Form 1041me-General Instructions

ADVERTISEMENT

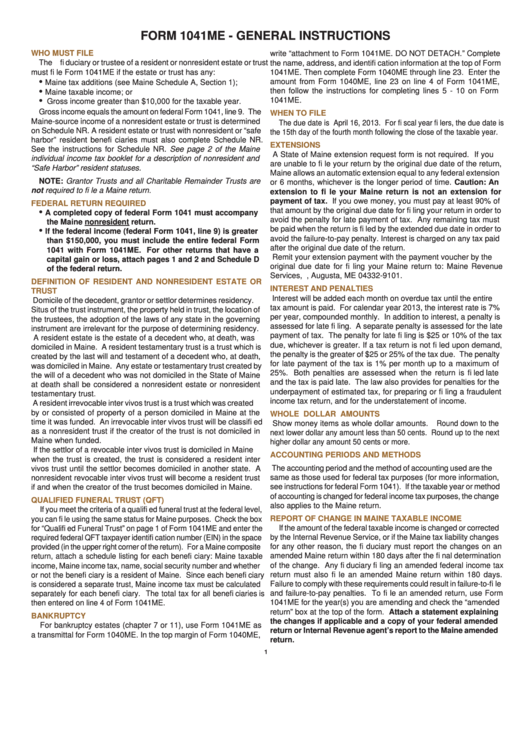

FORM 1041ME - GENERAL INSTRUCTIONS

WHO MUST FILE

write “attachment to Form 1041ME. DO NOT DETACH.” Complete

The fi duciary or trustee of a resident or nonresident estate or trust

the name, address, and identifi cation information at the top of Form

must fi le Form 1041ME if the estate or trust has any:

1041ME. Then complete Form 1040ME through line 23. Enter the

•

amount from Form 1040ME, line 23 on line 4 of Form 1041ME,

Maine tax additions (see Maine Schedule A, Section 1);

•

then follow the instructions for completing lines 5 - 10 on Form

Maine taxable income; or

•

1041ME.

Gross income greater than $10,000 for the taxable year.

Gross income equals the amount on federal Form 1041, line 9. The

WHEN TO FILE

Maine-source income of a nonresident estate or trust is determined

The due date is April 16, 2013. For fi scal year fi lers, the due date is

on Schedule NR. A resident estate or trust with nonresident or “safe

the 15th day of the fourth month following the close of the taxable year.

harbor” resident benefi ciaries must also complete Schedule NR.

EXTENSIONS

See the instructions for Schedule NR. See page 2 of the Maine

A State of Maine extension request form is not required. If you

individual income tax booklet for a description of nonresident and

are unable to fi le your return by the original due date of the return,

“Safe Harbor” resident statuses.

Maine allows an automatic extension equal to any federal extension

NOTE: Grantor Trusts and all Charitable Remainder Trusts are

or 6 months, whichever is the longer period of time. Caution: An

not required to fi le a Maine return.

extension to fi le your Maine return is not an extension for

payment of tax. If you owe money, you must pay at least 90% of

FEDERAL RETURN REQUIRED

that amount by the original due date for fi ling your return in order to

•

A completed copy of federal Form 1041 must accompany

avoid the penalty for late payment of tax. Any remaining tax must

the Maine nonresident return.

be paid when the return is fi led by the extended due date in order to

•

If the federal income (federal Form 1041, line 9) is greater

avoid the failure-to-pay penalty. Interest is charged on any tax paid

than $150,000, you must include the entire federal Form

after the original due date of the return.

1041 with Form 1041ME. For other returns that have a

Remit your extension payment with the payment voucher by the

capital gain or loss, attach pages 1 and 2 and Schedule D

original due date for fi ling your Maine return to: Maine Revenue

of the federal return.

Services, P.O. Box 9101, Augusta, ME 04332-9101.

DEFINITION OF RESIDENT AND NONRESIDENT ESTATE OR

INTEREST AND PENALTIES

TRUST

Interest will be added each month on overdue tax until the entire

Domicile of the decedent, grantor or settlor determines residency.

tax amount is paid. For calendar year 2013, the interest rate is 7%

Situs of the trust instrument, the property held in trust, the location of

per year, compounded monthly. In addition to interest, a penalty is

the trustees, the adoption of the laws of any state in the governing

assessed for late fi ling. A separate penalty is assessed for the late

instrument are irrelevant for the purpose of determining residency.

payment of tax. The penalty for late fi ling is $25 or 10% of the tax

A resident estate is the estate of a decedent who, at death, was

due, whichever is greater. If a tax return is not fi led upon demand,

domiciled in Maine. A resident testamentary trust is a trust which is

the penalty is the greater of $25 or 25% of the tax due. The penalty

created by the last will and testament of a decedent who, at death,

for late payment of the tax is 1% per month up to a maximum of

was domiciled in Maine. Any estate or testamentary trust created by

25%. Both penalties are assessed when the return is fi led late

the will of a decedent who was not domiciled in the State of Maine

and the tax is paid late. The law also provides for penalties for the

at death shall be considered a nonresident estate or nonresident

underpayment of estimated tax, for preparing or fi ling a fraudulent

testamentary trust.

income tax return, and for the understatement of income.

A resident irrevocable inter vivos trust is a trust which was created

by or consisted of property of a person domiciled in Maine at the

WHOLE DOLLAR AMOUNTS

time it was funded. An irrevocable inter vivos trust will be classifi ed

Show money items as whole dollar amounts. Round down to the

as a nonresident trust if the creator of the trust is not domiciled in

next lower dollar any amount less than 50 cents. Round up to the next

Maine when funded.

higher dollar any amount 50 cents or more.

If the settlor of a revocable inter vivos trust is domiciled in Maine

ACCOUNTING PERIODS AND METHODS

when the trust is created, the trust is considered a resident inter

The accounting period and the method of accounting used are the

vivos trust until the settlor becomes domiciled in another state. A

same as those used for federal tax purposes (for more information,

nonresident revocable inter vivos trust will become a resident trust

see instructions for federal Form 1041). If the taxable year or method

if and when the creator of the trust becomes domiciled in Maine.

of accounting is changed for federal income tax purposes, the change

QUALIFIED FUNERAL TRUST (QFT)

also applies to the Maine return.

If you meet the criteria of a qualifi ed funeral trust at the federal level,

REPORT OF CHANGE IN MAINE TAXABLE INCOME

you can fi le using the same status for Maine purposes. Check the box

If the amount of the federal taxable income is changed or corrected

for “Qualifi ed Funeral Trust” on page 1 of Form 1041ME and enter the

by the Internal Revenue Service, or if the Maine tax liability changes

required federal QFT taxpayer identifi cation number (EIN) in the space

for any other reason, the fi duciary must report the changes on an

provided (in the upper right corner of the return). For a Maine composite

return, attach a schedule listing for each benefi ciary: Maine taxable

amended Maine return within 180 days after the fi nal determination

of the change. Any fi duciary fi ling an amended federal income tax

income, Maine income tax, name, social security number and whether

return must also fi le an amended Maine return within 180 days.

or not the benefi ciary is a resident of Maine. Since each benefi ciary

Failure to comply with these requirements could result in failure-to-fi le

is considered a separate trust, Maine income tax must be calculated

and failure-to-pay penalties. To fi le an amended return, use Form

separately for each benefi ciary. The total tax for all benefi ciaries is

1041ME for the year(s) you are amending and check the “amended

then entered on line 4 of Form 1041ME.

return” box at the top of the form. Attach a statement explaining

BANKRUPTCY

the changes if applicable and a copy of your federal amended

For bankruptcy estates (chapter 7 or 11), use Form 1041ME as

return or Internal Revenue agent’s report to the Maine amended

a transmittal for Form 1040ME. In the top margin of Form 1040ME,

return.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4