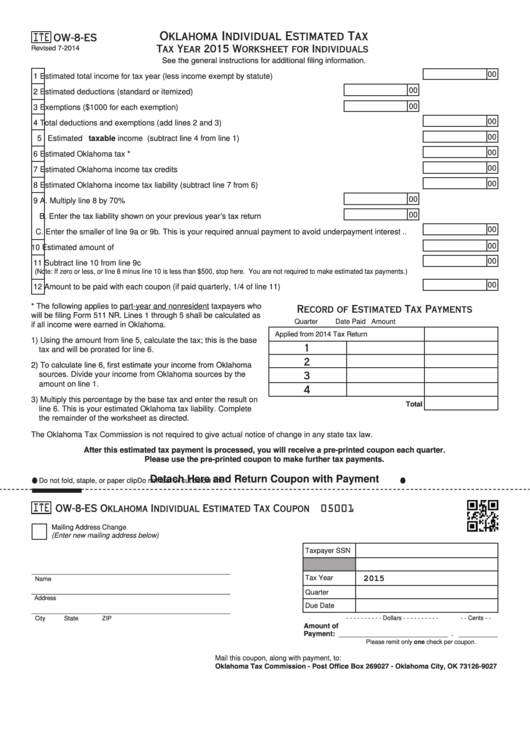

Oklahoma Individual Estimated Tax

ITE OW-8-ES

Tax Year 2015 Worksheet for Individuals

Revised 7-2014

See the general instructions for additional filing information.

00

1 Estimated total income for tax year (less income exempt by statute) ...............................................................

00

2 Estimated deductions (standard or itemized) ................................................................

00

3 Exemptions ($1000 for each exemption) .......................................................................

00

4 Total deductions and exemptions (add lines 2 and 3) .......................................................................................

00

5 Estimated taxable income (subtract line 4 from line 1) ....................................................................................

00

6 Estimated Oklahoma tax * .................................................................................................................................

00

7 Estimated Oklahoma income tax credits ...........................................................................................................

00

8 Estimated Oklahoma income tax liability (subtract line 7 from 6) ......................................................................

00

9 A. Multiply line 8 by 70% ..............................................................................................

00

B. Enter the tax liability shown on your previous year’s tax return ...............................

00

C. Enter the smaller of line 9a or 9b. This is your required annual payment to avoid underpayment interest ..

00

10 Estimated amount of withholding.......................................................................................................................

00

11 Subtract line 10 from line 9c ..............................................................................................................................

(Note: If zero or less, or line 8 minus line 10 is less than $500, stop here. You are not required to make estimated tax payments.)

00

12 Amount to be paid with each coupon (if paid quarterly, 1/4 of line 11) ..............................................................

* The following applies to part-year and nonresident taxpayers who

Record of Estimated Tax Payments

will be filing Form 511 NR. Lines 1 through 5 shall be calculated as

Quarter

Date Paid

Amount

if all income were earned in Oklahoma.

Applied from 2014 Tax Return ............................

1) Using the amount from line 5, calculate the tax; this is the base

1

tax and will be prorated for line 6.

2

2) To calculate line 6, first estimate your income from Oklahoma

sources. Divide your income from Oklahoma sources by the

3

amount on line 1.

4

3) Multiply this percentage by the base tax and enter the result on

Total

line 6. This is your estimated Oklahoma tax liability. Complete

the remainder of the worksheet as directed.

The Oklahoma Tax Commission is not required to give actual notice of change in any state tax law.

After this estimated tax payment is processed, you will receive a pre-printed coupon each quarter.

Please use the pre-printed coupon to make further tax payments.

Do not fold, staple, or paper clip

Detach Here and Return Coupon with Payment

Do not tear or cut below line

OW-8-ES Oklahoma Individual Estimated Tax Coupon

ITE

05001

Mailing Address Change

(Enter new mailing address below)

Taxpayer SSN

___________________________________________________

Tax Year

2015

Name

Quarter

___________________________________________________

Address

Due Date

___________________________________________________

- - - - - - - - - - Dollars - - - - - - - - - -

- - Cents - -

City

State

ZIP

Amount of

____________________________ . __________

Payment:

Please remit only one check per coupon.

Mail this coupon, along with payment, to:

Oklahoma Tax Commission - Post Office Box 269027 - Oklahoma City, OK 73126-9027

1

1 2

2