Print

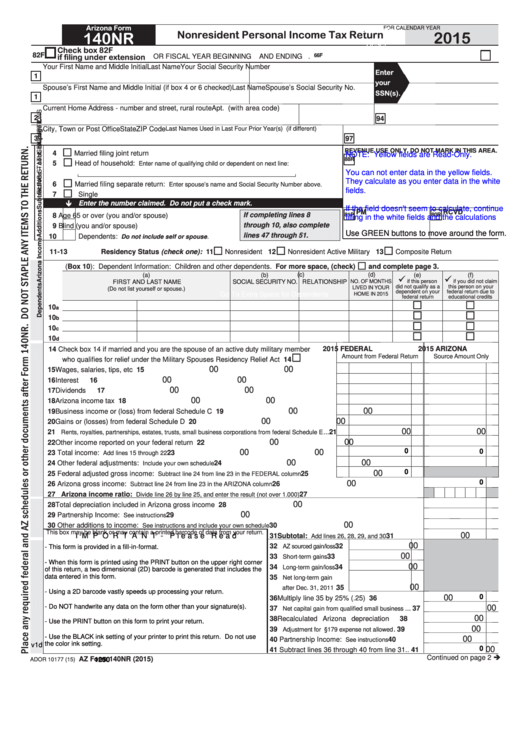

Arizona Form

FOR CALENDAR YEAR

Calculate

Nonresident Personal Income Tax Return

2015

140NR

Reset

Check box 82F

82F

if filing under extension

66F

OR FISCAL YEAR BEGINNING

AND ENDING

.

Your First Name and Middle Initial

Last Name

Your Social Security Number

Enter

1

your

Spouse’s First Name and Middle Initial (if box 4 or 6 checked)

Last Name

Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route

Apt. No.

Daytime Phone (with area code)

2

94

City, Town or Post Office

State

ZIP Code

Last Names Used in Last Four Prior Year(s) (if different)

3

97

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

4

Married filing joint return

NOTE: Yellow fields are Read-Only.

88R

5

Head of household:

Enter name of qualifying child or dependent on next line:

You can not enter data in the yellow fields.

They calculate as you enter data in the white

6

Married filing separate return:

Enter spouse’s name and Social Security Number above.

fields.

7

Single

Enter the number claimed. Do not put a check mark.

If the field doesn't seem to calculate, continue

PM

RCVD

If completing lines 8

81P

80R

8

Age 65 or over (you and/or spouse)

filling in the white fields and the calculations

through 10, also complete

9

Blind (you and/or spouse)

will "catch up".

Use GREEN buttons to move around the form.

lines 47 through 51.

10

Dependents:

Do not include self or spouse.

11-13

Residency Status (check one): 11

Nonresident 12

Nonresident Active Military 13

Composite Return

(Box 10): Dependent Information: Children and other dependents. For more space, (check)

and complete page 3.

(a)

(b)

(c)

(d)

(e)

(f)

NO. OF MONTHS

if this person

if you did not claim

FIRST AND LAST NAME

SOCIAL SECURITY NO.

RELATIONSHIP

did not qualify as a

this person on your

LIVED IN YOUR

(Do not list yourself or spouse.)

dependent on your

federal return due to

Go To Extra Space for Dependents

HOME IN 2015

federal return

educational credits

10

a

10

b

10

c

10

d

2015 FEDERAL

2015 ARIZONA

14 Check box 14 if married and you are the spouse of an active duty military member

Amount from Federal Return

Source Amount Only

who qualifies for relief under the Military Spouses Residency Relief Act .................. 14

00

00

15 Wages, salaries, tips, etc ....................................................................................................

15

00

00

16 Interest ................................................................................................................................

16

00

00

17 Dividends ............................................................................................................................

17

00

00

18 Arizona income tax refunds.................................................................................................

18

00

00

19 Business income or (loss) from federal Schedule C ...........................................................

19

00

00

20 Gains or (losses) from federal Schedule D .........................................................................

20

00

00

21

...

21

Rents, royalties, partnerships, estates, trusts, small business corporations from federal Schedule E

00

00

22 Other income reported on your federal return .....................................................................

22

0

00

0

00

23 Total income:

....................................................................................

23

Add lines 15 through 22

00

00

24 Other federal adjustments:

..........................................................

24

Include your own schedule

0

00

25 Federal adjusted gross income:

..............

25

Subtract line 24 from line 23 in the FEDERAL column

0

00

26 Arizona gross income:

...................................................................... 26

Subtract line 24 from line 23 in the ARIZONA column

27 Arizona income ratio:

......................................................... 27

Divide line 26 by line 25, and enter the result (not over 1.000)

00

28 Total depreciation included in Arizona gross income ................................................................................................... 28

00

29 Partnership Income:

............................................................................................................................ 29

See instructions

00

30 Other additions to income:

....................................................................... 30

See instructions and include your own schedule

This box may be blank or may contain a printed barcode of data from your return

.

00

I M P O R T A N T - P l e a s e R e a d

31 Subtotal:

.......... 31

Add lines 26, 28, 29, and 30

00

32

32

AZ sourced gain/loss

- This form is provided in a fill-in-format.

00

33

.... 33

Short-term gains

- When this form is printed using the PRINT button on the upper right corner

00

34

34

Long-term gain/loss

of this return, a two dimensional (2D) barcode is generated that includes the

data entered in this form.

35

Net long-term gain

00

. 35

after Dec. 31, 2011

- Using a 2D barcode vastly speeds up processing your return.

0

00

36 Multiply line 35 by 25% (.25) ..................... 36

- Do NOT handwrite any data on the form other than your signature(s).

00

37

... 37

Net capital gain from qualified small business

00

38 Recalculated Arizona depreciation ............ 38

- Use the PRINT button on this form to print your return.

00

39

. 39

Adjustment for I.R.C. §179 expense not allowed

- Use the BLACK ink setting of your printer to print this return. Do not use

00

40 Partnership Income:

.......... 40

See instructions

the color ink setting.

v1d

0

00

41 Subtract lines 36 through 40 from line 31.. 41

Continued on page 2

AZ Form 140NR (2015)

1250

ADOR 10177 (15)

1

1 2

2 3

3 4

4