Dealer’s Aircraft Sales and Use Tax Return Instructions

General: Registered dealers are required to collect and to pay the

Questions: Call (804) 786-2450 or write the Virginia Department

tax rate of 2% on gross receipts from the lease, charter or other use

of Taxation, P.O. Box 715, Richmond, VA 23218-0715. If you

of aircraft. The dealer must fi le a return and pay the tax monthly

have Internet access, you can obtain most Virginia tax forms from

based on the gross receipts arising from all taxable transactions

the Department’s Web-site

during the preceding month.

Gross Receipts: Enter the total gross receipts from lease, rental or

Mail completed forms to:

Virginia Department Of Taxation

other use of all aircraft. Gross receipts shall include hourly rental,

Aircraft Sales and Use Tax

maintenance and all charges for use of such aircraft, and unless

PO Box 2185

separately stated on the invoice, all charges for services of pilots

Richmond, VA 23218-2185

or instructors in such aircraft.

Monthly returns are due and the tax payable to the Virginia

Tax Rate: The tax rate is 2% of the gross receipts from taxable

Department of Taxation on or before the 20th of each month for

transactions during the preceding month.

the preceding month.

Penalty: The penalty for failure to fi le and/or pay on time is 6% of

Payments returned by the bank will be subject to a returned payment

the tax due for each month, or part of a month, that the tax is not

fee in addition to any other penalties that may be incurred.

paid, not to exceed 30%.

A return must be fi led for each reporting period even if no

Interest: Interest at the underpayment rate established by Section

tax is due.

6621 of the Internal Revenue Code, plus 2%, will be added to the

tax if not paid by the due date. Enter interest if you fi le the return

Do not report on this return any sales of aircraft parts or accessories

and/or pay the tax after the due date.

because such sales are subject to the retail sales tax and reportable

on Form ST-9, Retail Sales and Use Tax Return.

Declaration and Signature: Be sure to sign, date and enter your

phone number in the space indicated.

Change of Address or Out-Of-Business: If you change your

business or mailing address or discontinue business, either send

a completed Form R-3, Registration Change Request, or a letter to

the Virginia Department of Taxation, P.O. Box 1114, Richmond,

Virginia 23218-1114. The Form R-3 can be obtained from the

Department’s Web-site:

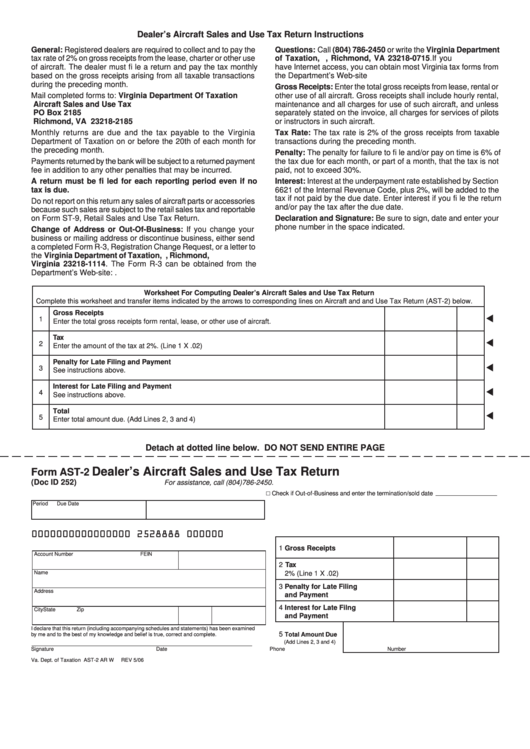

Worksheet For Computing Dealer’s Aircraft Sales and Use Tax Return

Complete this worksheet and transfer items indicated by the arrows to corresponding lines on Aircraft and and Use Tax Return (AST-2) below.

Gross Receipts

1

Enter the total gross receipts form rental, lease, or other use of aircraft.

Tax

2

Enter the amount of the tax at 2%. (Line 1 X .02)

Penalty for Late Filing and Payment

3

See instructions above.

Interest for Late Filing and Payment

4

See instructions above.

Total

5

Enter total amount due. (Add Lines 2, 3 and 4)

Detach at dotted line below. DO NOT SEND ENTIRE PAGE

Dealer’s Aircraft Sales and Use Tax Return

Form AST-2

(Doc ID 252)

For assistance, call (804)786-2450.

Check if Out-of-Business and enter the termination/sold date

Period

Due Date

0000000000000000 2528888 000000

1 Gross Receipts

Account Number

FEIN

2 Tax

Name

2% (Line 1 X .02)

3 Penalty for Late Filing

Address

and Payment

4 Interest for Late Filng

City

State

Zip

and Payment

I declare that this return (including accompanying schedules and statements) has been examined

5

Total Amount Due

by me and to the best of my knowledge and belief is true, correct and complete.

(Add Lines 2, 3 and 4)

Signature

Date

Phone Number

Va. Dept. of Taxation AST-2 AR W

REV 5/06

1

1