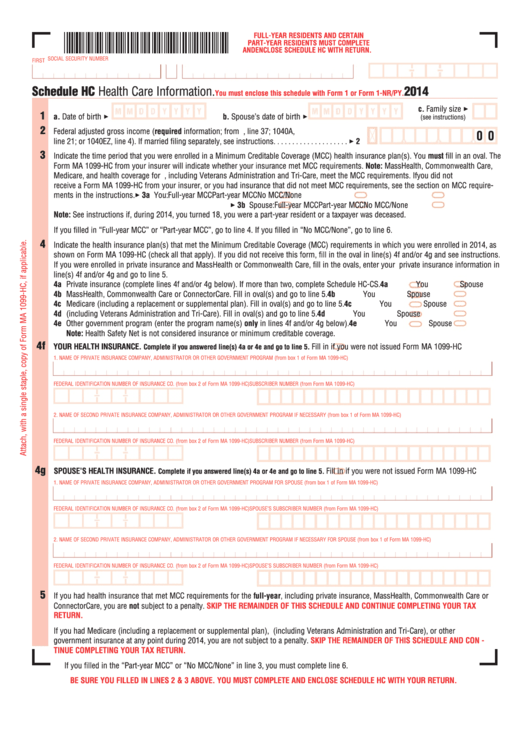

FULL-YEAR RESIDENTS AND CERTAIN

PART-YEAR RESIDENTS MUST COMPLETE

AND ENCLOSE SCHEDULE HC WITH RETURN.

SOCIAL SECURITY NUMBER

FIRST NAME

M.I.

LAST NAME

Schedule HC Health Care Information.

2014

You must enclose this schedule with Form 1 or Form 1-NR/PY.

c. Family size 3

1

a. Date of birth 3

b. Spouse’s date of birth 3

(see instructions)

2

Federal adjusted gross income (required information; from U.S. Forms 1040, line 37; 1040A,

0 0

line 21; or 1040EZ, line 4). If married filing separately, see instructions. . . . . . . . . . . . . . . . . . . . 3 2

3

Indicate the time period that you were enrolled in a Minimum Creditable Coverage (MCC) health insurance plan(s). You must fill in an oval. The

Form MA 1099-HC from your insurer will indicate whether your insurance met MCC requirements. Note: MassHealth, Commonwealth Care,

Medicare, and health coverage for U.S. Military, including Veterans Administration and Tri-Care, meet the MCC requirements. If you did not

receive a Form MA 1099-HC from your insurer, or you had insurance that did not meet MCC requirements, see the section on MCC require-

ments in the instructions.

3 3a You:

Full-year MCC

Part-year MCC

No MCC/None

3 3b Spouse:

Full-year MCC

Part-year MCC

No MCC/None

Note: See instructions if, during 2014, you turned 18, you were a part-year resident or a taxpayer was deceased.

If you filled in “Full-year MCC” or “Part-year MCC”, go to line 4. If you filled in “No MCC/None”, go to line 6.

4

Indicate the health insurance plan(s) that met the Minimum Creditable Coverage (MCC) requirements in which you were enrolled in 2014, as

shown on Form MA 1099-HC (check all that apply). If you did not receive this form, fill in the oval in line(s) 4f and/or 4g and see instructions.

If you were enrolled in private insurance and MassHealth or Commonwealth Care, fill in the ovals, enter your private insurance information in

line(s) 4f and/or 4g and go to line 5.

4a Private insurance (complete lines 4f and/or 4g below). If more than two, complete Schedule HC-CS.

4a

You

Spouse

4b MassHealth, Commonwealth Care or ConnectorCare. Fill in oval(s) and go to line 5.

4b

You

Spouse

4c Medicare (including a replacement or supplemental plan). Fill in oval(s) and go to line 5.

4c

You

Spouse

4d U.S. Military (including Veterans Administration and Tri-Care). Fill in oval(s) and go to line 5.

4d

You

Spouse

4e Other government program (enter the program name(s) only in lines 4f and/or 4g below).

4e

You

Spouse

Note: Health Safety Net is not considered insurance or minimum creditable coverage.

4f

YOUR HEALTH INSURANCE.

Fill in if you were not issued Form MA 1099-HC

Complete if you answered line(s) 4a or 4e and go to line 5.

1. NAME OF PRIVATE INSURANCE COMPANY, ADMINISTRATOR OR OTHER GOVERNMENT PROGRAM (from box 1 of Form MA 1099-HC)

FEDERAL IDENTIFICATION NUMBER OF INSURANCE CO. (from box 2 of Form MA 1099-HC)

SUBSCRIBER NUMBER (from Form MA 1099-HC)

2. NAME OF SECOND PRIVATE INSURANCE COMPANY, ADMINISTRATOR OR OTHER GOVERNMENT PROGRAM IF NECESSARY (from box 1 of Form MA 1099-HC)

FEDERAL IDENTIFICATION NUMBER OF INSURANCE CO. (from box 2 of Form MA 1099-HC)

SUBSCRIBER NUMBER (from Form MA 1099-HC)

4g

SPOUSE’S HEALTH INSURANCE.

Fill in if you were not issued Form MA 1099-HC

Complete if you answered line(s) 4a or 4e and go to line 5.

1. NAME OF PRIVATE INSURANCE COMPANY, ADMINISTRATOR OR OTHER GOVERNMENT PROGRAM FOR SPOUSE (from box 1 of Form MA 1099-HC)

FEDERAL IDENTIFICATION NUMBER OF INSURANCE CO. (from box 2 of Form MA 1099-HC)

SPOUSE’S SUBSCRIBER NUMBER (from Form MA 1099-HC)

2. NAME OF SECOND PRIVATE INSURANCE COMPANY, ADMINISTRATOR OR OTHER GOVERNMENT PROGRAM IF NECESSARY FOR SPOUSE (from box 1 of Form MA 1099-HC)

FEDERAL IDENTIFICATION NUMBER OF INSURANCE CO. (from box 2 of Form MA 1099-HC)

SPOUSE’S SUBSCRIBER NUMBER (from Form MA 1099-HC)

5

If you had health insurance that met MCC requirements for the full-year, including private insurance, MassHealth, Commonwealth Care or

ConnectorCare, you are not subject to a penalty.

SKIP THE REMAINDER OF THIS SCHEDULE AND CONTINUE COMPLETING YOUR TAX

RETURN.

If you had Medicare (including a replacement or supplemental plan), U.S. Military (including Veterans Administration and Tri-Care), or other

government insurance at any point during 2014, you are not subject to a penalty.

SKIP THE REMAINDER OF THIS SCHEDULE AND CON -

TINUE COMPLETING YOUR TAX RETURN.

If you filled in the “Part-year MCC” or “No MCC/None” in line 3, you must complete line 6.

BE SURE YOU FILLED IN LINES 2 & 3 ABOVE. YOU MUST COMPLETE AND ENCLOSE SCHEDULE HC WITH YOUR RETURN.

1

1 2

2 3

3 4

4