Apple Excise Tax Return Instructions

General Liability: The producer is liable for the payment of the tax on

Send completed return to:

all apples grown for sale. A producer is defined as any person who, in

a calendar year, grows or causes to be grown within the Commonwealth

Virginia Department of Taxation

of Virginia, for sale, a minimum of 5,000 tree run bushels of apples. Tree

Virginia Apple Excise Tax

run bushel means a container, with a content of not less that 2,140 cubic

P. O. Box 2185

inches or more than 2,500 cubic inches, of apples that have not yet been

Richmond VA 23218-2185

graded or sized.

Change of Address or Out of Business: If you change your business or

An excise tax is levied on apples grown in Virginia for sale by a producer.

mailing address, or if you are completely out of business, complete Form

R-3, Registration Change Request, or notify the Department by letter. Send

Tax Rate: The tax rate is 2.5 cents per tree run bushel.

the form or letter to the Virginia Department of Taxation, P. O. Box 1114,

Richmond, Virginia 23218-1114.

Penalties and Interest: If the tax is not paid when due, a penalty of 5% of

the tax due will be added to the tax, and the Virginia Department of Taxation

Questions: Call VA Department of Agriculture and Consumer Services,

will notify the taxpayer of such delinquency. If the tax and penalty are not

Division of Marketing Director, 804-786-3530. To obtain additional

paid within 30 days of the notification, interest at the underpayment rate

information, call (804) 786-2450 or write the Virginia Department of

established by Section 6621 of the Internal Revenue Code, plus 2%, will

Taxation, P. O. Box 715, Richmond, VA 23218-0715.

be added on both the tax and penalty.

Forms: You can obtain most Virginia tax forms from

Filing Procedure: The Apple Excise Tax return must be filed by the

Declaration and Signature: Be sure to sign, date and enter your phone

producer with the Virginia Department of Taxation on an annual basis. The

number on the return in the spaces indicated.

annual period for the return runs from January 1 through December 31. The

return is due and the tax payable on January 31 of the following year.

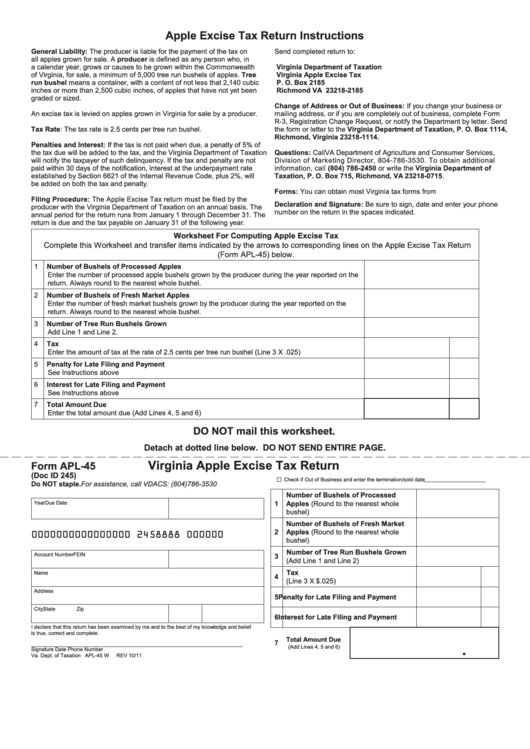

Worksheet For Computing Apple Excise Tax

Complete this Worksheet and transfer items indicated by the arrows to corresponding lines on the Apple Excise Tax Return

(Form APL-45) below.

1

Number of Bushels of Processed Apples

Enter the number of processed apple bushels grown by the producer during the year reported on the

return. Always round to the nearest whole bushel.

2

Number of Bushels of Fresh Market Apples

Enter the number of fresh market bushels grown by the producer during the year reported on the

return. Always round to the nearest whole bushel.

3

Number of Tree Run Bushels Grown

Add Line 1 and Line 2.

4

Tax

Enter the amount of tax at the rate of 2.5 cents per tree run bushel (Line 3 X .025)

5

Penalty for Late Filing and Payment

See Instructions above

6

Interest for Late Filing and Payment

See Instructions above

7

Total Amount Due

Enter the total amount due (Add Lines 4, 5 and 6)

DO NOT mail this worksheet.

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Virginia Apple Excise Tax Return

Form APL-45

(Doc ID 245)

Check if Out of Business and enter the termination/sold date

Do NOT staple.

For assistance, call VDACS: (804)786-3530

Number of Bushels of Processed

Year

Due Date

1

Apples (Round to the nearest whole

bushel)

Number of Bushels of Fresh Market

2

Apples (Round to the nearest whole

0000000000000000 2458888 000000

bushel)

Number of Tree Run Bushels Grown

Account Number

FEIN

3

(Add Line 1 and Line 2)

Tax

Name

4

(Line 3 X $.025)

Address

5

Penalty for Late Filing and Payment

City

State

Zip

6

Interest for Late Filing and Payment

I declare that this return has been examined by me and to the best of my knowledge and belief

is true, correct and complete.

Total Amount Due

7

(Add Lines 4, 5 and 6)

.

Signature

Date

Phone Number

Va. Dept. of Taxation APL-45 W

REV 10/11

1

1