Instructions For Form K-85 - Worksheet For University Deferred Maintenance Credit

ADVERTISEMENT

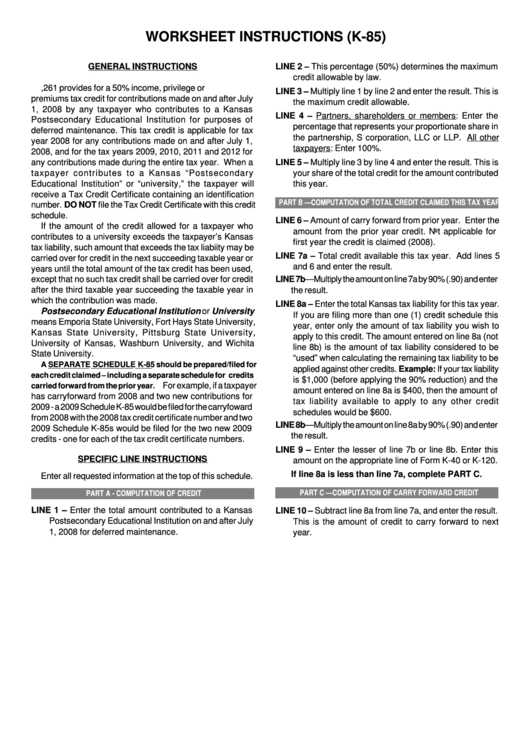

WORKSHEET INSTRUCTIONS (K-85)

LINE 2 – This percentage (50%) determines the maximum

GENERAL INSTRUCTIONS

credit allowable by law.

K.S.A. 79-32,261 provides for a 50% income, privilege or

LINE 3 – Multiply line 1 by line 2 and enter the result. This is

premiums tax credit for contributions made on and after July

the maximum credit allowable.

1, 2008 by any taxpayer who contributes to a Kansas

LINE 4 – Partners, shareholders or members: Enter the

Postsecondary Educational Institution for purposes of

percentage that represents your proportionate share in

deferred maintenance. This tax credit is applicable for tax

the partnership, S corporation, LLC or LLP. All other

year 2008 for any contributions made on and after July 1,

taxpayers: Enter 100%.

2008, and for the tax years 2009, 2010, 2011 and 2012 for

any contributions made during the entire tax year. When a

LINE 5 – Multiply line 3 by line 4 and enter the result. This is

taxpayer contributes to a Kansas “Postsecondary

your share of the total credit for the amount contributed

Educational Institution” or “university,” the taxpayer will

this year.

receive a Tax Credit Certificate containing an identification

PART B —COMPUTATION OF TOTAL CREDIT CLAIMED THIS TAX YEAR

number. DO NOT file the Tax Credit Certificate with this credit

schedule.

LINE 6 – Amount of carry forward from prior year. Enter the

If the amount of the credit allowed for a taxpayer who

amount from the prior year credit. Not applicable for

contributes to a university exceeds the taxpayer’s Kansas

first year the credit is claimed (2008).

tax liability, such amount that exceeds the tax liabiity may be

LINE 7a – Total credit available this tax year. Add lines 5

carried over for credit in the next succeeding taxable year or

and 6 and enter the result.

years until the total amount of the tax credit has been used,

except that no such tax credit shall be carried over for credit

LINE 7b—Multiply the amount on line 7a by 90% (.90) and enter

after the third taxable year succeeding the taxable year in

the result.

which the contribution was made.

LINE 8a – Enter the total Kansas tax liability for this tax year.

Postsecondary Educational Institution or University

If you are filing more than one (1) credit schedule this

means Emporia State University, Fort Hays State University,

year, enter only the amount of tax liability you wish to

Kansas State University, Pittsburg State University,

apply to this credit. The amount entered on line 8a (not

University of Kansas, Washburn University, and Wichita

line 8b) is the amount of tax liability considered to be

State University.

“used” when calculating the remaining tax liability to be

A SEPARATE SCHEDULE K-85 should be prepared/filed for

applied against other credits. Example: If your tax liability

each credit claimed – including a separate schedule for credits

is $1,000 (before applying the 90% reduction) and the

For example, if a taxpayer

carried forward from the prior year.

amount entered on line 8a is $400, then the amount of

has carryforward from 2008 and two new contributions for

tax liability available to apply to any other credit

2009 - a 2009 Schedule K-85 would be filed for the carryfoward

schedules would be $600.

from 2008 with the 2008 tax credit certificate number and two

LINE 8b—Multiply the amount on line 8a by 90% (.90) and enter

2009 Schedule K-85s would be filed for the two new 2009

the result.

credits - one for each of the tax credit certificate numbers.

LINE 9 – Enter the lesser of line 7b or line 8b. Enter this

SPECIFIC LINE INSTRUCTIONS

amount on the appropriate line of Form K-40 or K-120.

If line 8a is less than line 7a, complete PART C.

Enter all requested information at the top of this schedule.

PART C —COMPUTATION OF CARRY FORWARD CREDIT

PART A - COMPUTATION OF CREDIT

LINE 1 – Enter the total amount contributed to a Kansas

LINE 10 – Subtract line 8a from line 7a, and enter the result.

Postsecondary Educational Institution on and after July

This is the amount of credit to carry forward to next

1, 2008 for deferred maintenance.

year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1