TAB through to navigate. Use mouse to check

Print

Clear

Save

applicable boxes, press spacebar, or press Enter.

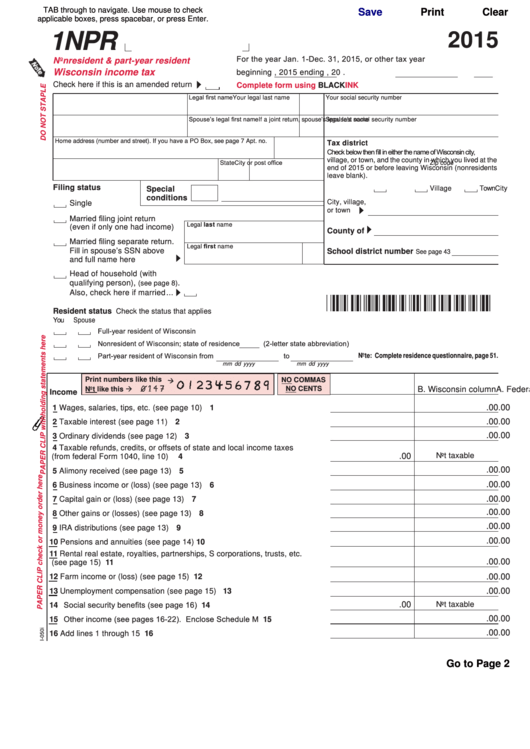

1NPR

2015

For the year Jan. 1-Dec. 31, 2015, or other tax year

Nonresident & part-year resident

Wisconsin income tax

beginning

, 2015

ending

, 20

.

Check here if this is an amended return

Complete form using

BLACK

INK

Legal first name

M.I.

Your legal last name

Your social security number

Spouse’s legal first name

M.I.

If a joint return, spouse’s legal last name

Spouse’s social security number

Home address (number and street). If you have a PO Box, see page 7

Apt. no.

Tax district

Check below then fill in either the name of Wisconsin city,

village, or town, and the county in which you lived at the

City or post office

State

Zip code

end of 2015 or before leaving Wisconsin (nonresidents

leave blank).

Filing status

City

Village

Town

Special

conditions

City, village,

Single

or town

Married filing joint return

Legal last name

(even if only one had income)

County of

Married filing separate return.

Legal first name

M.I.

Fill in spouse’s SSN above

School district number

See page 43

and full name here ...............

Head of household (with

qualifying person),

.

(see page 8)

Also, check here if married ...

Resident status

Check the status that applies

You

Spouse

Full-year resident of Wisconsin

Nonresident of Wisconsin; state of residence

(2-letter state abbreviation)

Part-year resident of Wisconsin from

to

Note: Complete residence questionnaire, page 51.

mm

dd

yyyy

mm

dd

yyyy

Print numbers like this

NO COMMAS

Not like this

NO CENTS

A. Federal column

B. Wisconsin column

Income

.00

.00

1 Wages, salaries, tips, etc. (see page 10) . . . . . . . . . . . . . . . . . . . . . . . .

1

.00

.00

2 Taxable interest (see page 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

.00

.00

3 Ordinary dividends (see page 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Taxable refunds, credits, or offsets of state and local income taxes

.00

Not taxable

(from federal Form 1040, line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.00

.00

5 Alimony received (see page 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.00

.00

6 Business income or (loss) (see page 13) . . . . . . . . . . . . . . . . . . . . . . . .

6

.00

.00

7 Capital gain or (loss) (see page 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.00

.00

8 Other gains or (losses) (see page 13) . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.00

.00

9 IRA distributions (see page 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

.00

.00

10 Pensions and annuities (see page 14) . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Rental real estate, royalties, partnerships, S corporations, trusts, etc.

.00

.00

(see page 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.00

.00

12 Farm income or (loss) (see page 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Unemployment compensation (see page 15) . . . . . . . . . . . . . . . . . . . . 13

.00

.00

14 Social security benefits (see page 16) . . . . . . . . . . . . . . . . . . . . . . . . . . 14

.00

Not taxable

15 Other income (see pages 16-22). Enclose Schedule M . . . . . . . . . . . . 15

.00

.00

.00

.00

16 Add lines 1 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

Go to Page 2

1

1 2

2 3

3 4

4