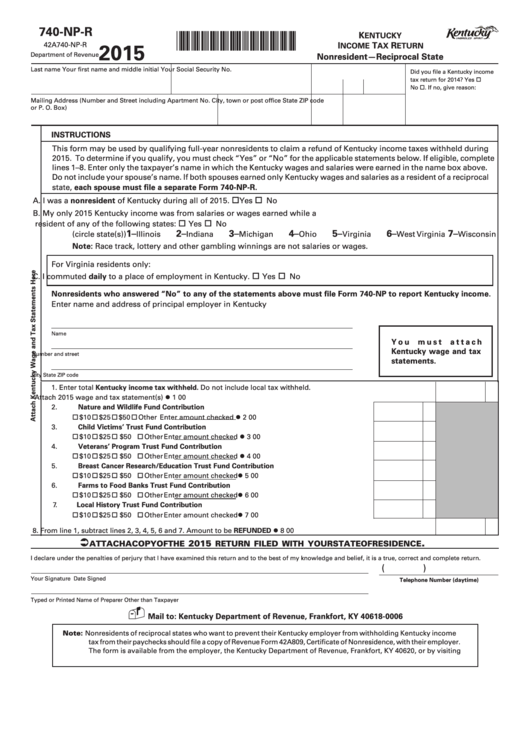

740-NP-R

K

ENTUCKY

*1500030007*

I

T

R

42A740-NP-R

2015

NCOME

AX

ETURN

Department of Revenue

Nonresident—Reciprocal State

Last name

Your first name and middle initial

Your Social Security No.

Did you file a Kentucky income

tax return for 2014? Yes

No . If no, give reason:

Mailing Address (Number and Street including Apartment No.

City, town or post office

State

ZIP code

or P . O. Box)

INSTRUCTIONS

This form may be used by qualifying full-year nonresidents to claim a refund of Kentucky income taxes withheld during

2015. To determine if you qualify, you must check “Yes” or “No” for the applicable statements below. If eligible, complete

lines 1–8. Enter only the taxpayer’s name in which the Kentucky wages and salaries were earned in the name box above.

Do not include your spouse’s name. If both spouses earned only Kentucky wages and salaries as a resident of a reciprocal

state, each spouse must file a separate Form 740-NP-R.

A. I was a nonresident of Kentucky during all of 2015.

Yes

No

B.

My only 2015 Kentucky income was from salaries or wages earned while a

resident of any of the following states:

Yes

No

1–

2–

3–

4–

5–

6–

7–

(circle state(s))

Illinois

Indiana

Michigan

Ohio

Virginia

West Virginia

Wisconsin

Note: Race track, lottery and other gambling winnings are not salaries or wages.

For Virginia residents only:

C.

I commuted daily to a place of employment in Kentucky.

Yes

No

Nonresidents who answered “No” to any of the statements above must file Form 740-NP to report Kentucky income.

Enter name and address of principal employer in Kentucky

Name

Yo u

m u s t

a t t a c h

Kentucky wage and tax

Number and street

statements.

City

State

ZIP code

1.

Enter total Kentucky income tax withheld. Do not include local tax withheld.

Attach 2015 wage and tax statement(s) ..................................................................................................................... l 1

00

2.

Nature and Wildlife Fund Contribution

$10 $25 $50 Other

Enter amount checked ..................... l 2

00

3.

Child Victims’ Trust Fund Contribution

$10 $25 $50 Other

Enter amount checked ..................... l 3

00

4.

Veterans’ Program Trust Fund Contribution

$10 $25 $50 Other

Enter amount checked ..................... l 4

00

5.

Breast Cancer Research/Education Trust Fund Contribution

$10 $25 $50 Other

Enter amount checked ...................... l 5

00

6.

Farms to Food Banks Trust Fund Contribution

$10 $25 $50 Other

Enter amount checked ...................... l 6

00

7.

Local History Trust Fund Contribution

$10 $25 $50 Other

Enter amount checked ...................... l 7

00

8.

From line 1, subtract lines 2, 3, 4, 5, 6 and 7. Amount to be REFUNDED ................................................................ l 8

00

.

2015

attach a copy of the

return filed with your state of residence

I declare under the penalties of perjury that I have examined this return and to the best of my knowledge and belief, it is a true, correct and complete return.

(

)

Your Signature

Date Signed

Telephone Number (daytime)

Typed or Printed Name of Preparer Other than Taxpayer

I.D. Number of Preparer

Date

Mail to: Kentucky Department of Revenue, Frankfort, KY 40618-0006

Note: Nonresidents of reciprocal states who want to prevent their Kentucky employer from withholding Kentucky income

tax from their paychecks should file a copy of Revenue Form 42A809, Certificate of Nonresidence, with their employer.

The form is available from the employer, the Kentucky Department of Revenue, Frankfort, KY 40620, or by visiting

1

1