilities are accessible to

persons with disabilities. If you have questions about special accommodations for persons with disabilities, please call the information numbers listed above.

If you need to write, address your letter to: NYS Tax Department, Taxpayer Assistance Bureau, W A Harriman Campus, Albany NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2