Instructions For Form 343 - Arizona Renewable Energy Production Tax Credit - 2014

ADVERTISEMENT

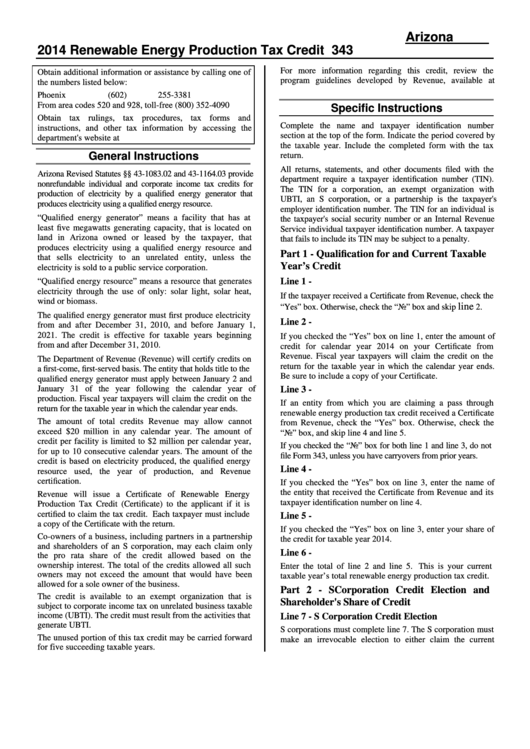

Arizona Form

2014 Renewable Energy Production Tax Credit

343

For more information regarding this credit, review the

Obtain additional information or assistance by calling one of

program guidelines developed by Revenue, available at

the numbers listed below:

on the Tax Credits page.

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

Specific Instructions

Obtain tax rulings, tax procedures, tax forms and

Complete the name and taxpayer identification number

instructions, and other tax information by accessing the

section at the top of the form. Indicate the period covered by

department's website at .

the taxable year. Include the completed form with the tax

General Instructions

return.

All returns, statements, and other documents filed with the

Arizona Revised Statutes §§ 43-1083.02 and 43-1164.03 provide

department require a taxpayer identification number (TIN).

nonrefundable individual and corporate income tax credits for

The TIN for a corporation, an exempt organization with

production of electricity by a qualified energy generator that

UBTI, an S corporation, or a partnership is the taxpayer's

produces electricity using a qualified energy resource.

employer identification number. The TIN for an individual is

“Qualified energy generator” means a facility that has at

the taxpayer's social security number or an Internal Revenue

least five megawatts generating capacity, that is located on

Service individual taxpayer identification number. A taxpayer

land in Arizona owned or leased by the taxpayer, that

that fails to include its TIN may be subject to a penalty.

produces electricity using a qualified energy resource and

Part 1 - Qualification for and Current Taxable

that sells electricity to an unrelated entity, unless the

Year’s Credit

electricity is sold to a public service corporation.

“Qualified energy resource” means a resource that generates

Line 1 -

electricity through the use of only: solar light, solar heat,

If the taxpayer received a Certificate from Revenue, check the

wind or biomass.

line

“Yes” box. Otherwise, check the “No” box and skip

2.

The qualified energy generator must first produce electricity

Line 2 -

from and after December 31, 2010, and before January 1,

2021. The credit is effective for taxable years beginning

If you checked the “Yes” box on line 1, enter the amount of

from and after December 31, 2010.

credit for calendar year 2014 on your Certificate from

Revenue. Fiscal year taxpayers will claim the credit on the

The Department of Revenue (Revenue) will certify credits on

return for the taxable year in which the calendar year ends.

a first-come, first-served basis. The entity that holds title to the

Be sure to include a copy of your Certificate.

qualified energy generator must apply between January 2 and

January 31 of the year following the calendar year of

Line 3 -

production. Fiscal year taxpayers will claim the credit on the

If an entity from which you are claiming a pass through

return for the taxable year in which the calendar year ends.

renewable energy production tax credit received a Certificate

The amount of total credits Revenue may allow cannot

from Revenue, check the “Yes” box. Otherwise, check the

exceed $20 million in any calendar year. The amount of

“No” box, and skip line 4 and line 5.

credit per facility is limited to $2 million per calendar year,

If you checked the “No” box for both line 1 and line 3, do not

for up to 10 consecutive calendar years. The amount of the

file Form 343, unless you have carryovers from prior years.

credit is based on electricity produced, the qualified energy

Line 4 -

resource used, the year of production, and Revenue

certification.

If you checked the “Yes” box on line 3, enter the name of

the entity that received the Certificate from Revenue and its

Revenue will issue a Certificate of Renewable Energy

taxpayer identification number on line 4.

Production Tax Credit (Certificate) to the applicant if it is

certified to claim the tax credit. Each taxpayer must include

Line 5 -

a copy of the Certificate with the return.

If you checked the “Yes” box on line 3, enter your share of

Co-owners of a business, including partners in a partnership

the credit for taxable year 2014.

and shareholders of an S corporation, may each claim only

Line 6 -

the pro rata share of the credit allowed based on the

ownership interest. The total of the credits allowed all such

Enter the total of line 2 and line 5. This is your current

owners may not exceed the amount that would have been

taxable year’s total renewable energy production tax credit.

allowed for a sole owner of the business.

Part 2 - S Corporation Credit Election and

The credit is available to an exempt organization that is

Shareholder's Share of Credit

subject to corporate income tax on unrelated business taxable

income (UBTI). The credit must result from the activities that

Line 7 - S Corporation Credit Election

generate UBTI.

S corporations must complete line 7. The S corporation must

The unused portion of this tax credit may be carried forward

make an irrevocable election to either claim the current

for five succeeding taxable years.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2