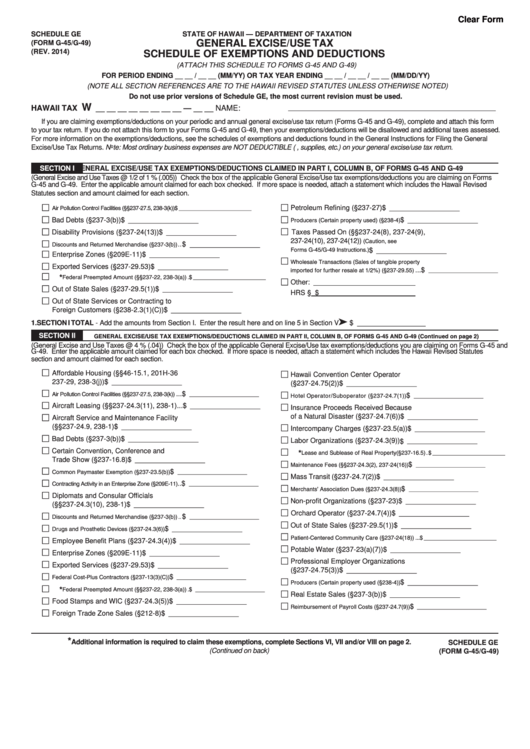

Clear Form

SCHEDULE GE

STATE OF HAWAII — DEPARTMENT OF TAXATION

GENERAL EXCISE/USE TAX

(FORM G-45/G-49)

(REV. 2014)

SCHEDULE OF EXEMPTIONS AND DEDUCTIONS

(ATTACH THIS SCHEDULE TO FORMS G-45 AND G-49)

FOR PERIOD ENDING __ __ / __ __ (MM/YY) OR TAX YEAR ENDING __ __ / __ __ / __ __ (MM/DD/YY)

(NOTE ALL SECTION REFERENCES ARE TO THE HAWAII REVISED STATUTES UNLESS OTHERWISE NOTED)

Do not use prior versions of Schedule GE, the most current revision must be used.

W

HAWAII TAX I.D. NO.

__ __ __ __ __ __ __ __ — __ __

NAME:

If you are claiming exemptions/deductions on your periodic and annual general excise/use tax return (Forms G-45 and G-49), complete and attach this form

to your tax return. If you do not attach this form to your Forms G-45 and G-49, then your exemptions/deductions will be disallowed and additional taxes assessed.

For more information on the exemptions/deductions, see the schedules of exemptions and deductions found in the General Instructions for Filing the General

Excise/Use Tax Returns. Note: Most ordinary business expenses are NOT DEDUCTIBLE (e.g. materials, supplies, etc.) on your general excise/use tax return.

SECTION I

GENERAL EXCISE/USE TAX EXEMPTIONS/DEDUCTIONS CLAIMED IN PART I, COLUMN B, OF FORMS G-45 AND G-49

(General Excise and Use Taxes @ 1/2 of 1 % (.005)) Check the box of the applicable General Excise/Use tax exemptions/deductions you are claiming on Forms

G-45 and G-49. Enter the applicable amount claimed for each box checked. If more space is needed, attach a statement which includes the Hawaii Revised

Statutes section and amount claimed for each section.

Air Pollution Control Facilities (§§237-27.5, 238-3(k)) ....$ _______________________

Petroleum Refining (§237-27) ....................$ __________________

Producers (Certain property used) (§238-4) .......... $ __________________

Bad Debts (§237-3(b)) ...............................$ __________________

Disability Provisions (§237-24(13)) ............$ __________________

Taxes Passed On (§§237-24(8), 237-24(9),

237-24(10), 237-24(12)) (Caution, see

Discounts and Returned Merchandise (§237-3(b)) ..$ __________________

Forms G-45/G-49 Instructions.) ..........................$ __________________

Enterprise Zones (§209E-11) ....................$ __________________

Wholesale Transactions (Sales of tangible property

Exported Services (§237-29.53) ................$ __________________

imported for further resale at 1/2%) (§237-29.55) ...$ ______________________

*

Federal Preempted Amount (§§237-22, 238-3(a)) .$ _______________________

Other:

Out of State Sales (§237-29.5(1)) ..............$ __________________

HRS §

$ __________________

Out of State Services or Contracting to

Foreign Customers (§238-2.3(1)(C)) .........$ __________________

1. SECTION I TOTAL - Add the amounts from Section I. Enter the result here and on line 5 in Section V ....................................

$ __________________

GENERAL EXCISE/USE TAX EXEMPTIONS/DEDUCTIONS CLAIMED IN PART II, COLUMN B, OF FORMS G-45 AND G-49 (Continued on page 2)

SECTION II

(General Excise and Use Taxes @ 4 % (.04)) Check the box of the applicable General Excise/Use tax exemptions/deductions you are claiming on Forms G-45 and

G-49. Enter the applicable amount claimed for each box checked. If more space is needed, attach a statement which includes the Hawaii Revised Statutes

section and amount claimed for each section.

Affordable Housing (§§46-15.1, 201H-36

Hawaii Convention Center Operator

237-29, 238-3(j)) ........................................$ __________________

(§237-24.75(2)) ..........................................$ __________________

Air Pollution Control Facilities (§§237-27.5, 238-3(k)) ...$ ______________________

Hotel Operator/Suboperator (§237-24.7(1)) .......$ ______________________

Aircraft Leasing (§§237-24.3(11), 238-1) ...$ __________________

Insurance Proceeds Received Because

of a Natural Disaster (§237-24.7(6)) ..........$ __________________

Aircraft Service and Maintenance Facility

(§§237-24.9, 238-1) ...................................$ __________________

Intercompany Charges (§237-23.5(a)) ......$ __________________

Bad Debts (§237-3(b)) ...............................$ __________________

Labor Organizations (§237-24.3(9)) .......... $ __________________

*

Certain Convention, Conference and

Lease and Sublease of Real Property(§237-16.5) .$ _______________________

Trade Show (§237-16.8) ............................$ __________________

Maintenance Fees (§§237-24.3(2), 237-24(16)) .....$ ______________________

Common Paymaster Exemption (§237-23.5(b)) .......$ ______________________

Mass Transit (§237-24.7(2)) .......................$ __________________

Contracting Activity in an Enterprise Zone (§209E-11) ..$ ______________________

Merchants’ Association Dues (§237-24.3(8)) .........$ ______________________

Diplomats and Consular Officials

Non-profit Organizations (§237-23) ...........$ __________________

(§§237-24.3(10), 238-1) .............................$ __________________

Orchard Operator (§237-24.7(4)) ...............$ __________________

Discounts and Returned Merchandise (§237-3(b)) ..$ ______________________

Out of State Sales (§237-29.5(1)) ..............$ __________________

Drugs and Prosthetic Devices (§237-24.3(6)) ........$ __________________

Patient-Centered Community Care (§237-24(18)) ...$ _______________________

Employee Benefit Plans (§237-24.3(4)) .....$ __________________

Potable Water (§237-23(a)(7)) ...................$ __________________

Enterprise Zones (§209E-11) ....................$ __________________

Professional Employer Organizations

Exported Services (§237-29.53) ................$ __________________

(§237-24.75(3)) ..........................................$ __________________

Federal Cost-Plus Contractors (§237-13(3)(C)) ......$ ______________________

Producers (Certain property used (§238-4)) ..........$ __________________

*

Federal Preempted Amount (§§237-22, 238-3(a)) .$ ______________________

Real Estate Sales (§237-3(b)) ...................$ __________________

Food Stamps and WIC (§237-24.3(5)) .......$ __________________

Reimbursement of Payroll Costs (§237-24.7(9)) ..... $ ______________________

Foreign Trade Zone Sales (§212-8) ...........$ __________________

*

Additional information is required to claim these exemptions, complete Sections VI, VII and/or VIII on page 2.

SCHEDULE GE

(Continued on back)

(FORM G-45/G-49)

1

1 2

2