Form M-6 - General Instructions

ADVERTISEMENT

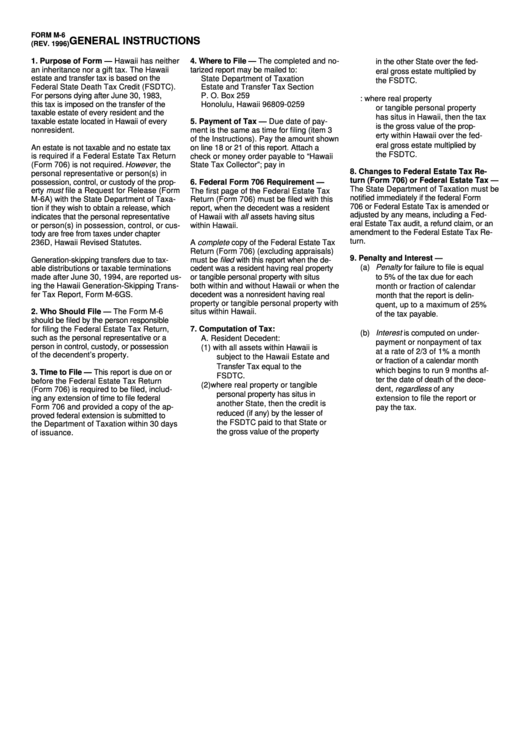

FORM M-6

GENERAL INSTRUCTIONS

(REV. 1996)

1. Purpose of Form — Hawaii has neither

4. Where to File — The completed and no-

in the other State over the fed-

an inheritance nor a gift tax. The Hawaii

tarized report may be mailed to:

eral gross estate multiplied by

estate and transfer tax is based on the

State Department of Taxation

the FSDTC.

Federal State Death Tax Credit (FSDTC).

Estate and Transfer Tax Section

For persons dying after June 30, 1983,

P. O. Box 259

B.

Nonresident: where real property

this tax is imposed on the transfer of the

Honolulu, Hawaii 96809-0259

or tangible personal property

taxable estate of every resident and the

has situs in Hawaii, then the tax

taxable estate located in Hawaii of every

5. Payment of Tax — Due date of pay-

is the gross value of the prop-

nonresident.

ment is the same as time for filing (item 3

erty within Hawaii over the fed-

of the Instructions). Pay the amount shown

eral gross estate multiplied by

An estate is not taxable and no estate tax

on line 18 or 21 of this report. Attach a

the FSDTC.

is required if a Federal Estate Tax Return

check or money order payable to “Hawaii

(Form 706) is not required. However , the

State Tax Collector”; pay in U.S. dollars.

8. Changes to Federal Estate Tax Re-

personal representative or person(s) in

turn (Form 706) or Federal Estate Tax —

possession, control, or custody of the prop-

6. Federal Form 706 Requirement —

The State Department of Taxation must be

erty must file a Request for Release (Form

The first page of the Federal Estate Tax

notified immediately if the federal Form

M-6A) with the State Department of Taxa-

Return (Form 706) must be filed with this

706 or Federal Estate Tax is amended or

tion if they wish to obtain a release, which

report, when the decedent was a resident

adjusted by any means, including a Fed-

of Hawaii with all assets having situs

indicates that the personal representative

eral Estate Tax audit, a refund claim, or an

or person(s) in possession, control, or cus-

within Hawaii.

amendment to the Federal Estate Tax Re-

tody are free from taxes under chapter

turn.

236D, Hawaii Revised Statutes.

A complete copy of the Federal Estate Tax

Return (Form 706) (excluding appraisals)

9. Penalty and Interest —

Generation-skipping transfers due to tax-

must be filed with this report when the de-

(a) Penalty for failure to file is equal

able distributions or taxable terminations

cedent was a resident having real property

made after June 30, 1994, are reported us-

or tangible personal property with situs

to 5% of the tax due for each

ing the Hawaii Generation-Skipping Trans-

both within and without Hawaii or when the

month or fraction of calendar

fer Tax Report, Form M-6GS.

decedent was a nonresident having real

month that the report is delin-

property or tangible personal property with

quent, up to a maximum of 25%

2. Who Should File — The Form M-6

situs within Hawaii.

of the tax payable.

should be filed by the person responsible

for filing the Federal Estate Tax Return,

7. Computation of Tax:

(b) Interest is computed on under-

such as the personal representative or a

A. Resident Decedent:

payment or nonpayment of tax

person in control, custody, or possession

(1) with all assets within Hawaii is

at a rate of 2/3 of 1% a month

of the decendent’s property.

subject to the Hawaii Estate and

or fraction of a calendar month

Transfer Tax equal to the

which begins to run 9 months af-

3. Time to File — This report is due on or

FSDTC.

ter the date of death of the dece-

before the Federal Estate Tax Return

(2) where real property or tangible

dent, regardless of any

(Form 706) is required to be filed, includ-

personal property has situs in

ing any extension of time to file federal

extension to file the report or

another State, then the credit is

Form 706 and provided a copy of the ap-

pay the tax.

reduced (if any) by the lesser of

proved federal extension is submitted to

the FSDTC paid to that State or

the Department of Taxation within 30 days

the gross value of the property

of issuance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1