Reset Form

Print Form

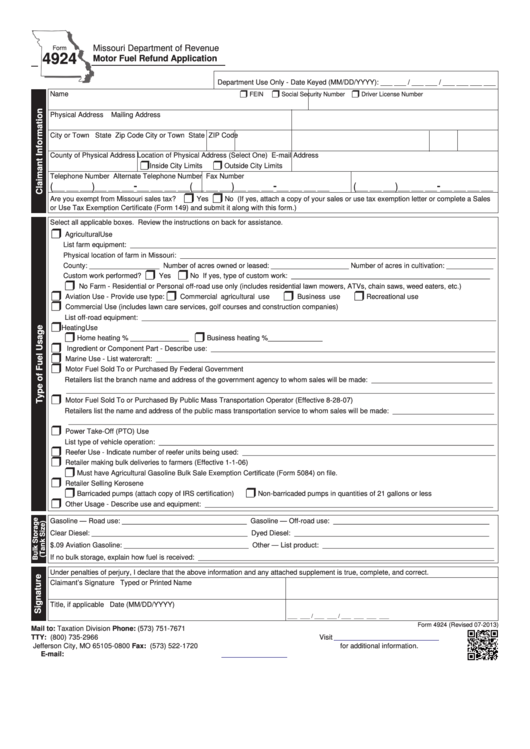

Missouri Department of Revenue

Form

4924

Motor Fuel Refund Application

Department Use Only - Date Keyed (MM/DD/YYYY): ___ ___ / ___ ___ / ___ ___ ___ ___

r

r

r

Name

FEIN

Social Security Number

Driver License Number

Physical Address

Mailing Address

City or Town

State

Zip Code

City or Town

State

ZIP Code

County of Physical Address Location of Physical Address (Select One)

E-mail Address

r

r

Inside City Limits

Outside City Limits

Telephone Number

Alternate Telephone Number

Fax Number

-

-

-

(

)

(

)

(

)

___ ___ ___

___ ___ ___

___ ___ ___ ___

___ ___ ___

___ ___ ___

___ ___ ___ ___

___ ___ ___

___ ___ ___

___ ___ ___ ___

r

r

Are you exempt from Missouri sales tax?

Yes

No (If yes, attach a copy of your sales or use tax exemption letter or complete a Sales

or Use Tax Exemption Certificate (Form 149) and submit it along with this form.)

Select all applicable boxes. Review the instructions on back for assistance.

r

Agricultural Use

List farm equipment: ______________________________________________________________________________________________

Physical location of farm in Missouri: _________________________________________________________________________________

County: __________________ Number of acres owned or leased: ____________________ Number of acres in cultivation: ____________

r

r

Custom work performed?

Yes

No If yes, type of custom work: ___________________________________________________

r

No Farm - Residential or Personal off-road use only (includes residential lawn mowers, ATVs, chain saws, weed eaters, etc.)

r

r

r

r

Aviation Use - Provide use type:

Commercial agricultural use

Business use

Recreational use

r

Commercial Use (includes lawn care services, golf courses and construction companies)

List off-road equipment: ___________________________________________________________________________________________

r

Heating Use

r

r

Home heating % _______________

Business heating %______________

r

Ingredient or Component Part - Describe use: _________________________________________________________________________

r

Marine Use - List watercraft: _______________________________________________________________________________________

r

Motor Fuel Sold To or Purchased By Federal Government

Retailers list the branch name and address of the government agency to whom sales will be made: _______________________________

______________________________________________________________________________________________________________

r

Motor Fuel Sold To or Purchased By Public Mass Transportation Operator (Effective 8-28-07)

Retailers list the name and address of the public mass transportation service to whom sales will be made: __________________________

______________________________________________________________________________________________________________

r

Power Take-Off (PTO) Use

List type of vehicle operation: ______________________________________________________________________________________

r

Reefer Use - Indicate number of reefer units being used: _________________________________________________________________

r

Retailer making bulk deliveries to farmers (Effective 1-1-06)

r

Must have Agricultural Gasoline Bulk Sale Exemption Certificate (Form 5084) on file.

r

Retailer Selling Kerosene

r

r

Barricaded pumps (attach copy of IRS certification)

Non-barricaded pumps in quantities of 21 gallons or less

r

Other Usage - Describe use and equipment: __________________________________________________________________________

Gasoline — Road use: ________________________________ Gasoline — Off-road use: ________________________________________

Clear Diesel: ________________________________________ Dyed Diesel: __________________________________________________

$.09 Aviation Gasoline: ________________________________ Other — List product: ____________________________________________

If no bulk storage, explain how fuel is received: ____________________________________________________________________________

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Claimant’s Signature

Typed or Printed Name

Title, if applicable

Date (MM/DD/YYYY)

___ ___ / ___ ___ / ___ ___ ___ ___

Form 4924 (Revised 07-2013)

Mail to:

Taxation Division

Phone: (573) 751-7671

P.O. Box 800

TTY: (800) 735-2966

Visit

Jefferson City, MO 65105-0800

Fax: (573) 522-1720

for additional information.

E-mail:

excise@dor.mo.gov

1

1 2

2