Click Here to Print Document

CLICK HERE TO CLEAR FORM

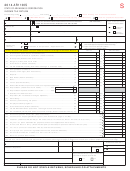

SCHEDULE A

CTSC141

Apportionment Of Income

For Multistate Corporation

FEIN:

A. INCOME TO APPORTION:

00

1.

1.

Income: (Enter amount from page 1, Line 27, Total Column )........................................................

00

2.

Interest Income:(Attach schedule).................................................................................................

2.

00

3.

Dividend Income: (Attach schedule)...............................................................................................

3.

00

4.

4.

Net Income (loss) from rental activities and Royalties: (Attach schedule)......................................

00

5.

5.

Net capital gain (loss) not listed on page 1: (Attach schedule).......................................................

00

6.

6.

Other income (loss): (Attach schedule)..........................................................................................

00

7.

Total Income: (Add Lines 1 through 6 and enter here)..............................................................................................................

7.

00

8.

Charitable Contributions: (Attach schedule)...................................................................................

8.

Section 179 expense deduction: (Attach schedule).......................................................................

00

9.

9.

00

10.

Other expenses (adjustments) not included elsewhere: (Attach schedule)..................................

10.

00

11.

Total deductions: (Add Lines 8 through 10 and enter here)...........................................................

11.

00

12.

TOTAL APPORTIONABLE INCOME: (Subtract Line 11 from Line 7).....................................................................................

12.

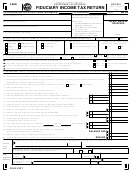

(A)

(B)

(C)

B.

APPORTIONMENT FACTOR:

Amounts in Arkansas

Percentage (A)÷(B)

Total Amounts

1.

Property used in the Production of Business Income:

a.

Tangible Assets used in Business and Inventories

Less Construction in Progress

(Calculate to 6 places

00

00

to the right of decimal.

1.

Amount at the Beginning of Year...................................................

1.

1.

Fill in all spaces)

00

00

2.

Amount at the End of Year............................................................

2.

2.

00

00

3.

Total: (Add Lines a1 and a2).........................................................

3.

3.

9 9 9 . 9 9 9 9 9 9

%

00

00

4.

Average Tangible Assets: (Line a3 divided by 2)..........................

4.

4.

(EXAMPLE)

00

00

b.

Rented Property: (8 X net annual rent)............................................

b.

b.

00

00

Average Value of Intangible Property:.............................................

c.

c.

c.

(For Financial Institutions Only - Attach schedule)

%

00

00

d.

d.

TOTAL PROPERTY: (Add Lines a4, b and c )................................d.

d.

2.

Salaries, Wages, Commissions and Other Compensation Related to the Production of Income:

00

00

%

a.

a.

a.

TOTAL:...........................................................................................

a

3.

Sales / Receipts:

00

a.

a.

Destination Shipped From Within Arkansas:...................................

00

b.

Destination Shipped From Without Arkansas:.................................

b.

00

c.

Origin Shipped From Within Arkansas to U. S. Govt:......................

c.

d.

Origin Shipped From Within Arkansas to

00

Other Non-taxable Jurisdictions:.....................................................

d.

00

e.

Other Business Gross Receipts:.....................................................

e.

(Interest, Dividends, Rents, Gains, etc. Attach Schedule)

00

00

%

f.

TOTAL SALES: (Add Lines 3a through 3e)......................................

f.

f.

f.

%

g.

Multiply Column C, Line 3f by 2 to Doubleweight the Sales Factor

g.

(Financial Institutions must use Single Weighted Factor).................

%

Sum of the Percentages: (Add Column C, Lines 1d, 2a, and 3g).............................................................................................

4.

4.

%

%

=

Percentage Attributable to Arkansas:........................................... Line 4

Divided by

5.

*5.

* For Part B, Line 5, divide Line 4 by the number of entries other than zero which you make on Part B, Column B, Lines (1d), (2a), and (3f).

Note: An entry other than zero in Part B, Column B, Line 3g, counts as two (2) entries.

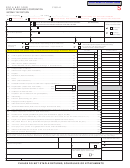

C.

ARKANSAS TAXABLE INCOME:

00

1.

Income Apportioned to Arkansas: (Multiply Part A, Line 12 by Part B, Line 5).........................................................................

1.

00

2.

Add: Direct Income Allocated to Arkansas: (Attach schedule)..................................................................................................

2.

00

3.

TOTAL INCOME TAXABLE TO ARKANSAS:(Enter here and on page 1, line 27, Arkansas Column )...................................

3.

SCHEDULE D - Capital Gains Tax

A.

TAX IMPOSED ON CERTAIN CAPITAL GAINS:

00

1.

Taxable Income: (See Instructions; Attach computation schedule)............................................................................................

1.

00

Enter tax on Line 1 amount: (See Instructions for computation of tax)......................................................................................

2.

2.

00

3.

Net long-term capital gain reduced by net short-term capital loss:

3.

(If Multistate, multiply by apportionment factor, Part B,Line 5 above)........

$25,000

00

4.

4.

Statutory minimum:....................................................................................................................................................................

00

5.

Subtract Line 4 from Line 3:.......................................................................................................................................................

5.

00

6.

Tax: (Enter 6.5% of Line 5)........................................................................................................................................................

6.

00

7.

Compare Line 2 and Line 6: (Enter the smaller amount here and on Line 29, page 1, Form AR1100S)................................

7.

B.

TAX IMPOSED ON CERTAIN BUILT-IN GAINS:

00

1.

Taxable Income: (See Instructions; Attach computation schedule)..........................................................................................

1.

00

2.

Recognized built-in gain:

2.

(If Multistate, multiply by apportionment factor,Part B, Line 5 above).....................................................................

00

3.

Enter smaller of Line 1 or 2:.......................................................................................................................................................

3.

00

4.

Section 1374(b)(2) deduction:...................................................................................................................................................

4.

00

Subtract Line 4 from Line 3: (If zero or less, enter zero here and on Line 6 below)..................................................................

5.

5.

00

6.

Enter 6.5% of Line 5: (Enter here and on Line 29, page 1, Form AR1100S)...........................................................................

6.

AR 1100S Back (R 8/14)

1

1 2

2