Instructions For Form 140py (Schedule A(Pyn)) - Itemized Deductions - 2014

ADVERTISEMENT

2014 Form 140PY Schedule A(PYN) Itemized Deductions

For part-year residents who also had Arizona source

resident. Also enter the amount of such taxes from Arizona

income during the part of the year while an Arizona

sources that you incurred and paid during the part of the year

nonresident.

while a nonresident.

Do not include any state taxes paid to other states for prior

Completing Schedule A(PYN) Itemized Deductions

years if you were not an Arizona resident for that prior year.

Before you complete Arizona Form 140PY, Schedule

Line 3 - Interest Expense

A(PYN), you must complete a federal Form 1040, Schedule A.

Enter the amount of interest expense allowable on federal

You may itemize your deductions on your Arizona return

Form 1040, Schedule A, that you incurred and paid while an

even if you do not itemize deductions on your federal return.

Arizona resident. Also enter the amount of such interest

For the most part, you can deduct those items that are

from Arizona sources that you incurred and paid during the

allowable itemized deductions under the Internal Revenue

part of the year while a nonresident.

Code (IRC).

If you received a federal credit for interest paid on mortgage

A part-year resident who also has Arizona source income

credit certificates (from federal Form 8396), you may deduct

during the part of the year while an Arizona nonresident can

some of the mortgage interest you paid for 2014 that you

deduct all of the following.

could not deduct for federal purposes. Include that portion of

1. Those expenses incurred and paid during the part of the

such interest that you incurred and paid during the part of the

year while an Arizona resident.

year while an Arizona resident.

2. Arizona source itemized deductions incurred and paid

Do not enter any interest expense that you incurred to

during the part of the year while a nonresident.

purchase or carry U.S. obligations, the income from which is

3. A portion of all other itemized deductions paid during

exempt from Arizona income tax.

the part of the year while a nonresident.

Line 4 - Gifts to Charity

For more information, see the department’s Individual

Enter the amount of gifts to charity allowable on federal

Income Tax Ruling, ITR 94-10, at

Form 1040, Schedule A, that you incurred and paid while an

In some cases, the itemized deductions allowed on your

Arizona resident. Also enter the amount of such gifts from

Arizona return are not the same as those allowable under the

Arizona sources that you incurred and paid during the part of

IRC. The itemized deductions allowed on your Arizona

the year while a nonresident.

return can differ if any of the following apply.

If you claimed a credit for any charitable contribution, do not

1. You are deducting medical and dental expenses.

include any contribution for which you claimed a tax credit.

2. You are claiming a federal credit (from federal Form

8396) for interest paid on mortgage credit certificates.

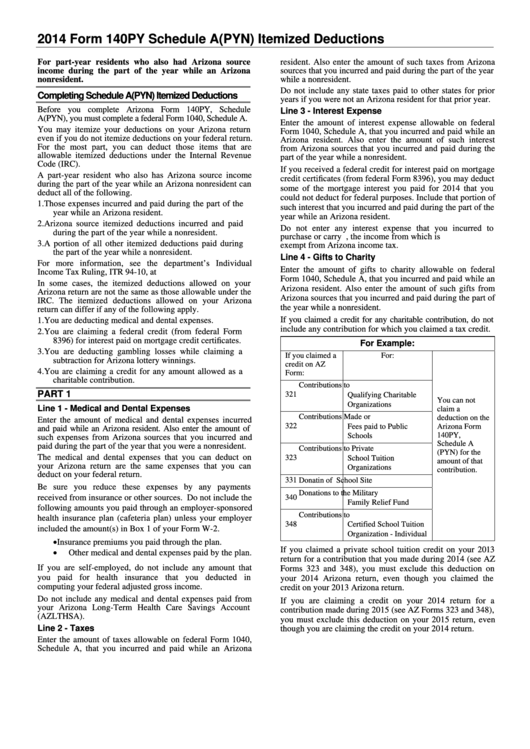

For Example:

3. You are deducting gambling losses while claiming a

If you claimed a

For:

subtraction for Arizona lottery winnings.

credit on AZ

4. You are claiming a credit for any amount allowed as a

Form:

charitable contribution.

Contributions to

PART 1

321

Qualifying Charitable

You can not

Organizations

Line 1 - Medical and Dental Expenses

claim a

Contributions Made or

deduction on the

Enter the amount of medical and dental expenses incurred

322

Arizona Form

Fees paid to Public

and paid while an Arizona resident. Also enter the amount of

140PY,

Schools

such expenses from Arizona sources that you incurred and

Schedule A

paid during the part of the year that you were a nonresident.

Contributions to Private

(PYN) for the

The medical and dental expenses that you can deduct on

323

School Tuition

amount of that

your Arizona return are the same expenses that you can

Organizations

contribution.

deduct on your federal return.

331

Donatin of School Site

Be sure you reduce these expenses by any payments

Donations to the Military

received from insurance or other sources. Do not include the

340

Family Relief Fund

following amounts you paid through an employer-sponsored

Contributions to

health insurance plan (cafeteria plan) unless your employer

348

Certified School Tuition

included the amount(s) in Box 1 of your Form W-2.

Organization - Individual

Insurance premiums you paid through the plan.

If you claimed a private school tuition credit on your 2013

Other medical and dental expenses paid by the plan.

return for a contribution that you made during 2014 (see AZ

If you are self-employed, do not include any amount that

Forms 323 and 348), you must exclude this deduction on

you paid for health insurance that you deducted in

your 2014 Arizona return, even though you claimed the

computing your federal adjusted gross income.

credit on your 2013 Arizona return.

Do not include any medical and dental expenses paid from

If you are claiming a credit on your 2014 return for a

your Arizona Long-Term Health Care Savings Account

contribution made during 2015 (see AZ Forms 323 and 348),

(AZLTHSA).

you must exclude this deduction on your 2015 return, even

Line 2 - Taxes

though you are claiming the credit on your 2014 return.

Enter the amount of taxes allowable on federal Form 1040,

Schedule A, that you incurred and paid while an Arizona

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3